Ethereum is buying and selling at vital ranges after days of volatility, pushing nearer to its all-time excessive close to $4,800. Bulls stay in management, and the market is more and more targeted on whether or not ETH can break via resistance and make sure a brand new part of the uptrend. Including to the momentum, Bitmine Immersion Applied sciences, Inc., a blockchain expertise firm based totally in america, introduced that it has simply bought $129.9 million price of ETH following a short day of inactivity.

This strategic acquisition highlights the rising pattern of institutional gamers allocating straight into Ethereum, reinforcing confidence in its long-term worth. Bitmine’s transfer mirrors comparable treasury methods adopted by companies comparable to Sharplink Gaming, signaling a wider company shift towards ETH accumulation. The timing is notable, as change balances proceed to shrink and demand intensifies, inserting supply-side stress in the marketplace.

For traders, the convergence of institutional shopping for and robust technical positioning suggests Ethereum could also be gearing up for a decisive breakout. Nonetheless, with volatility nonetheless excessive, market contributors are intently watching whether or not ETH can maintain momentum above key ranges and solidify its management function within the broader altcoin rally.

Ethereum Accumulation Grows As Bitmine Expands Holdings

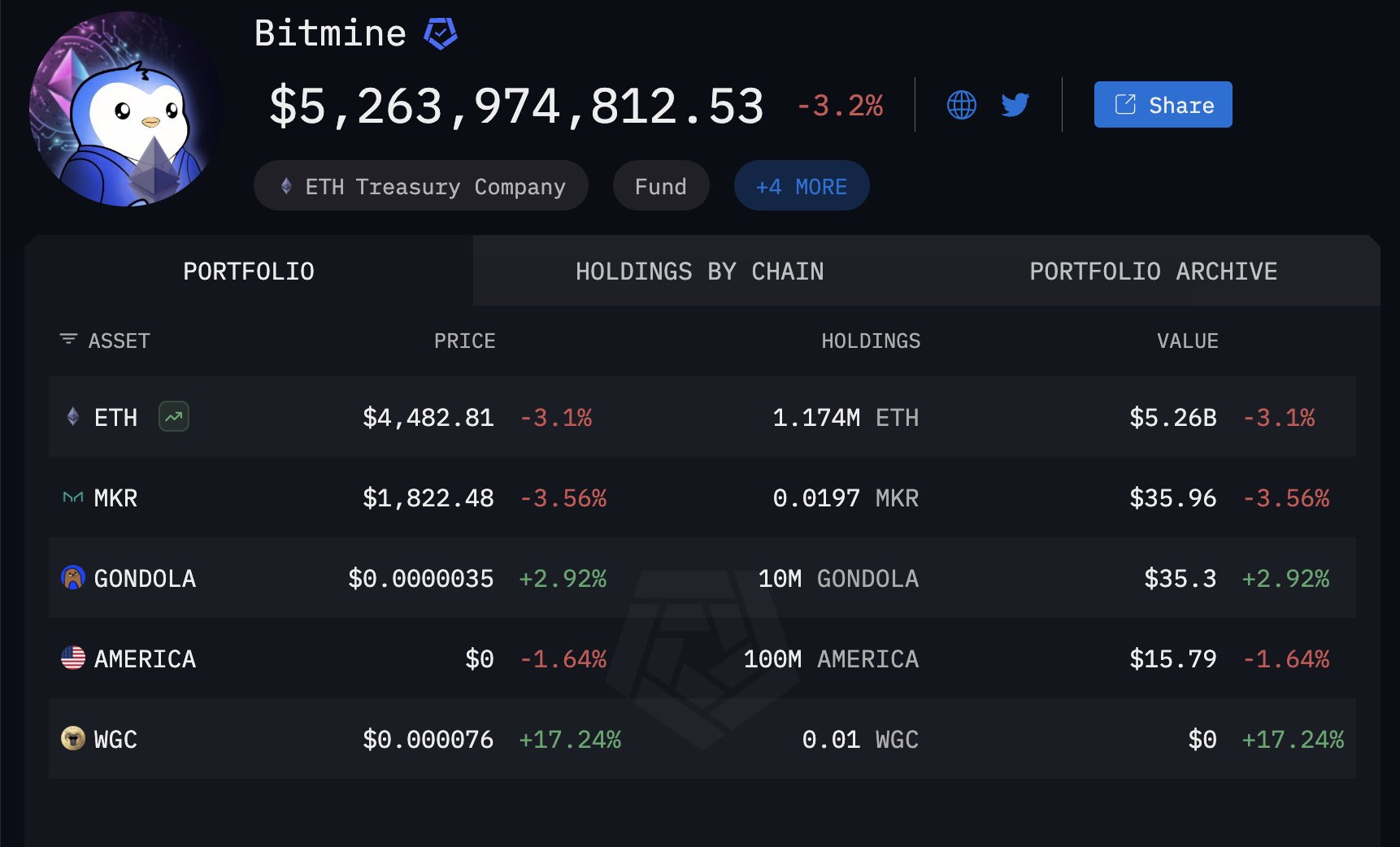

With this newest acquisition, Bitmine’s complete holdings now stand at 1.174 million ETH, valued at roughly $5.26 billion. This ongoing accumulation pattern comes at a vital juncture for Ethereum, because the asset exams main resistance ranges close to its all-time highs.

The timing of Bitmine’s buy highlights a rising conviction amongst institutional gamers that Ethereum will proceed to outperform within the present cycle. Trade reserves and OTC desk provide have been steadily shrinking, signaling robust demand whereas obtainable liquidity dries up. This tightening provide dynamic usually serves as gas for sharp upward worth actions, notably when paired with vital institutional inflows like these from Bitmine.

In the meantime, Bitcoin stays below stress just under its all-time excessive, struggling to verify a breakout. This distinction is shaping a brand new part within the crypto market, the place Ethereum’s relative energy is turning into more and more evident. If ETH efficiently pushes via resistance, it could lead on the following leg of the altcoin rally, with liquidity flowing towards stronger property within the sector.

Value Holds Key Help After Robust Rally

Ethereum’s worth motion exhibits resilience regardless of the current pullback from highs close to $4,800. On the 4-hour chart, ETH is presently buying and selling round $4,422, holding above the 50-period transferring common at $4,347. This stage is performing as short-term dynamic help, suggesting that patrons stay energetic even after profit-taking on the prime.

The rally over the previous weeks has been marked by larger highs and better lows, confirming robust bullish construction. Quantity spikes throughout upward strikes spotlight continued demand, whereas the latest correction has seen comparatively decrease promoting quantity, an encouraging signal for bulls. The 100- and 200-period transferring averages at $3,988 and $3,780, respectively, stay far under the present worth, reinforcing the broader uptrend.

If ETH maintains help above $4,350, a rebound towards $4,600–$4,800 is probably going, with a possible breakout try at all-time highs. Nonetheless, a breakdown under the 50-period transferring common may set off a deeper correction, with $4,000 as the following main help zone. With bullish fundamentals, diminished provide, and rising institutional curiosity, the market seems poised for a decisive transfer.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.