Opening Observe

Welcome, Altcoin Traders! 🚀 Whether or not you are a seasoned dealer or simply starting your crypto journey, staying knowledgeable is the important thing to maximizing your alternatives on this ever-evolving market. We’re right here to offer you the newest updates, market insights, and altcoin tendencies so you possibly can commerce and make investments with readability and confidence. Strap in for a deep dive into immediately’s most vital developments taking place throughout the crypto ecosystem.

Market Recap

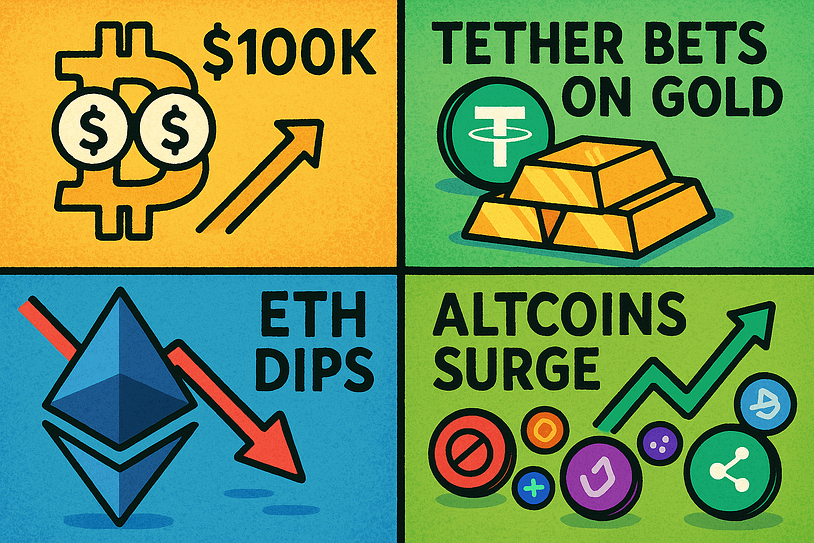

The crypto markets proceed to show dynamic momentum as Bitcoin and different cryptocurrencies reply to altering macroeconomic situations, investor sentiment, and institutional curiosity. Let’s break down the newest market motion:

- Bitcoin (BTC): Bitcoin has surged to $93,000, gaining vital traction following a large leverage flush that cleared out overleveraged positions. This essential transfer has reset funding charges and paved the best way for more healthy worth motion. Analysts are carefully watching the $100,000 psychological barrier—a key stage that, if damaged, may set off accelerated institutional inflows and sign the affirmation of a renewed crypto bull market. On-chain metrics additionally recommend elevated accumulation amongst long-term holders, indicating rising confidence in Bitcoin’s upward trajectory.

- Ethereum (ETH): Ethereum worth motion stays bearish within the quick time period, slipping again under $3,800 as treasury shopping for curiosity wanes. The shortage of institutional staking mixed with waning decentralized finance (DeFi) utilization has created downward stress. Nonetheless, optimism stays on the horizon as Ethereum builders put together for the following spherical of upgrades geared toward bettering scalability and decreasing fuel charges. In the meantime, traders are eyeing a possible aid rally if ETH can reclaim and stabilize above the $4,000 stage.

- Altcoin Market: Altcoins are exhibiting blended alerts this week. Binance Coin (BNB), particularly, has drawn consideration after posting a number of consecutive inexperienced days on the charts. The token now eyes a possible retest of the $1,000 mark amidst rising investor confidence. Different notable performers embody SOL and AVAX, each of which have seen elevated exercise of their respective ecosystems. Meme cash and AI-powered tokens additionally stay trending, drawing consideration to the evolving narratives in altcoin hypothesis.

Featured Pattern or Perception

Tether Buying Gold

Tether (USDT), the world’s largest stablecoin issuer, has attracted headlines as soon as once more—this time for its forward-looking financial technique. The corporate is reportedly buying massive portions of gold, outpacing reserves held by many nationwide central banks. This growth is reshaping the dialog about how digital belongings can preserve pegged valuations and macro stability.

Historically, stablecoins akin to USDT have been backed by money and short-term U.S. Treasury payments. Nevertheless, Tether’s elevated allocation to treasured metals like gold is a calculated hedge in opposition to inflations and market turbulence. This large accumulation is sparking debates amongst economists and crypto analysts alike. Some applaud Tether’s risk-management method, whereas others query its transparency and auditing course of.

The transfer alerts a broader shift towards diversified stablecoin reserves, particularly amid international issues about fiat debasement and central banking uncertainty. Within the occasion of a macroeconomic downturn or widespread geopolitical danger, gold-backed digital currencies may emerge as the following frontier of economic stability in Web3. This development introduces an essential query: may we see extra stablecoin issuers undertake related reserve methods? Time will inform, however the intersection of conventional commodities and digital belongings is definitely one to look at carefully.

Prime Gainers & Losers

Understanding the every day movers within the crypto house is essential to navigating short-term trades and figuring out longer-term tendencies. Right here’s a fast breakdown:

- Prime Gainers: CleanSpark, a U.S.-based Bitcoin mining agency, has posted vital good points this week. The corporate has reported will increase in each mining effectivity and power utilization. By leveraging revolutionary applied sciences, together with sustainable power and next-generation ASIC rigs, CleanSpark has been in a position to develop its hash fee whereas decreasing operational prices. This marks a pointy distinction from the broader trade development of declining profitability, positioning CleanSpark as an outlier and a possible mannequin for future mining operations amid rising issue.

- Prime Losers: Sadly, it’s not all excellent news for the crypto mining group. A number of Bitcoin miners are seeing shrinking revenue margins, even after {hardware} upgrades geared toward boosting effectivity. The mixed impact of Bitcoin’s rising community issue and unchanged block reward continues to squeeze the underside strains of smaller operations. Based on current knowledge, some miners may be approaching unprofitability, an indication that might doubtlessly foreshadow a transition right into a bear market part. Traders with publicity to mining shares or mining tokenomics needs to be cautious and preserve a detailed eye on international hash fee metrics.

Information Highlights

Listed here are a number of key information tales you need to learn about that might affect the course of the market over the approaching days and weeks:

- Kalshi Raises $1 Billion: The cryptocurrency prediction market startup Kalshi has closed its Sequence E funding spherical, elevating a staggering $1 billion. With this contemporary capital, the platform now plans to scale up operations, develop its product choices, and double its consumer base. The current spherical additionally doubled the corporate’s valuation, following record-breaking buying and selling volumes. Kalshi’s emergence marks a rising urge for food for on-chain betting and prediction infrastructures that serve each institutional and retail traders.

- Gensler’s Bitcoin Assertion: Gary Gensler, the Chair of the U.S. Securities and Trade Fee (SEC), not too long ago delineated Bitcoin from different cryptocurrencies, emphasizing that it needs to be seen extra as a digital commodity than a speculative asset. This stance comes at a vital time when regulatory readability has been a central concern for traders. Gensler’s feedback reinforce the narrative of Bitcoin as a retailer of worth corresponding to gold, doubtlessly bettering sentiment amongst risk-averse institutional traders. Study extra concerning the evolving position of Bitcoin (BTC) within the broader economic system and portfolio diversification methods.

- Taiwan’s Stablecoin Initiative: Taiwan’s authorities has formally launched plans to create a nationwide stablecoin pegged to the New Taiwan Greenback (NTD), with a projected launch date set for 2026. Policymakers see this initiative as a solution to modernize the monetary system, foster innovation, and preserve management within the face of decentralized digital fee techniques. Laws surrounding the CBDC is receiving robust assist from lawmakers, which signifies an expedited timeline for testing and rollout phases. The digital NTD may turn out to be a regional commonplace if Taiwan’s regulatory framework aligns properly with international requirements.

On Our Radar

ETHZilla & Karus Partnership

The strategic partnership between ETHZilla and Karus Finance may turn out to be a blueprint for future blockchain-fintech convergence. ETHZilla has acquired a significant fairness stake in Karus, which is creating a protocol to tokenize AI-modeled auto mortgage portfolios. This alerts a daring step ahead in creating real-world asset-backed blockchain merchandise, particularly in underserved fintech markets.

By combining blockchain’s transparency with AI’s predictive energy, the alliance goals to unlock new ranges of effectivity within the credit score market. Traders can anticipate tokenized merchandise that provide fractional publicity to structured debt devices—historically a troublesome sector to entry. The usage of good contracts can even decrease intermediaries and scale back administrative overhead considerably, offering extra worth to each debtors and lenders.

This partnership additionally underscores the rising affect of AI within the DeFi and CeFi ecosystems. From predictive analytics and algorithmic buying and selling to credit score scoring and asset administration, AI is shortly turning into indispensable within the subsequent technology of crypto-financial merchandise. Regulate this one, people—it may set the tone for a way conventional finance evolves inside the decentralized world.

That wraps up immediately’s publication. Thanks for becoming a member of us as we discover what’s shaping the digital asset panorama. Don’t miss out—be certain to subscribe for future updates and share your insights in our group remark part. Crypto by no means sleeps, and neither can we. Till subsequent time, keep good, keep safe, and blissful investing! 🌟