Ethereum stays in a variety part following the latest market rebound, however continues to carry above key institutional demand zones. The market has entered a interval of consolidation between structural helps and resistances, suggesting that the following decisive transfer will seemingly be pushed by liquidity displacement from this vary.

Technical Evaluation

By Shayan

The Each day Chart

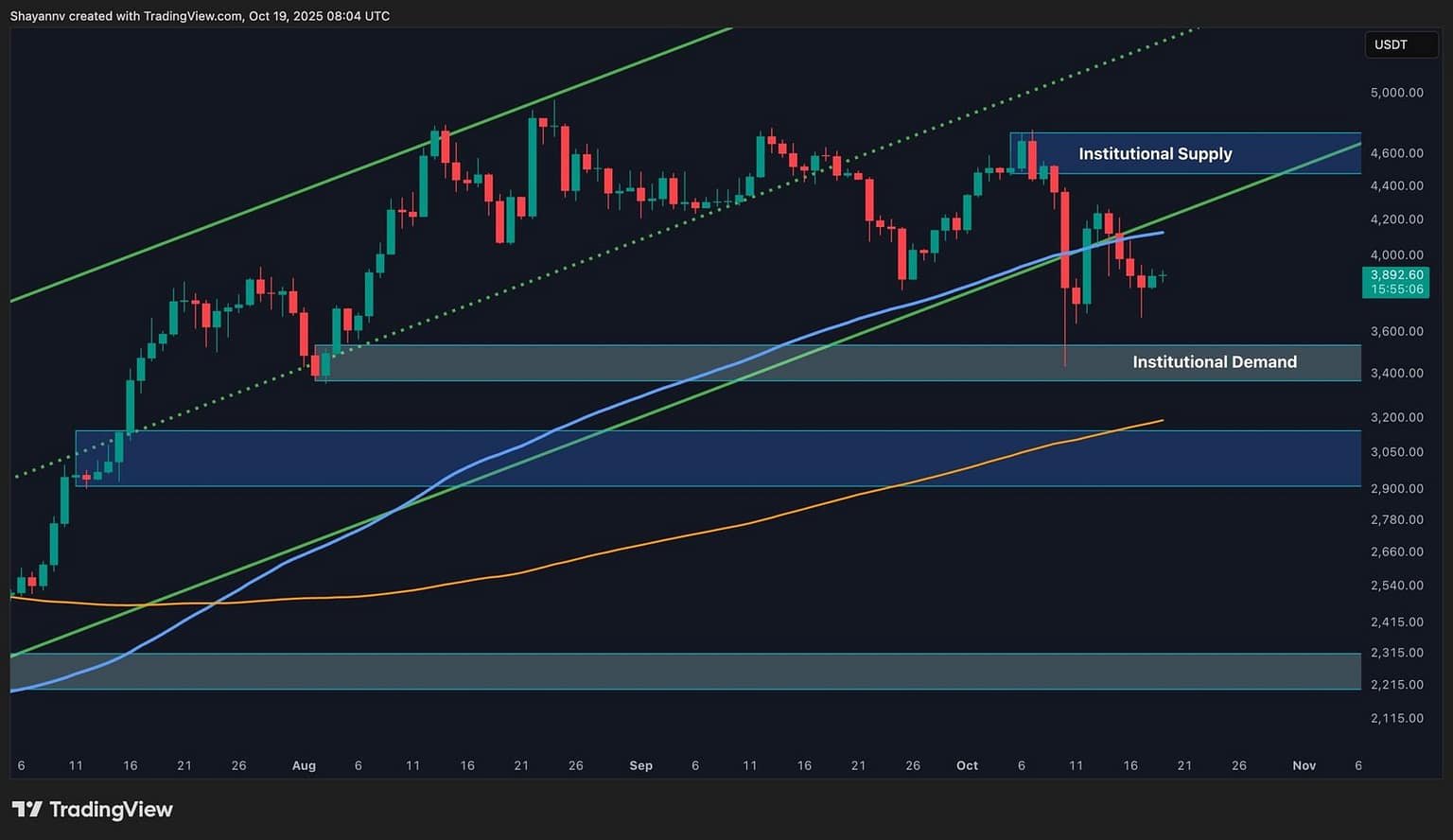

On the every day timeframe, Ethereum continues to commerce between two main zones: the institutional provide space round $4.6K–$4.7K and the institutional demand zone close to $3.4K–$3.5K. After shedding the channel’s decrease trendline assist earlier this month, the asset has now retested it from beneath, confirming it as resistance.

The construction means that Ethereum is at present in a mid-range equilibrium part, the place neither consumers nor sellers have clear management. The 100-day MA, which beforehand supplied dynamic assist, has now flipped right into a resistance zone close to $4.1K–$4.2K, whereas the 200-day MA close to $3.1K stays the final line of structural defence.

So long as the worth stays above the $3.4K institutional demand, Ethereum’s macro development stays intact. Nevertheless, failure to keep up this degree might expose the market to a deeper retracement towards the $3.0K–$2.9K liquidity cluster, the place the 200-day MA and prior accumulation base converge.

The 4-Hour Chart

The 4-hour construction reveals a descending wedge sample, forming after a pointy rejection from the $4.2K breakdown zone. The repeated rejections at this confluence of descending and ascending trendlines replicate the continued tug-of-war between short-term consumers and sellers.

On the identical time, the decrease boundary of the wedge aligns carefully with the broader institutional demand zone, suggesting that Ethereum is approaching a degree of compression the place volatility enlargement is imminent.

If the worth breaks above the descending trendline and closes above the $4K–$4.1K resistance, it might verify a reversal, concentrating on $4.4K–$4.6K. Conversely, a breakdown beneath $3.7K would seemingly set off a deeper decline towards $3.4K, the identical zone that underpins the broader bullish construction. Till affirmation happens, Ethereum stays range-bound, oscillating between structural provide and demand.

Sentiment Evaluation

By Shayan

Current on-chain information factors to a renewed tightening in Ethereum’s market construction. Since mid-October, two important dynamics have emerged concurrently: trade reserves have declined sharply, whereas common spot order sizes have more and more been dominated by massive whale transactions.

Following October 15, ETH’s value has remained comparatively steady just under the $4K degree, however the underlying market composition has shifted meaningfully. Whale-sized spot orders (inexperienced clusters) have expanded, signalling renewed exercise from deep-pocketed individuals, whereas the quantity of Ethereum held on exchanges, measured in USD phrases, has dropped to one of many lowest ranges of 2025.

This mix, shrinking trade reserves and rising whale spot exercise, has traditionally indicated strategic accumulation by institutional or high-net-worth traders. With liquidity thinning throughout exchanges, even reasonable inflows of latest demand might produce amplified value reactions, as lowered sell-side availability magnifies volatility to the upside.

Ethereum now seems to be getting into one other provide squeeze part, echoing the quiet however highly effective accumulation interval of late 2020. Throughout that cycle, constant spot shopping for and trade outflows preceded considered one of ETH’s strongest multi-month rallies. If macro situations stabilise and ETF-related inflows return, the present structural tightening might function the muse for Ethereum’s subsequent main upward cycle.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome provide on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!

Disclaimer: Data discovered on CryptoPotato is these of writers quoted. It doesn’t signify the opinions of CryptoPotato on whether or not to purchase, promote, or maintain any investments. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use supplied data at your individual threat. See Disclaimer for extra data.

Cryptocurrency charts by TradingView.