Michael Saylor despatched a brief, cryptic message on X on November 2, 2025: “Orange is the colour of November.” The publish included a chart tied to Technique’s (previously MicroStrategy) Bitcoin tracker. Studies have disclosed that crypto shops and market watchers rapidly learn the road as a touch at one other company Bitcoin purchase.

Associated Studying

Bitcoin Purchase: Orange Dot Indicators

In accordance To screenshots and media protection, the publish echoed previous Saylor posts that used orange imagery to flag Bitcoin strikes. Some shops known as it a tease for a thirteenth straight buy by Technique.

That description comes from reporters monitoring the agency’s shopping for sample, not from an official Technique assertion. The tweet didn’t lay out timing or greenback quantities.

Technique Holdings And Current Buys

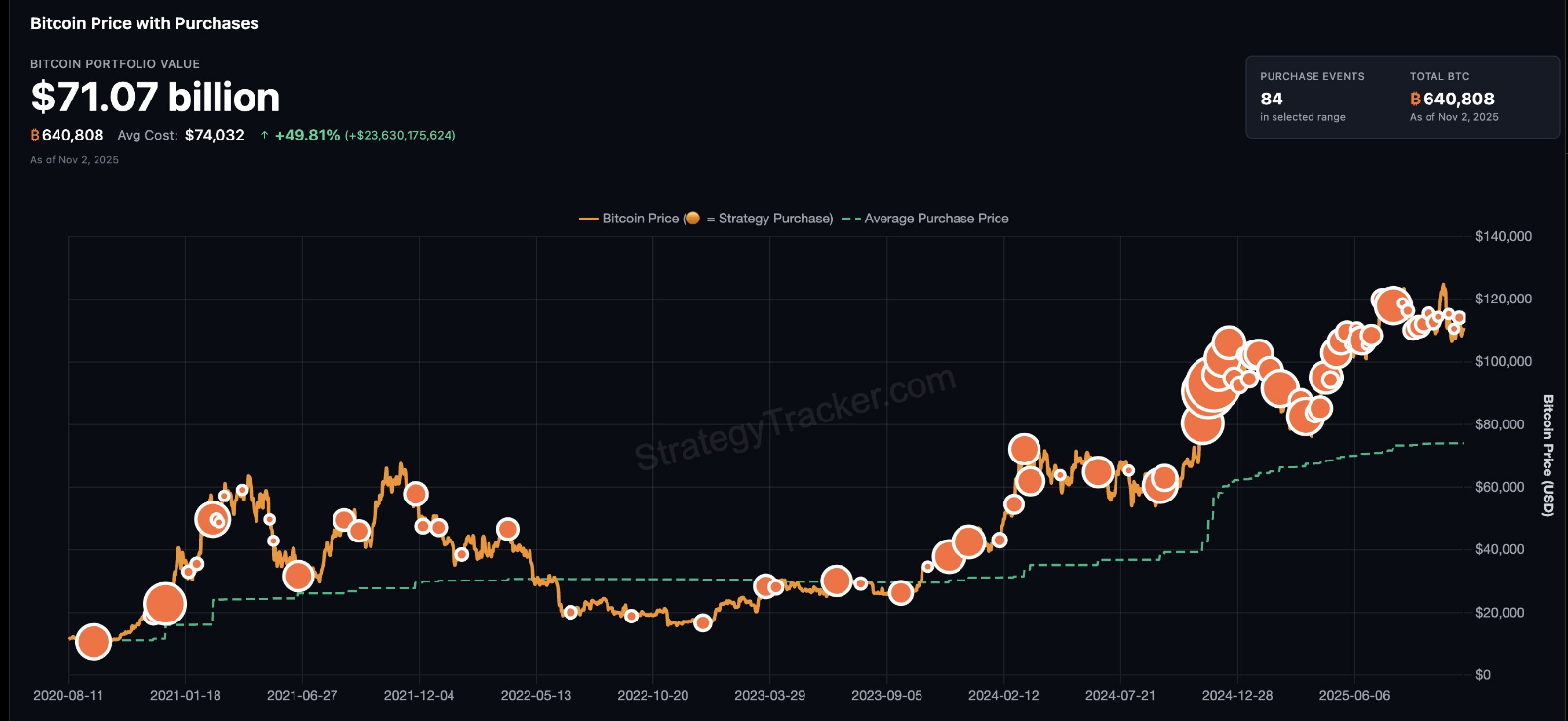

Based mostly on stories and filings summarized in market protection, Strategy at present holds roughly 640,808 BTC, with a median price foundation close to $74,302 per coin.

The corporate’s final disclosed acquisition was about 390 BTC, which market trackers put at roughly $43 million. These figures come from public disclosures and monitoring companies that observe company treasury buys.

Orange is the colour of November. pic.twitter.com/M3JoIuDpRk

— Michael Saylor (@saylor) November 2, 2025

Market Reactions And Dangers

Merchants reacted quick. Some patrons pushed costs larger on the concept one other company purchaser was about to enter the market.

Others bought into the noise, treating the tweet as a sign that may not instantly result in a commerce. Headlines linking the publish to different massive political or financial occasions—equivalent to reporting on US President Donald Trump—appeared in a number of shops, however analysts say such connections are speculative until tied to filings or on-chain strikes.

Why Watch For Filings

Based mostly on previous apply, Technique tends to file disclosures after finishing purchases. That sample makes regulatory filings and on-chain addresses value awaiting anybody monitoring precise flows.

If a recent 8-Okay seems or a pockets tied to the corporate posts motion, that can flip rumor into confirmed motion. Till then, the market runs on interpretation and expectation.

What This Means For Traders

For holders, company accumulation typically serves as a sentiment enhance. For brief-term merchants, it raises volatility. Institutional watchers shall be wanting not just for extra purchases but additionally for any change in scale.

The corporate’s massive stake—tons of of 1000’s of BTC at a multi-thousand greenback common—signifies that public buys or gross sales have the ability to maneuver sentiment.

Associated Studying

What To Watch Subsequent

Based mostly on stories, the clearest indicators to observe are regulatory filings, updates from Technique itself, and on-chain transfers tied to recognized firm addresses.

Market knowledge suppliers who tracked the final 390 BTC buy will probably flag any new motion rapidly. Till these gadgets seem, the tweet stays a robust trace however not proof of an imminent massive buy.

Featured picture from Unsplash, chart from TradingView