In accordance with a brand new SEC filing at present, Brown College, a personal college based mostly in Windfall, Rhode Island, revealed a big place in BlackRock’ spot Bitcoin ETF, IBIT, as first reported by market analyst MacroScope. The place confirmed Brown held $4,915,050 in IBIT as of March 31, 2025, which sees the varsity grow to be the third U.S. college to publicly announce a Bitcoin buy after Emory & College of Austin (UATX), according to VanEck’s Matthew Siegel.

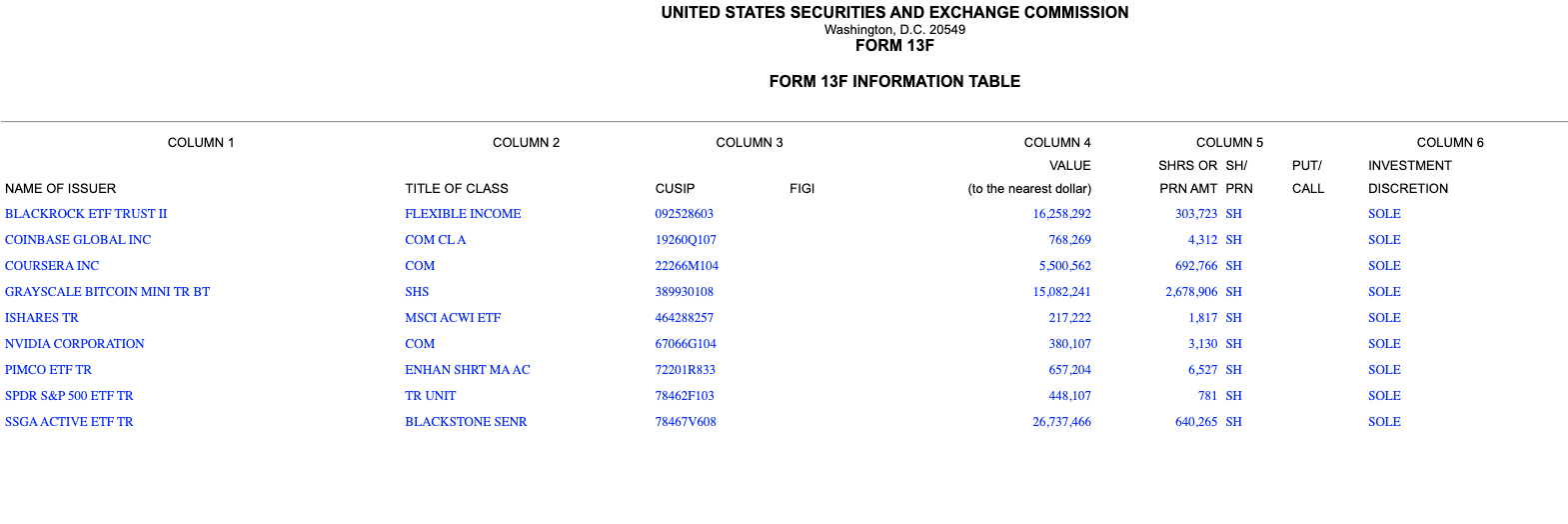

“In a 13F submitting this morning, Brown College reported proudly owning 105,000 shares of the IBIT Bitcoin ETF as of March 31, valued at $4.9 million,” MacroScope posted to X. “This can be a new place, which suggests it was acquired in January, February or March. The overall worth of all 14 positions within the submitting is $216 million. This is a crucial one.”

A rising variety of U.S. universities are signaling confidence in Bitcoin’s long-term potential by including the digital asset to their endowment portfolios or tutorial packages. Beforehand, Emory College, and the College of Austin (UATX) have every disclosed Bitcoin-related initiatives, additional validating the cryptocurrency’s institutional attraction.

Emory College was the primary to reveal its Bitcoin holdings, revealed in an October 25 SEC filing, that it owned practically 2.7 million shares of the Grayscale Bitcoin Mini Belief ETF, initially value $15.1 million.

With Bitcoin reaching all-time highs since buying, Emory’s holdings might now exceed $21 million. Emory Funding Administration (EIM) CIO Srinivas Pulavarti famous that the ETF conversion led to the general public disclosure of their place.

“There are some dangers with doing it your self,” said Emory’s Affiliate Professor of Accounting Matthew Lyle on shopping for the Bitcoin ETFs vs buying and holding the Bitcoin themselves. “Whereas for those who use an organization like Grayscale or BlackRock to do it for you… it’s unlikely that they’re going to steal your cash as a result of they’re well-known.”

In Might 2024, the College of Austin additionally gained publicity to Bitcoin, by partnering with Bitcoin monetary companies agency Unchained to boost $5 million in Bitcoin for its endowment. “I’ve seen the values the group locations on free speech and on constructing a contemporary tutorial establishment… and I’m thrilled to play a job in serving to the college make bitcoin part of its long run technique,” stated Unchained CEO Joseph Kelly, who donated 2 BTC to the marketing campaign.

“College endowments are about serving college students,” added Thomas Hogan, incoming Affiliate Professor at UATX. “And bitcoin offers a singular alternative for advancing UATX’s dedication to cultivating future generations of leaders and innovators.”