As volatility engulfs the cryptocurrency market amid conflict tensions, on-chain information exhibits that the Bitcoin short-term holders are promoting at a loss.

Bitcoin Quick-Time period Holders Simply Made Giant Trade Inflows At A Loss

In a brand new post on X, CryptoQuant writer Axel Adler Jr has talked about how the Bitcoin short-term holders have reacted to the value volatility that has come alongside rising tensions within the Center East following US strikes on three nuclear amenities in Iran.

The short-term holders (STHs) discuss with the BTC buyers who bought their cash inside the previous 155 days. The opposite facet of the community, the holders with a holding time better than 155 days, are termed because the long-term holders (LTHs). The previous group comprises the brand new entrants and low conviction holders, who usually panic simply every time some change happens available in the market. However, the latter cohort contains the veterans of the market, who have a tendency to take a seat tight by crashes and rallies alike.

As such, given the latest sharp worth motion that has occurred within the sector, the STHs are prone to have made some strikes. And certainly, on-chain information would affirm so.

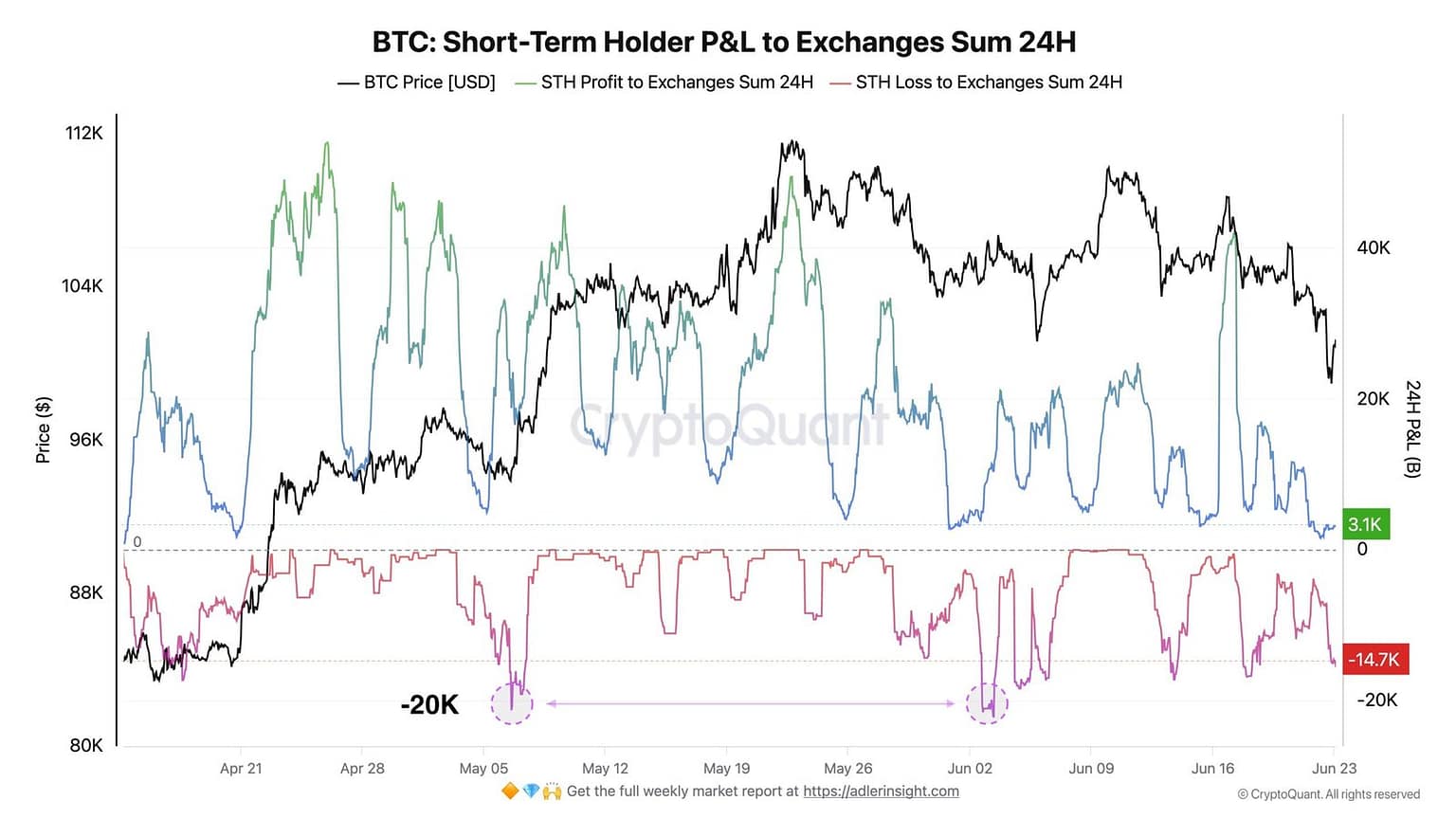

The above chart, shared by the analyst, exhibits the info for the revenue and loss trade deposit transactions that the STHs as an entire are making. Traders often switch to those centralized platforms once they need to promote, so inflows going to them can present hints about whether or not promoting is elevated or not.

From the graph, it’s seen that the loss transactions going to the exchanges from this cohort have amounted to 14,700 BTC, which, though decrease than the 2 main capitulation occasions from the previous couple of months, is critical. Thus, it will seem that a few of the STHs have reacted to the information by exiting the market, even when it means taking a loss.

It’s additionally obvious from the chart that the worthwhile transfers have remained comparatively low at 3,100 BTC. That is possible right down to the truth that the STHs are left with little revenue following the value decline, because the on-chain analytics agency Glassnode has identified in an X post.

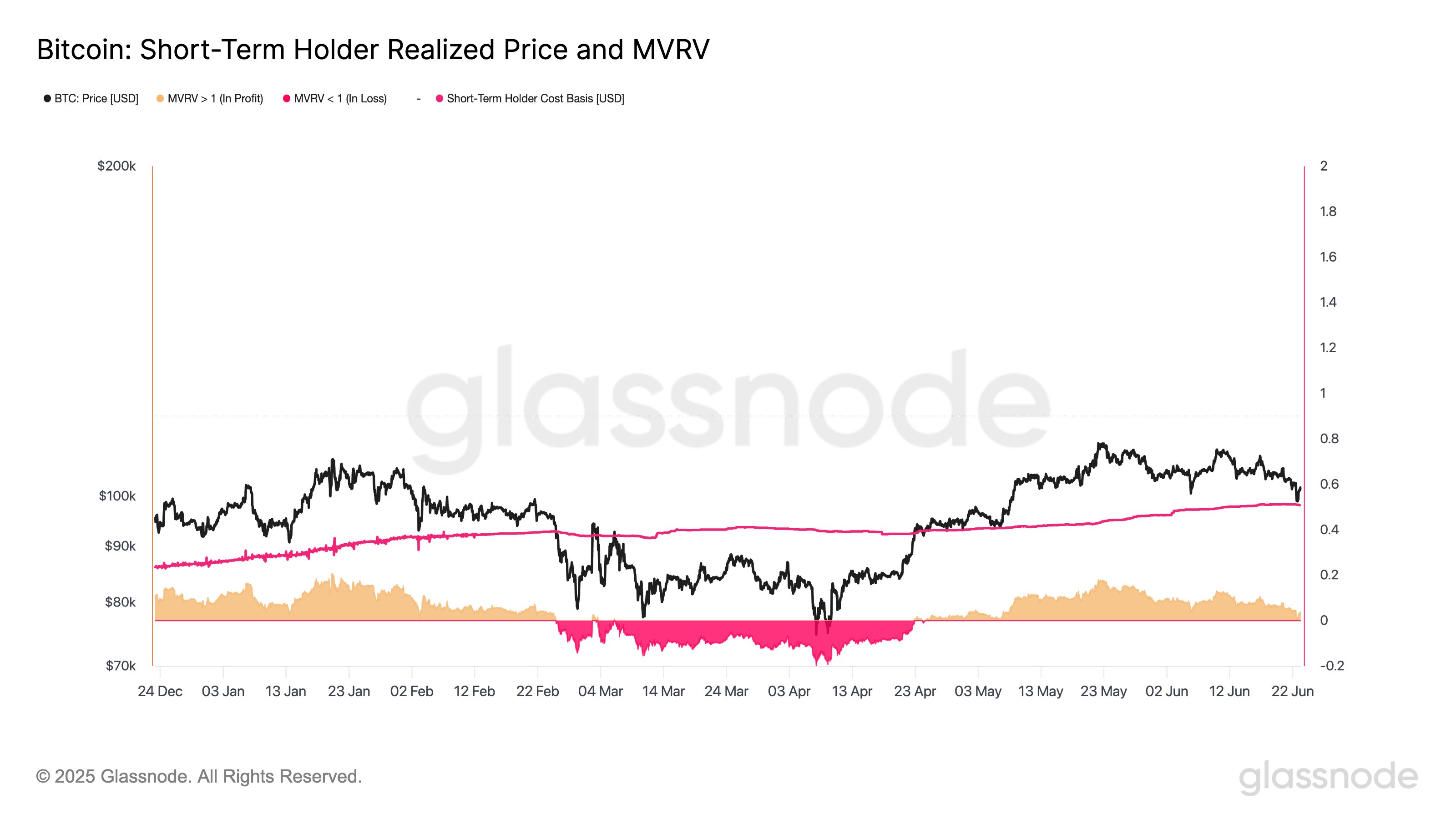

Within the chart, the pattern of the STH Realized Price is displayed. This indicator retains monitor of the Bitcoin value foundation or acquisition degree of the typical STH. Through the crash, the value nearly retested the road, and even after the rebound, it stays near it, which means the revenue margin for the cohort remains to be tight.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $101,300, down over 5% within the final week.