Bitcoin has held up strongly in comparison with the businesses which have adopted it as part of their treasury technique, however the hole between the digital asset and these corporations is turning into extra pronounced.

During the last 10 weeks, shares of Bitcoin Treasury Firms (BTCTCs) have fallen sharply, shedding between 50% and 80% of their worth. This divergence exhibits an uncommon sample, successfully making a “1:4 ratio” in cycle habits.

Associated Studying

12 Mini-Bear Markets In 18 Months

Bitcoin’s worth motion up to now 18 months has principally been in a bullish cycle on the macro finish, with the main cryptocurrency creating new price highs upon new worth highs inside this era. This has induced a rise in lots of companies adopting a Bitcoin treasury strategy of their steadiness books, often known as Bitcoin Treasury Firms (BTCTCs).

Nonetheless, in accordance to data from crypto commentator Mark Moss, the inventory costs of firms with a Bitcoin technique have diverged from Bitcoin, shedding between 50% and 80% of their inventory worth over the past ten weeks. This divergence, Moss famous, exhibits an uncommon 1:4 cycle ratio the place company Bitcoin holders endure 4 mini-cycles for each one Bitcoin market cycle.

The Japanese firm MetaPlanet is the prime case examine for this incidence. During the last 18 months, its inventory ($MTPLF) has gone by 12 distinct drawdowns, starting from sharp single-day plunges to extended declines stretching over months. On common, these downturns erased 32.4% of worth and lasted about 20 days. The shortest correction was a brutal one-day slide of twenty-two.2% in April 2024, whereas the longest and deepest crash lasted 119 days from July to November 2024, wiping out 78.6%.

The chart under, of MetaPlanet’s inventory, exhibits repeated selloff cycles that seem way more compressed and excessive than Bitcoin’s worth corrections up to now 18 months or so.

MetaPlanet Stock Price: Mark Moss on X

Correlation With Bitcoin?

Apparently, solely 41.7% of MetaPlanet’s drawdowns have instantly lined up with Bitcoin’s corrections. Out of the 12 mini-bear markets recognized, simply 5 occurred in sync with BTC’s declines. The bulk (7 out of 12) had been unrelated to Bitcoin and had been as a substitute brought on by company-specific elements. In line with Moss, these elements embody warrant workout routines, fundraising actions, and compression of the Bitcoin premium that MetaPlanet trades at in comparison with its BTC holdings.

The 2 most extreme drawdowns, nonetheless, did overlap with Bitcoin volatility. The -78.6% collapse in late 2024 and a -54.4% drawdown each coincided with durations when Bitcoin itself was present process corrections. These overlapping occasions counsel that whereas BTC volatility sometimes adds to the drawdown, MetaPlanet’s inventory selloffs have a tendency to increase past Bitcoin downturns.

Primarily, what this implies is that as a substitute of BTC 4-year cycles, BTCTCs are actually extra like 4 cycles in 1 yr.

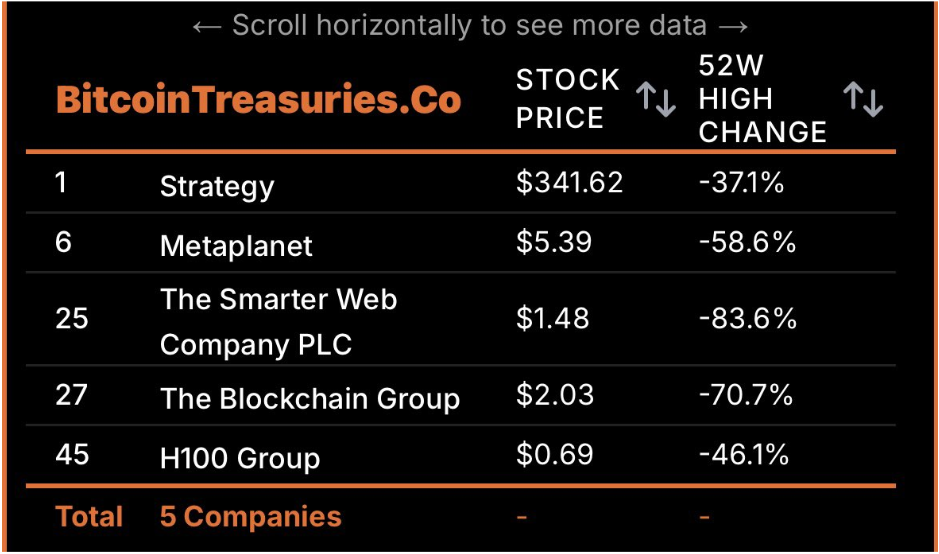

On the time of writing, Bitcoin is in a correction phase and is struggling to carry above the $110,000 assist degree. Widespread BTCTC shares are additionally battling downtrends alongside Bitcoin. Strategy’s stock is down 37.1% from its 52-week excessive, whereas MetaPlanet is down 58.6%. Others, like The Smarter Net Firm PLC (-83.6%) and The Blockchain Group (-70.7%), are at higher losses.

BTCTC Stock Prices: BitcoinTreasuries

Associated Studying

Featured picture from Unsplash, chart from TradingView