What Is Modular DeFi?

Conventional DeFi apps usually work as all-in-one methods. They deal with lending, borrowing, swapping, and extra – the whole lot inside a single codebase. This will make them onerous to alter or enhance.

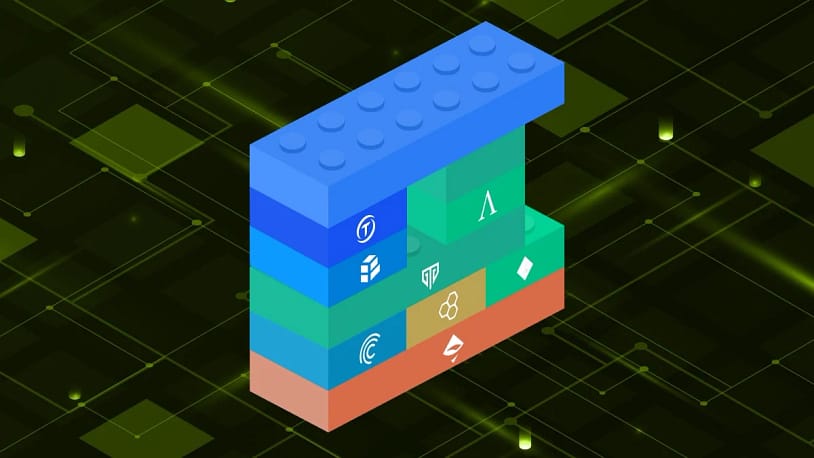

Modular DeFi modifications this strategy. It breaks DeFi apps into smaller, particular person elements known as modules. Every module focuses on one job, like dealing with rates of interest or processing transactions. Builders can combine and match these elements to construct apps quicker and with extra freedom.

This technique can also be known as composable finance, which suggests completely different DeFi modules can join and work collectively. Consider it like utilizing small instruments that snap collectively to make one thing larger.

Why Modular DeFi Issues

Modular DeFi isn’t just a tech pattern. It brings actual advantages to each builders and customers. Right here’s why it’s gaining a lot consideration:

1. Flexibility

Builders don’t want to begin from scratch. They’ll use ready-made modules and mix them in new methods.

2. Quicker Innovation

Updates can occur to 1 module with out breaking all the app. This implies new concepts and options will be examined rapidly.

3. Higher Safety

Isolating capabilities helps cut back danger. If an issue occurs in a single module, it’s simpler to repair with out affecting the entire system.

4. Value Effectivity

Utilizing pre-built modules saves money and time. It lowers the price of creating new monetary instruments.

5. Higher Person Expertise

Modular methods will be custom-made to satisfy particular consumer wants, providing a smoother and extra private expertise.

Actual-World Examples of Modular DeFi

A number of tasks are already utilizing modular DeFi in spectacular methods. Right here’s a easy desk that will help you perceive how they work:

|

Venture |

Goal |

Modular Function |

|

Rari Capital |

Yield farming and lending |

Makes use of plug-in modules for customized methods |

|

Balancer |

Token swaps and liquidity swimming pools |

Permits customized pool configurations |

|

Enzyme Finance |

Asset administration |

Affords modules for buying and selling, investing, and costs |

|

Composable Finance |

Infrastructure for DeFi apps |

Gives cross-chain instruments with modular design |

These platforms present how DeFi app constructing is transferring towards flexibility and management.

How Builders Use Modular DeFi

Builders at the moment are in search of instruments that permit fast creation and simple upgrades. With modular DeFi, they’ll:

- Choose from a library of smart contract modules

- Customise how these modules work together

- Reuse trusted code from different DeFi apps

- Give attention to designing higher front-end experiences

For instance, a developer may use one module for lending, one other for rewards, and a 3rd for transaction monitoring – all related however impartial. That is composable finance in motion.

Challenges to Take into account

Whereas modular DeFi presents many advantages, it’s not with out challenges. Among the points embody:

- Integration complexity: Connecting many modules will be difficult, particularly if they arrive from completely different sources.

- Good contract danger: Every module provides new code, which might improve the assault floor.

- Person confusion: Non-technical customers may discover it onerous to grasp how modules work behind the scenes.

- Governance: Managing updates throughout a number of modules can create disagreements in the neighborhood.

These challenges are actual however solvable with cautious planning, audits, and higher consumer schooling.

The Way forward for DeFi App Constructing

The rise of modular DeFi is simply starting. As extra builders and platforms embrace this mannequin, we’ll see a brand new wave of monetary instruments which can be:

- Simpler to construct

- Safer to make use of

- Extra aware of consumer wants

In some ways, modular DeFi opens the door for composable finance to succeed in its full potential. It encourages cooperation, creativity, and openness – three key values that made DeFi standard within the first place.

Modular DeFi is altering the way in which monetary apps are created. As a substitute of constructing one massive product, builders can now snap collectively many small elements. This makes apps quicker, smarter, and safer. Whether or not you’re simply beginning out with DeFi or are already concerned, understanding this pattern will show you how to keep forward of the way forward for finance.

It’s much like constructing with Lego blocks – piece by piece, however with limitless prospects.