Bitcoin Value Weekly Outlook

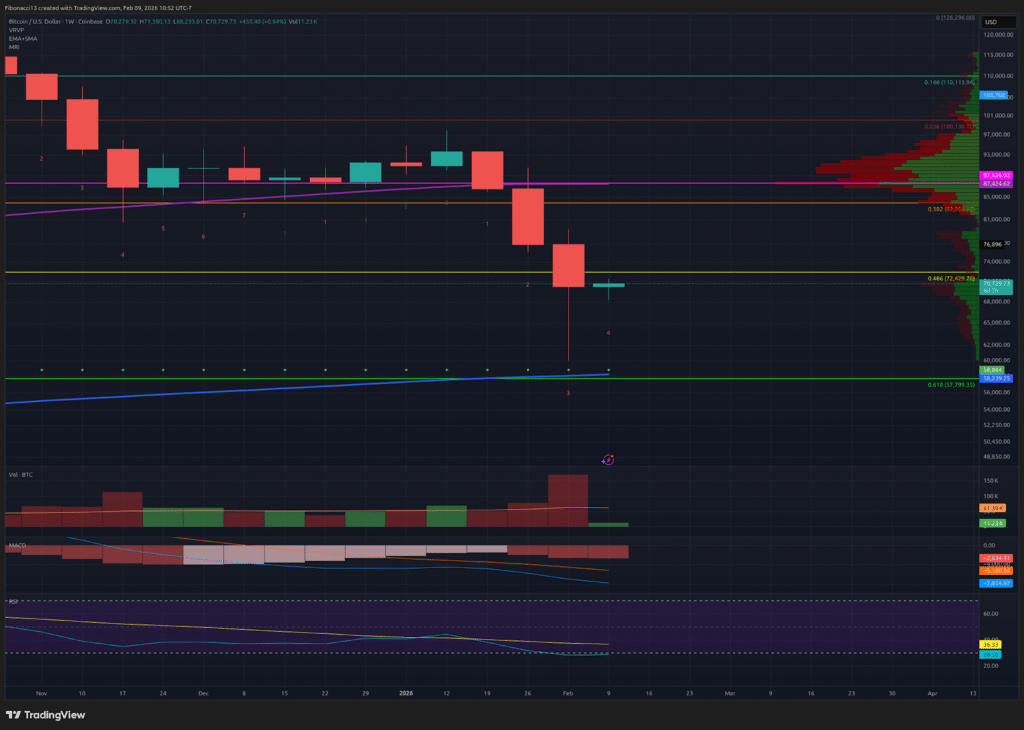

Properly, that escalated rapidly! The bitcoin worth simply melted all over the $70,000s and $60,000s final week, however lastly discovered its footing at $60,000. The bulls battled again from down there to push the worth again as much as $71,700 earlier than it moved again barely to shut the week out at $70,315. The bears lined a number of floor to the draw back final week, so the bulls will attempt to get again some floor this week. Count on $60,000 assist to carry a minimum of into this week.

Key Help and Resistance Ranges Now

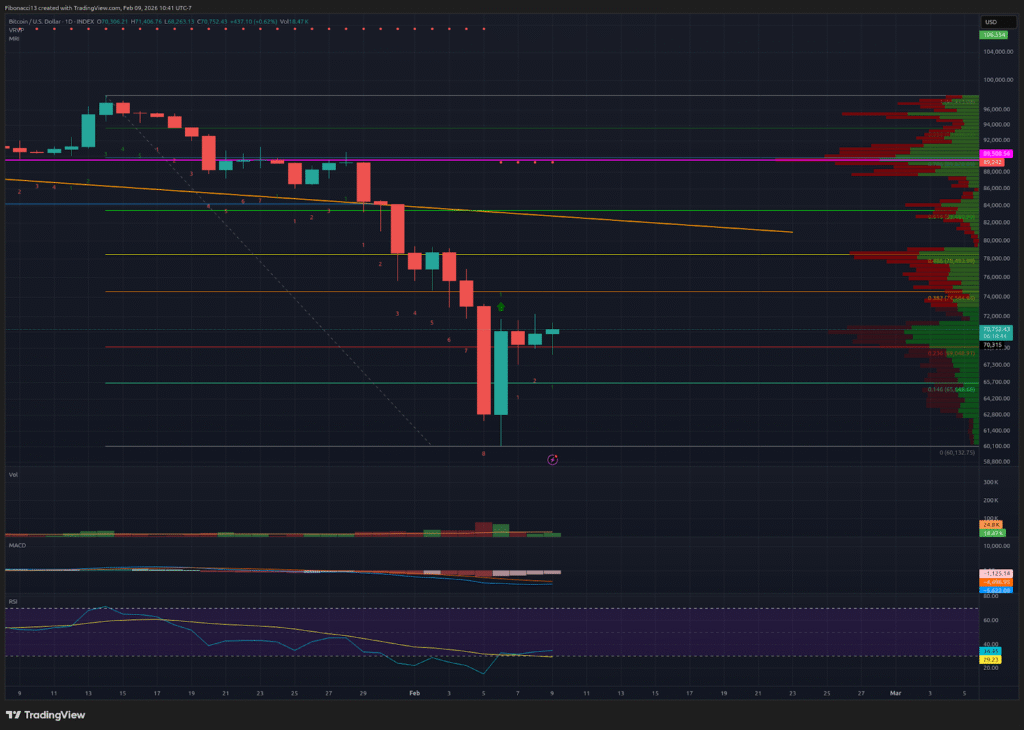

With such an enormous transfer down final Thursday, we might want to discover new resistance ranges to look at going ahead. Over the brief time period, $71,800 is a degree to look at after the worth rejected there Friday into Saturday. Above right here, we now have the 0.382 Fibonacci retracement from the newest transfer down, sitting at $74,500. If the worth can handle to climb above this degree, $79,000 must be a robust resistance. $84,000 sits firmly above this degree and must be very robust resistance going ahead.

Trying beneath, the bulls will look to carry $65,650 to be able to attempt to put within the reversal right here. $63,000 sits just under right here as assist. Subsequent, we now have $60,000 as newfound assist simply above the 0.618 Fibonacci retracement at $57,800. Arguably, the true assist sits at $57,800 right here and was barely front-run at that $60,000 low. If this degree is misplaced, we are going to look all the best way right down to $44,000 for assist, then $39,000 on the 0.786 Fibonacci retracement beneath right here.

Outlook For This Week

The MRI Indicator gave us a purchase sign on Friday final week on the each day chart off of the $60,000 low. The transfer was robust from that degree, so the bulls must attempt to capitalize on this bounce to proceed the momentum into this week. This sign can produce a full reversal, however usually solely ends in a 1 to 4 candle correction of the development. So if the bulls can preserve the push greater going into Wednesday, we could also be a sustainable reversal on the each day chart, which may try and reclaim the $80,000 degree.

Market temper: Bearish – The value misplaced a number of floor final week. The bears are in management. Interval.

The subsequent few weeks

The bears took the worth down one other huge leg final week. Weekly RSI hit oversold ranges and produced an enormous bounce. After such a major drop and such an enormous bounce again from $60,000, the worth ought to stay constrained inside a variety right here for a minimum of the subsequent few weeks. Don’t count on to see any worth motion above $80,000 or beneath $60,000 for the subsequent few weeks.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go greater.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Help or assist degree: A degree at which the worth ought to maintain for the asset, a minimum of initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent that’s prone to reject the worth, a minimum of initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the worth.

Oscillators: Technical indicators that fluctuate over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold situations) and a excessive degree (usually representing overbought situations). E.G., Relative Power Index (RSI) and Transferring Common Convergence-Divergence (MACD).

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the velocity of the worth and modifications within the velocity of the worth actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is beneath 30, it’s thought-about to be oversold.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).

Momentum Reversal Indicator (MRI): A proprietary indicator created by Tone Vays. The MRI indicator tracks purchaser and vendor momentum and exhaustion, offering alerts to point when to count on momentum to fade and speed up.