Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The on-chain analytics agency Glassnode has revealed how the massive Bitcoin buyers have been shopping for throughout this value rally to date.

Accumulation Development Rating Suggests Sturdy Shopping for From Mega Whales

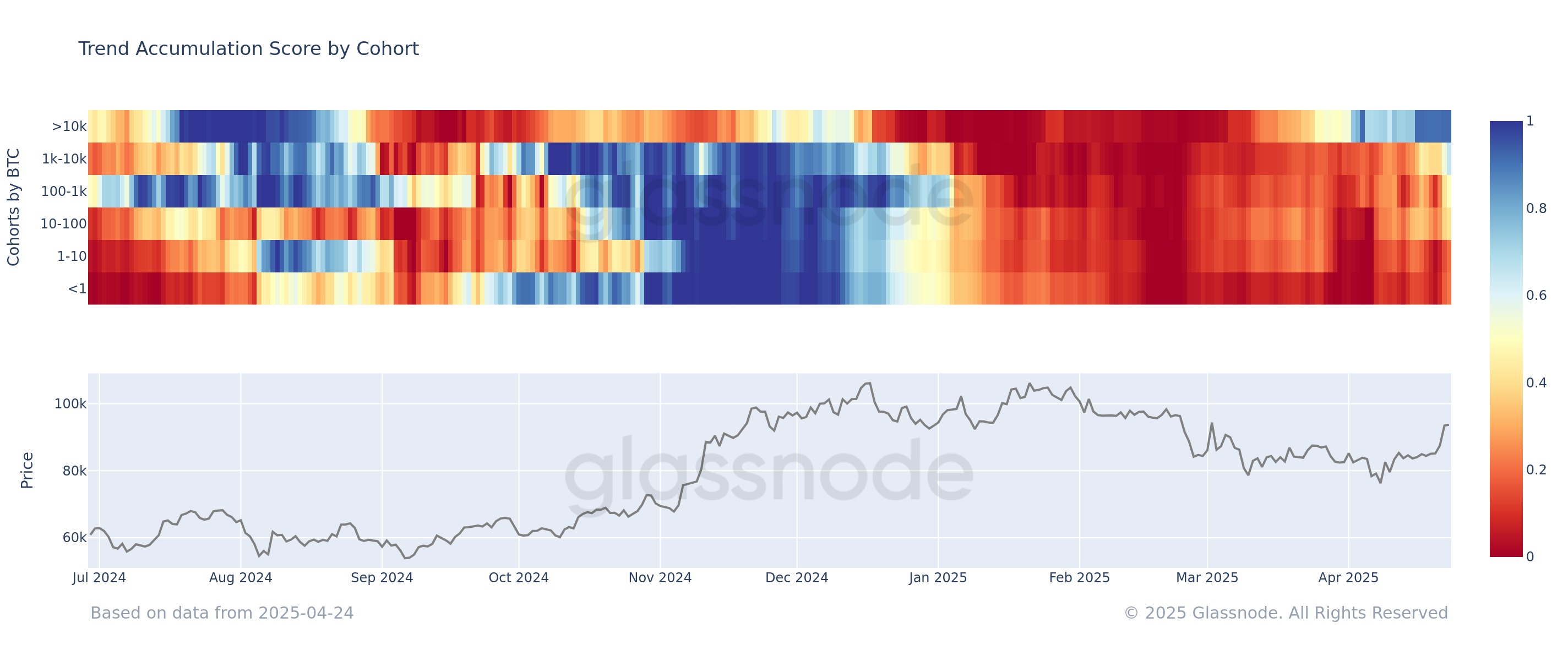

In a brand new post on X, Glassnode has mentioned about how the Accumulation Development Rating has modified for the completely different Bitcoin investor cohorts lately. The “Accumulation Trend Score” refers to an on-chain indicator that principally tells us about whether or not the BTC holders are shopping for or promoting.

The metric calculates its worth by not solely making use of the steadiness modifications taking place within the wallets of the buyers, but in addition the dimensions of the wallets themselves. Because of this massive addresses have a better weightage within the indicator’s worth.

Associated Studying

When the Accumulation Development Rating is larger than 0.5, it means that the massive buyers (or a lot of small holders) are collaborating in accumulation. The nearer the metric is to 1.0, the stronger is that this conduct.

However, the indicator being underneath 0.5 implies the buyers are distributing or just not doing any shopping for. On this aspect of the dimensions, the zero mark acts as the purpose of utmost.

Within the context of the present matter, the mixed Accumulation Development Rating of your entire Bitcoin market isn’t of curiosity, however moderately the separate scores for the completely different investor cohorts.

There are two primary methods to divide holder teams: holding time and steadiness measurement. Right here, the cohorts are based mostly on the latter categorization. Under is the chart shared by the analytics agency that reveals the development within the Accumulation Development Rating for these teams over the previous 12 months.

As displayed within the above graph, the Bitcoin market as an entire has been in a state of distribution throughout the previous couple of months, however one cohort began to drag away from the remainder final month: the ten,000+ BTC holders.

The buyers holding between 1,000 and 10,000 BTC are popularly often known as the whales, so these buyers, who’re much more humongous, could possibly be termed because the mega whales.

From the chart, it’s seen that the remainder of the market continued to promote into this month, however the mega whales, who had been already dropping off their distribution, pivoted to purchasing as an alternative. They’ve since solely strengthened their conduct, with the metric now even reaching a near-perfect rating of 0.9.

The whales have additionally turned issues round very lately, because the rating has hit 0.7 for them. Thus, it could seem that the big-money buyers as an entire have been accumulating Bitcoin throughout the newest restoration rally.

Associated Studying

Among the many remainder of the market, the sharks (100 to 1,000 BTC) are the closest at catching as much as the whales, with their Accumulation Development Rating sitting at 0.5. The buyers on the smaller finish are nonetheless persevering with to distribute.

The present sample is kind of much like what was witnessed again in December 2024, the place the Bitcoin mega whales began collaborating in sturdy distribution forward of the remainder.

Bitcoin Worth

Bitcoin crossed above the $94,000 stage earlier, however it appears the coin has seen a pullback since then as its value is again at $92,600.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com