On-chain analytics agency CryptoQuant has revealed the 5 key Bitcoin on-chain alerts that may very well be to keep watch over within the coming week.

Bitcoin Is Observing Developments On These Metrics

In a brand new thread on X, CryptoQuant has mentioned about some Bitcoin on-chain alerts that may very well be to observe amid the consolidation section within the cryptocurrency’s value.

The primary indicator shared by the analytics agency is the 60-day change out there cap of USDT, the primary stablecoin.

As is seen within the above chart, the 60-day change within the USDT market cap has continued to take a seat at a notable constructive degree not too long ago, implying the stablecoin has been witnessing progress.

Stablecoins are one of many principal inlets of capital into the cryptocurrency sector, so progress in them can typically be a constructive signal. Presently, the 60-day change within the USDT market cap has a price of $10 billion. “It is a clear signal of contemporary liquidity getting into the market,” notes CryptoQuant.

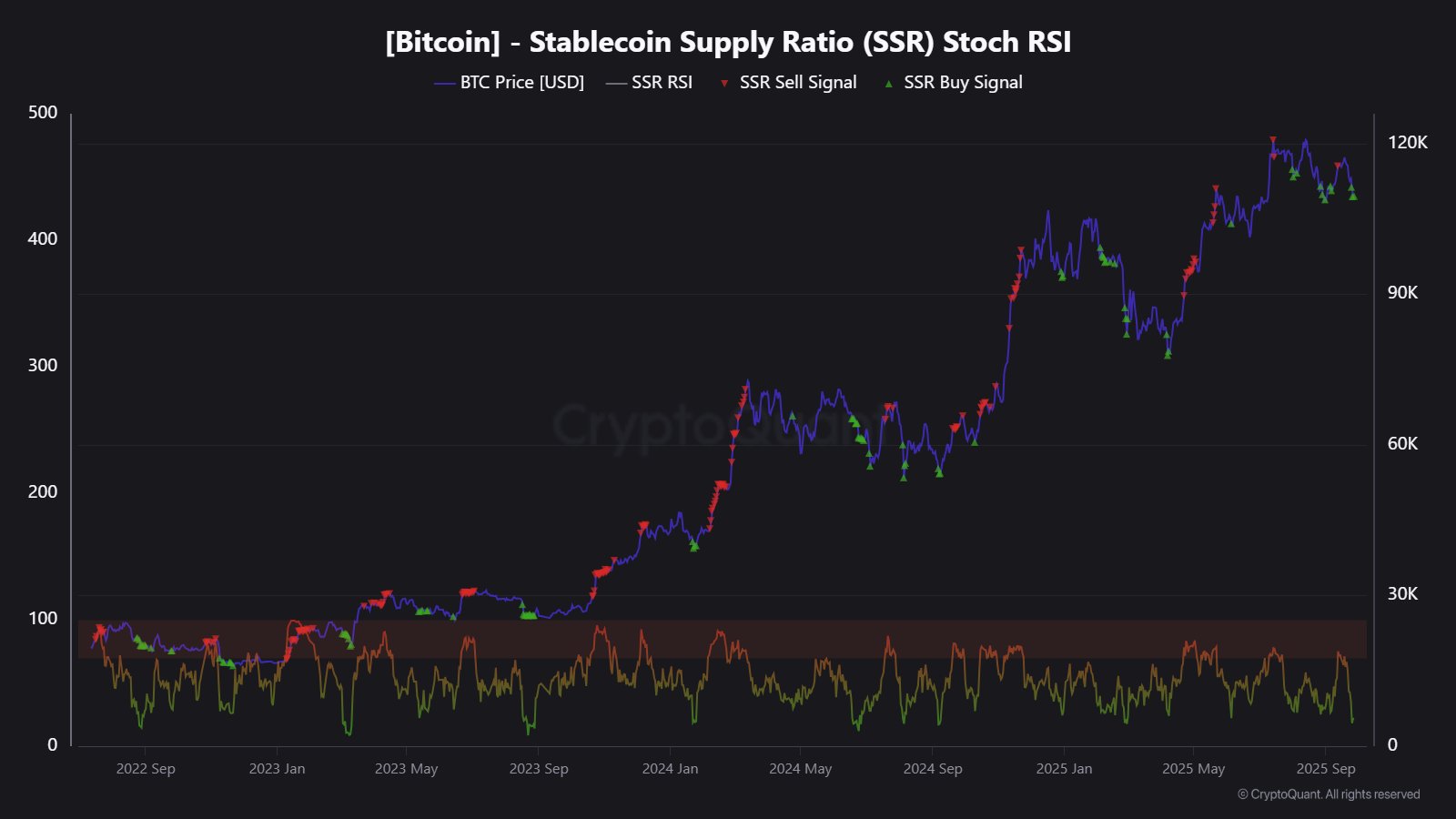

One other stablecoins-related indicator that may be related for Bitcoin is the Stablecoin Supply Ratio (SSR), which measures the ratio between the market cap of BTC and mixed that of all stables.

A low worth within the indicator can show to be a bullish signal, because it implies investor buying energy within the type of stablecoins is excessive in comparison with the Bitcoin market cap.

From the under chart, it’s obvious that the Relative Energy Index (RSI) of the BTC SSR stands at a price of 21 proper now, which is taken into account to be contained in the “purchase” territory.

One other bullish signal that’s creating for Bitcoin is within the Accumulator Deal with Demand, an indicator that measures the demand that’s coming from addresses which have zero historical past of promoting the cryptocurrency. These perennial HODLers now personal 298,000 BTC, which is a brand new file.

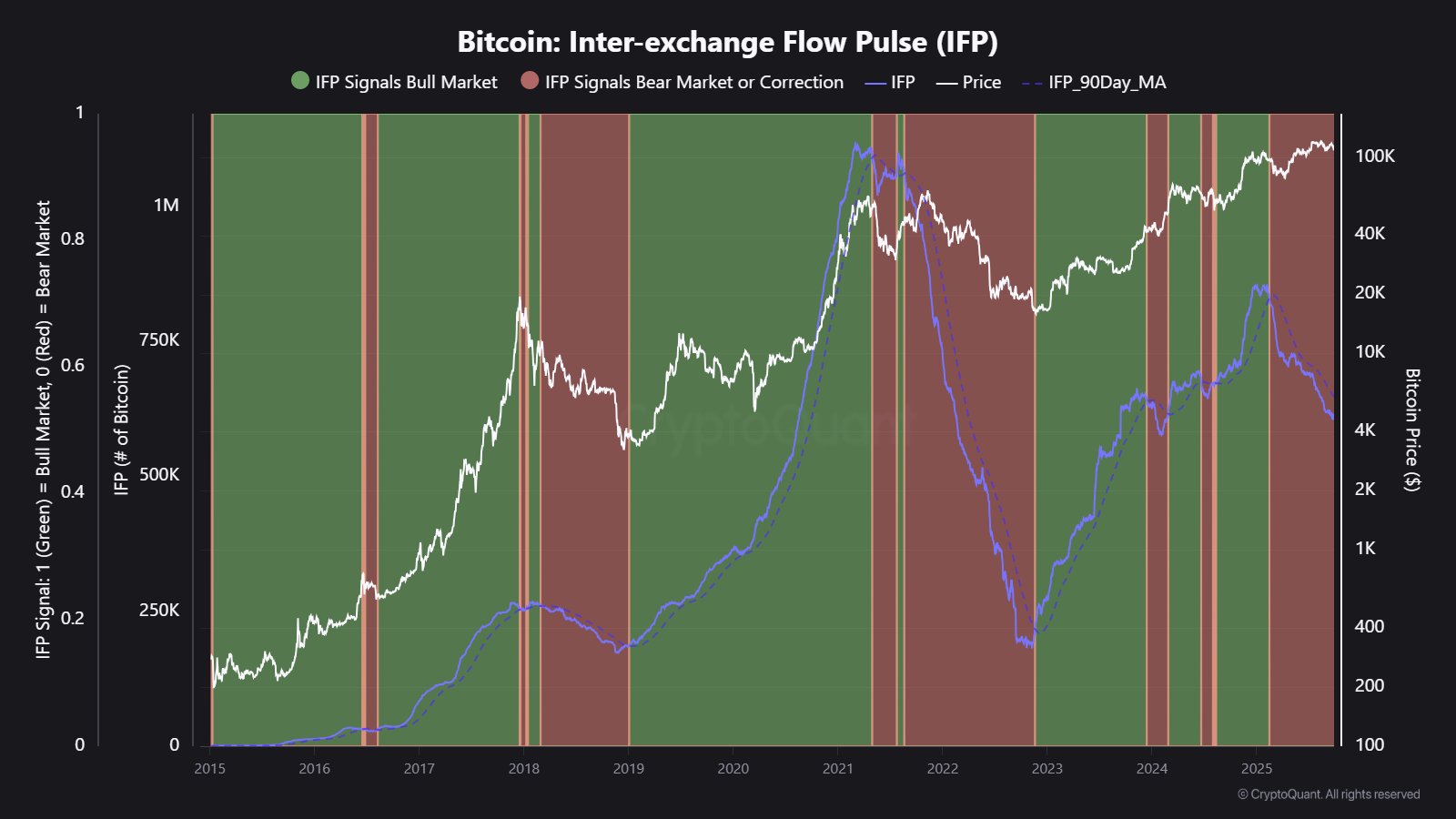

A metric that’s nonetheless contained in the bearish zone, nonetheless, is the Inter-Exchange Flow Pulse (IFP). This metric retains monitor of the BTC flows taking place between spot and derivatives exchanges.

The indicator has been following a downtrend in the course of the previous few months, which is taken into account to be a bear market sample. “Watch intently: a shift upward usually marks the beginning of bullish momentum,” says the analytics agency.

The ultimate metric shared by CryptoQuant is the Realized Value of the short-term holders (STHs), which measures the typical value foundation of the Bitcoin traders who acquired in over the last 155 days.

Throughout BTC’s latest plunge, the STHs briefly dipped into losses, however the asset has since recovered above their Realized Value of $109,775. Bullish developments have traditionally continued when the coin has traded above this degree.

BTC Value

Bitcoin has climbed again to $114,200 following its restoration surge within the final couple of days.