Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Regardless of current volatility, a number of key indicators are pointing to a bullish undercurrent for Bitcoin (BTC). These embody Binance’s rising market dominance, renewed accumulation by long-term holders (LTH), and vital BTC withdrawals from main crypto exchanges.

Bitcoin Displaying Indicators Of Renewed Energy

On the time of writing, Bitcoin is buying and selling within the mid-$100,000 vary – roughly 6.1% under its newest all-time excessive (ATH) recorded on Could 22. The flagship cryptocurrency has declined greater than 3.5% over the previous seven days amid renewed considerations over world commerce tensions and tariffs.

Associated Studying

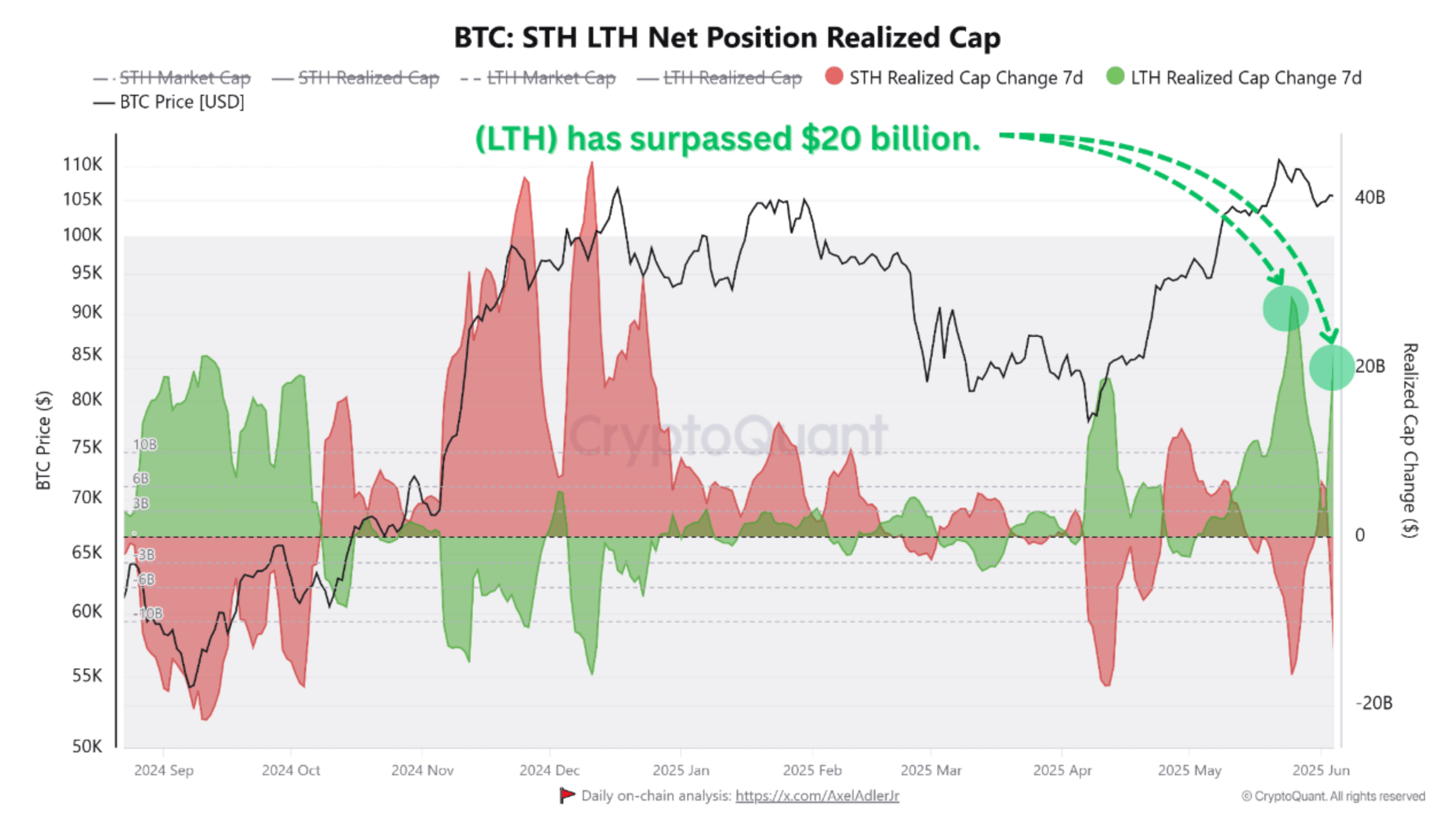

Nonetheless, based on a current CryptoQuant Quicktake put up by contributor Amr Taha, a number of bullish alerts have emerged because the begin of June. Most notably, the LTH Internet Place Realized Cap just lately crossed the $20 billion threshold, reflecting elevated confidence amongst seasoned buyers.

For context, LTHs are entities which have held BTC for over 155 days. Sometimes called “good cash,” these buyers usually comply with long-term methods and are much less prone to promote throughout short-term market corrections.

The Realized Cap metric tracks the full worth of BTC held by LTHs, primarily based on the value at which cash have been final moved. A rising worth on this metric implies accumulation by long-term buyers – habits that traditionally precedes bullish continuation phases.

In the meantime, main exchanges comparable to Kraken and Bitfinex have witnessed substantial BTC outflows. Over two consecutive days, greater than 20,000 BTC exited these platforms – marking one of many largest short-term withdrawal spikes in current months.

Such main Bitcoin withdrawals from exchanges are thought of bullish as a result of they sign that buyers intend to carry their BTC in non-public wallets moderately than promote it, lowering the accessible provide for buying and selling. This provide contraction can create upward strain on value, particularly when demand stays regular or will increase.

On the similar time, Binance has strengthened its lead in spot market dominance. Since early June, its share of BTC spot buying and selling quantity has elevated from 26% to 35%, signalling rising market exercise. This uptick aligns with BTC testing key resistance ranges. Taha remarked:

The convergence of rising alternate dominance, long-term holder confidence, and provide tightening paints a bullish image for Bitcoin. Whereas short-term corrections are potential, the underlying demand and discount in accessible BTC on exchanges counsel that the uptrend is way from over.

BTC Benefitting From Impartial Funding Charges, Low Promoting Strain

Current on-chain information exhibits that the BTC derivatives market has undergone an entire reset, with its funding charges now hovering round zero, not exhibiting any directional bias. Equally, promoting strain on BTC has remained subdued, evident from low Binance inflows.

Associated Studying

That mentioned, some warning is warranted. Contemporary on-chain information suggests that cracks could also be forming within the sustainability of the present bullish momentum. At press time, BTC trades at $105,022, down 0.3% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com