Bitcoin treasury companies have been hit exhausting by Bitcoin’s disappointing value motion all through 2025. Publicly traded companies holding important BTC reserves are struggling probably the most, with leaders like (Micro)Technique pushing aggressive accumulation amid headwinds—but most now commerce under web asset worth, making a uncommon alternative for risk-tolerant strategic buyers.

The Bitcoin Treasury Firms Panorama

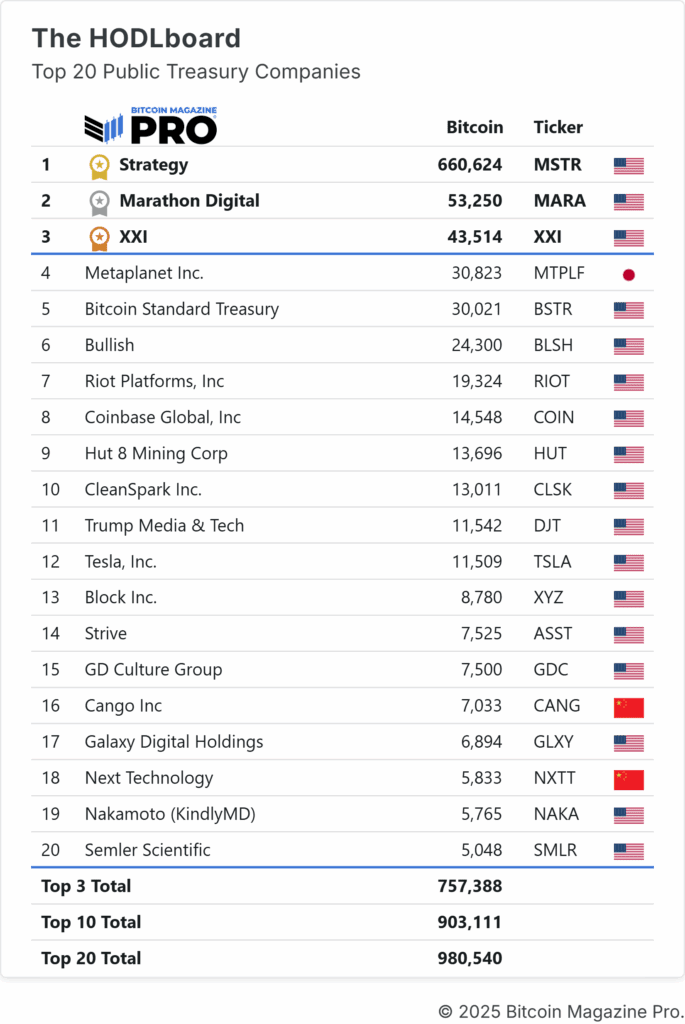

Not all Bitcoin treasury firms are created equally. Technique stands aside because the trade standard-bearer, the “Bitcoin amongst treasury firms,” because it had been. The corporate has maintained its accumulation self-discipline whilst its inventory has suffered, lately saying a $1.44 billion USD reserve particularly designed to pay dividends and debt obligations with out forcing Bitcoin gross sales.

This capital buffer theoretically eliminates the necessity for extreme dilutive share issuance or pressured BTC liquidation, a crucial distinction from weaker rivals. Many will probably face shareholder strain and potential pressured promoting as their inventory costs decline, making a cascade of provide strain that might paradoxically profit the strongest gamers like MSTR.

Valuation Dynamics of Bitcoin Treasury Firms

Probably the most compelling facet of present treasury firm valuations is that they now commerce under web asset worth on a per-share foundation. In sensible phrases, you may at the moment buy one greenback’s price of Bitcoin for lower than one greenback by treasury firm inventory. This represents an arbitrage alternative for buyers, although one accompanied by elevated volatility and company-specific dangers.

Technique at the moment sits at a web asset worth premium of lower than 1, which means the corporate’s market capitalization is under the worth of its Bitcoin holdings alone. The upside state of affairs is placing. If Bitcoin reclaims its earlier all-time excessive round $126,000, Technique continues accumulating towards 700,000 BTC, and the market assigns even a modest 1.5x to 1.75x web asset worth premium, Technique might strategy the $500 area per share.

From Weak to Robust: The Way forward for Bitcoin Treasury Firms

Inspecting Technique’s efficiency in the course of the earlier Bitcoin bear market and overlaying it onto the present cycle reveals eerie alignment. The bar patterns recommend present value ranges symbolize cheap assist, with solely a catastrophic remaining flush justified by Bitcoin weak spot offering purpose to count on considerably decrease ranges.

As weaker treasury firms face pressured promoting, a consolidation thesis emerges, that Technique and comparable strong-positioned gamers will doubtlessly accumulate low-cost Bitcoin from distressed sellers, additional concentrating holdings in probably the most disciplined accumulators. This dynamic mirrors Bitcoin’s personal consolidation course of, weaker fingers promote, stronger fingers accumulate, and the asset turns into extra concentrated amongst conviction holders.

Conclusion: Alternative in Bitcoin Treasury Firms

Bitcoin treasury firms have for probably the most half delivered disappointing returns in 2025, however this efficiency has created a window of outstanding alternative for disciplined buyers. At present valuations, Technique is actually promoting one greenback of Bitcoin for roughly 90 cents, a reduction that turns into much more enticing if Bitcoin experiences one remaining capitulation flush. The likelihood of this state of affairs mixed with Technique’s positioned upside creates uneven risk-reward worthy of small, carefully-sized positions inside aggressive portfolios.

For deeper knowledge, charts, {and professional} insights into bitcoin value traits, go to BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding selections.