The on-chain analytics agency Glassnode has revealed Bitcoin has just lately been buying and selling inside a short-term band that has its higher stage presently positioned at $117,000.

Bitcoin Is Buying and selling Between These Two Quick-Time period Holder Worth Bands

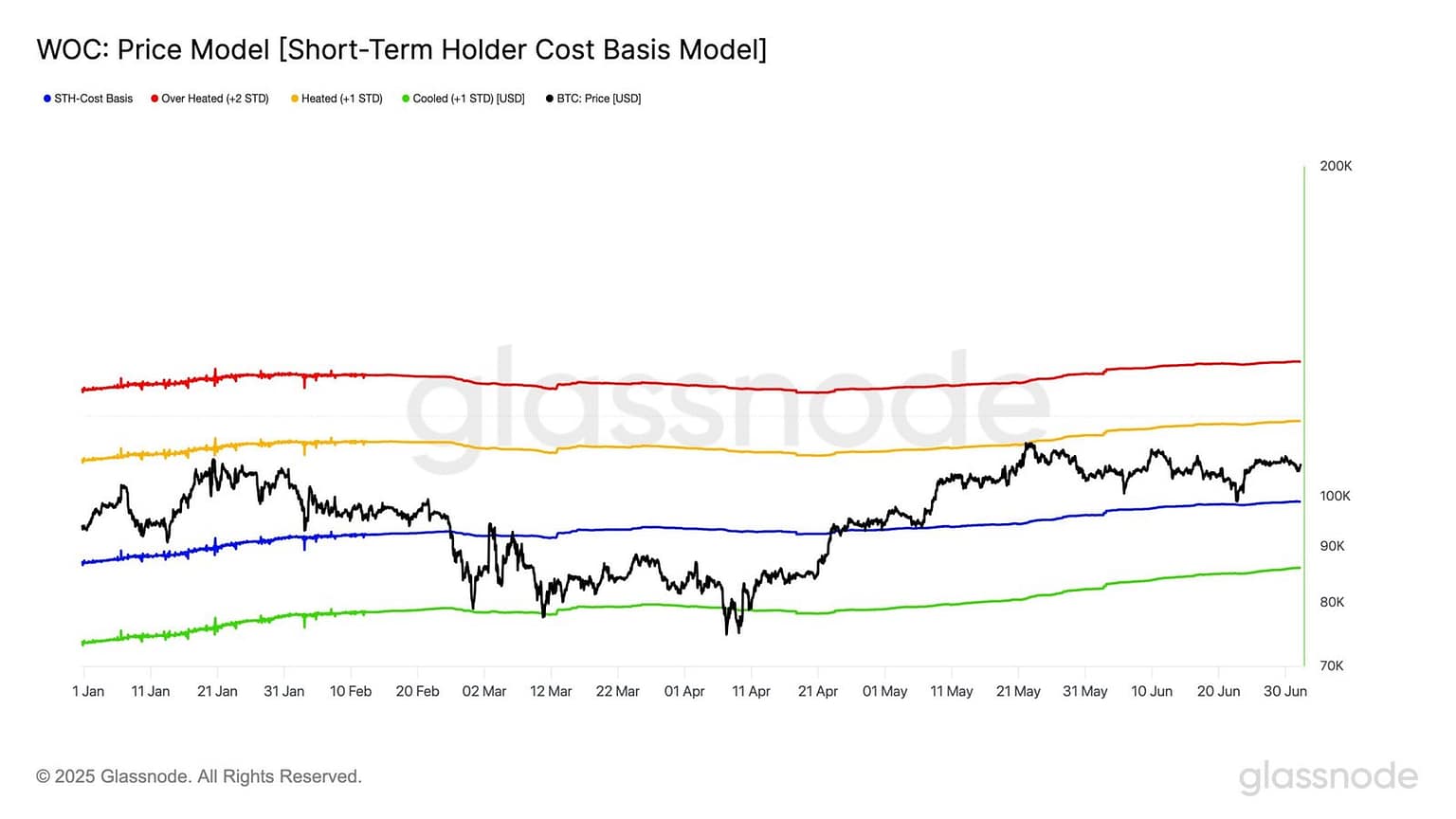

In a brand new post on X, Glassnode has mentioned in regards to the short-term worth band that Bitcoin has been buying and selling inside these days. The band in query relies on two ranges related to the short-term holders (STHs), traders who bought their cash throughout the previous 155 days.

The indicator associated to the STHs that’s of curiosity right here is the Realized Price, which retains monitor of the typical price foundation or acquisition stage of the BTC addresses belonging to the group.

When the worth of this metric is larger than the asset’s spot worth, it means the STHs as a complete may be thought-about to be in a state of web unrealized revenue. However, it being beneath the coin’s worth suggests the dominance of loss amongst this cohort.

Now, right here is the chart shared by Glassnode, which reveals the pattern within the STH Realized Worth and some traces comparable to totally different normal deviations (SDs) from it:

As displayed within the above graph, the Bitcoin worth has curiously traded in a variety outlined by two of those traces over the past six months. The decrease sure of the vary has been the -1 SD and the higher one the +1 SD.

The STHs are made up of the brand new entrants into the sector and fickle-minded merchants, so the group tends to simply react to happenings available in the market. As such, the cryptocurrency’s worth can have some interactions with the STH Realized Worth, because of the cohort’s panic shopping for/promoting.

From the chart, it’s obvious that the identical has been true on this interval of consolidation as effectively. Whereas the indicator has actually not acted as an absolute assist or resistance, the asset has nonetheless seen such results round it within the brief time period.

At present, Bitcoin is buying and selling above the metric after discovering a rebound at it final month. The extent forward of the asset now could be the +1 SD. On this interval of sideways motion, it has thus far solely been in a position to check this line as soon as.

“This stage may be seen because the higher band of the short-term worth motion,” notes the analytics agency. The +1 SD is positioned at round $117,000 proper now. It solely stays to be seen whether or not Bitcoin will check this stage within the close to future or not.

BTC Worth

Bitcoin has loved a surge of greater than 3% over the previous day that has taken its worth to $109,500.