On-chain analytics agency Checkonchain has identified how knowledge may recommend that the most recent Bitcoin decline is a part of a deeper bear market development, slightly than the ultimate capitulation occasion.

Bitcoin Has Damaged Under Each True Market Imply & Common ETF Price Foundation

In a brand new post on X, Checkonchain has talked in regards to the current bearish motion within the Bitcoin value. Because the beneath chart shared by the analytics agency reveals, this drawdown has taken the cryptocurrency beneath two key on-chain price foundation ranges.

The primary degree that Bitcoin dropped underneath was the ETF Price Foundation, akin to the common influx value of the US spot exchange-traded funds (ETFs). Earlier than this, the asset had stayed above the road because the second half of 2024. A detailed name got here within the final quarter of 2025, however the degree had ended up appearing as a assist cushion.

This time round, nonetheless, the value went straight by way of the road. After the ETF Price Foundation was damaged, the following degree Bitcoin misplaced was the True Market Mean, a metric monitoring the common shopping for value of the economically energetic BTC provide. Thus, the break additionally despatched the vast majority of the asset’s energetic traders right into a state of internet unrealized loss for the primary time since 2023.

Whereas the value drawdown thus far has clearly induced loads of market ache, it might not be sufficient but, as Checkonchain has famous, “the underlying knowledge suggests that is development deeper into the bear, not the ultimate capitulation occasion.”

The analytics agency has listed a couple of metrics pointing to this. First, the spot ETFs have confronted unfavorable netflows lately, however whereas the outflows have been sizeable, they’ve nonetheless lacked the character related to the panic exodus witnessed on the finish of a cycle.

Likewise, on-chain losses have noticed a rise because the market crash has occurred, however additionally they haven’t but reached a degree that could be thought-about to be a mirrored image of a real capitulation occasion.

Lastly, futures market knowledge suggests merchants have nonetheless been attempting to catch the underside. Checkonchain has described these circumstances as “a regime the place sturdy lows hardly ever type.”

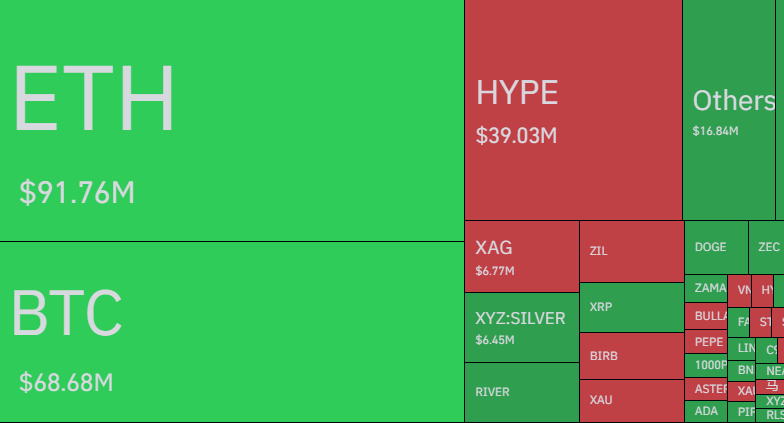

This hypothesis from futures merchants has been leading to mass liquidations on the varied exchanges. Through the previous day alone, lengthy Bitcoin bets value $50 million have been liquidated as the value has seen a swing from round $79,000 to ranges underneath $76,500, in keeping with knowledge from CoinGlass.

In whole, the cryptocurrency market as an entire has witnessed the flush of $185 million in lengthy positions inside this window.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $76,100, down practically 14% during the last week.