On-chain information exhibits the Binance Change Reserve has diverged between Bitcoin and the stablecoins. Right here’s what this might imply for the market.

Bitcoin & Stablecoin Change Reserves Have Decoupled On Binance

In a CryptoQuant Quicktake post, an analyst has talked in regards to the newest development within the Binance Change Reserve for Bitcoin and the stablecoins. The “Exchange Reserve” right here refers to an on-chain metric that retains monitor of the overall quantity of a given asset that’s sitting on the wallets hooked up to a centralized alternate.

When the worth of this metric rises, it means the holders are making web deposits of the asset to the platform. Usually, traders use exchanges after they need to take part in buying and selling actions, so them making inflows might sign urge for food for buying and selling the coin away.

For cryptocurrencies like Bitcoin, that is one thing that may naturally have a bearish affect on the worth. The identical, nonetheless, isn’t true within the case of the stablecoins, as they’re, by definition, at all times steady across the identical worth because the fiat foreign money that they’re pegged to.

Buyers normally retailer their capital within the type of these tokens after they need to keep away from the volatility related to belongings like Bitcoin. Lots of them, nonetheless, plan to finally return again to the risky aspect. As soon as they’ve determined to make the swap, they switch their stablecoins to exchanges.

After they make the swap to a coin like Bitcoin, its value naturally observes a shopping for increase. As such, stablecoin inflows could be bullish for the risky cryptocurrencies.

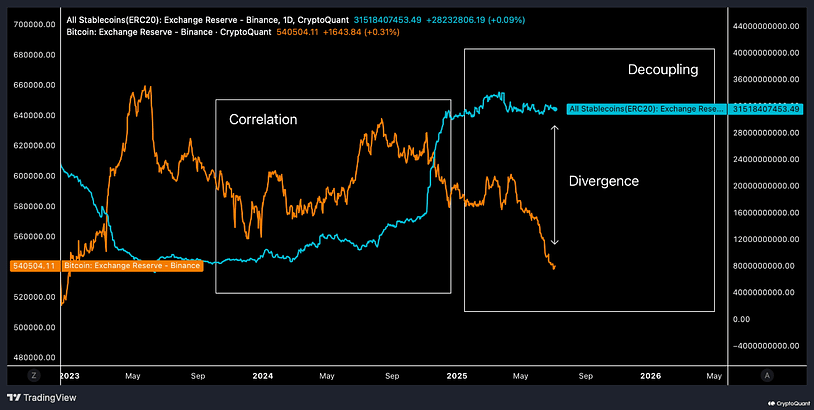

Now, right here is the chart shared by the analyst that exhibits the development within the Change Reserve of Binance for Bitcoin and the stablecoins over the past couple of years:

As displayed within the above graph, the Binance Change Reserve for the 2 asset courses confirmed some correlation in 2024. However by the tip of the yr, a shift had occurred, with the stablecoins witnessing sharp inflows and Bitcoin outflows.

The 2 have remained decoupled in 2025 to this point, though their developments now not diverge as extraordinarily. The stablecoin Binance alternate reserve has lately been trending sideways, whereas the one for Bitcoin has quickly been transferring down.

Thus, it will seem that there’s a great amount of fiat-tied tokens on the alternate doubtlessly ready to be deployed into the risky aspect and on the identical time, traders are additionally pulling out BTC provide, hinting at ongoing accumulation.

This might trace at bullish circumstances aligning on the biggest cryptocurrency alternate, however it solely stays to be seen whether or not the setup would mirror within the Bitcoin value or not.

BTC Worth

Bitcoin is holding regular as its value remains to be buying and selling across the $108,800 degree.