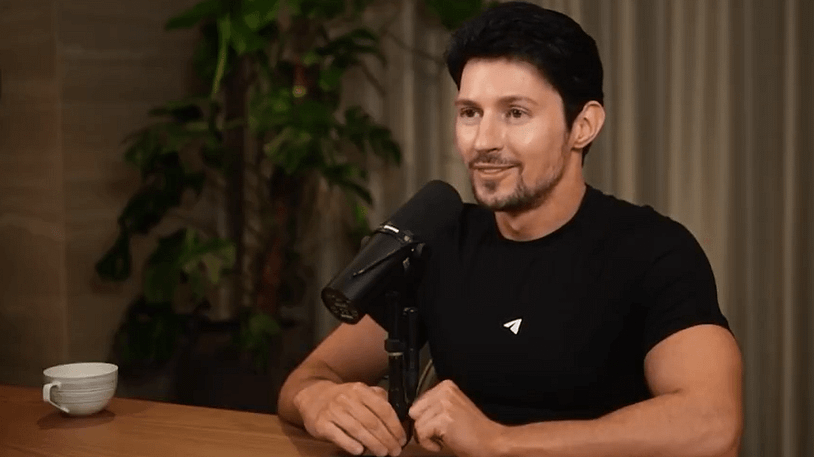

Pavel Durov, the founder and CEO of Telegram, used a wide-ranging dialog on the Lex Fridman Podcast to make one in every of his clearest long-term calls on Bitcoin but: “I imagine it is going to come to some extent when Bitcoin is price $1 million.” The remarks seem on Fridman’s newly launched episode with Durov.

Why Bitcoin Will Attain $1 Million: Pavel Durov

Pressed by Fridman on why he saved accumulating Bitcoin and whether or not he sees additional upside, Durov traced his conviction to the asset’s earliest days and to its financial design. “I used to be an enormous believer in Bitcoin since kind of the beginning of it,” he stated, recalling that he purchased “my first few thousand of Bitcoin in 2013,” round “$700 per Bitcoin,” and refused to promote at the same time as the value later fell towards $300.

Associated Studying

“And my response to them was, I don’t care. I’m not going to promote it. I imagine on this factor.” For Durov, the crux is Bitcoin’s censorship resistance and predictable issuance: “No person can confiscate your Bitcoin from you. No person can censor you for political causes. That is the last word technique of change… The governments keep printing money like no tomorrow. No person’s printing Bitcoin. There’s a predictable inflation after which it stops at a sure level. Bitcoin is right here to remain.”

Durov additionally drew a pointy line between his private funds and Telegram’s working economics, saying Bitcoin appreciation has successfully financed his way of life, not earnings from the corporate. “Telegram is a cash shedding operation for me personally. Bitcoin is one thing that allowed me to remain afloat,” he famous, including that his long-term horizon on the asset has not modified since his early purchases greater than a decade in the past.

The timing of Durov’s $1 million thesis is notable given Telegram’s increasing function at crypto’s client edge. The corporate has progressively built-in the TON ecosystem into its product and enterprise mannequin, committing to Toncoin-based advert funds and income sharing for channel homeowners and opening its promoting platform to a broad set of markets. That TON-denominated advert infrastructure has been credited with catalyzing consumer and developer exercise throughout Telegram’s mini-app economy.

Associated Studying

On the pockets facet, Telegram’s crypto performance—first rolled out internationally—prolonged to the USA in July 2025, with the TON neighborhood’s pockets mini-app enabling in-app transfers and funds. The US growth adopted what Telegram described as nine-figure world pockets activation metrics in 2024, underscoring the size of a possible distribution channel for on-chain funds and video games.

As for the $1 million quantity itself, Durov anchored it in provide self-discipline and fiat debasement fairly than in short-term market catalysts. His reasoning tracks with hard-cap arguments lengthy superior by Bitcoin’s most dedicated holders: issuance is programmatic and terminal, whereas fiscal and financial growth stays discretionary.

JUST IN: Telegram CEO says he thinks Bitcoin will go to $1,000,000 👀

“The governments retains printing cash like no tomorrow. No person is printing bitcoin.” 🚀 pic.twitter.com/AiDwr7xVkQ

— Bitcoin Journal (@BitcoinMagazine) September 30, 2025

Whether or not that macro narrative alone can ship seven-figure costs is a market query; what Durov made clear is that his personal positioning displays a decade of conviction. “Simply have a look at the tendencies,” he instructed Fridman. “Bitcoin is right here to remain. All of the fiat currencies stay to be seen.”

At press time, Bitcoin traded at $114,372.

Featured picture created with DALL.E, chart from TradingView.com