Knowledge reveals Altcoins are breaking away from Bitcoin’s lead. Right here’s what that would imply for the market, primarily based on historic developments.

Altcoins Are Witnessing A Quick Drop In Correlation To Bitcoin

In a brand new post on X, analytics agency Alphractal has mentioned how the Correlation between Bitcoin and the altcoins has modified not too long ago. The Correlation is an indicator that retains monitor of how tied collectively the costs of any two belongings are. The metric can tackle each constructive and damaging values. In each circumstances, some relationship exists between the belongings, however the relative motion of their costs is totally different.

When the indicator has a constructive worth, it means one asset is reacting to actions within the different by transferring in the identical route. The nearer is the metric to 1, the stronger is that this relationship. Alternatively, it being below zero suggests a damaging correlation exists between the belongings: they’re transferring in reverse instructions. On this case, the intense level lies at -1.

If the Correlation is sitting precisely at zero, it suggests no relationship exists between the 2 costs in any respect. In statistics, this situation corresponds to the variables being impartial.

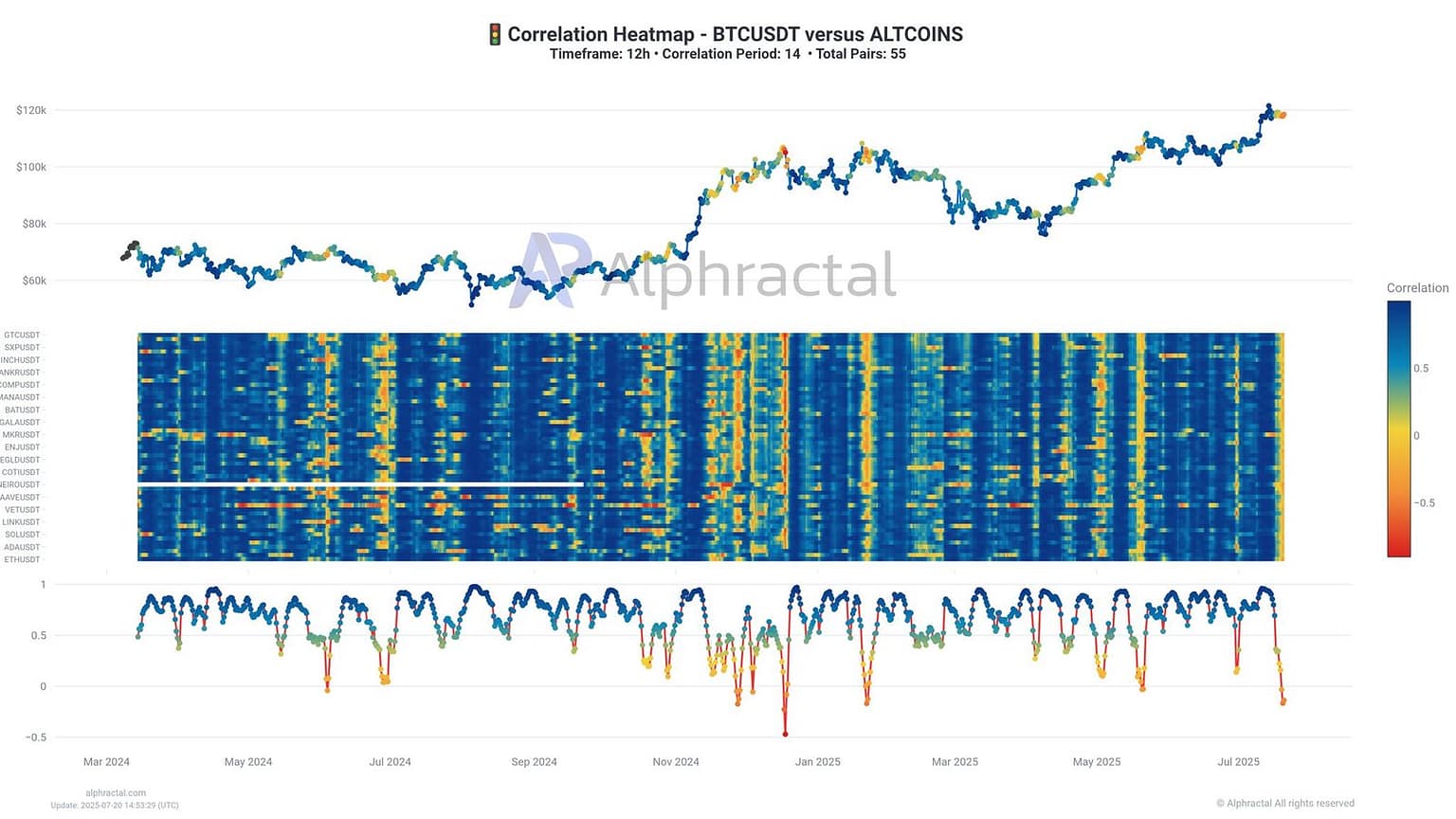

Now, right here is the heatmap shared by Aphractal that reveals the pattern within the Correlation between Bitcoin and the varied altcoins within the sector:

As is seen above, the Correlation between Bitcoin and the totally different altcoins was near 1 simply earlier, however the indicator has seen a fast decline since then. The typical worth of the indicator for the 2 has now dipped towards the zero stage and has even turned barely damaging.

This transformation would counsel that whereas the altcoins have been carefully following the footsteps of the unique cryptocurrency earlier than, they’re now following a chart that’s roughly impartial. This pattern, nonetheless, might not really be a constructive signal for the sector. “Traditionally, low correlation is a pink flag,” explains the analytics agency. “It usually precedes durations of excessive volatility and mass liquidations — whether or not from shorts or longs.”

From the chart, it’s obvious that the final time the Correlation between Bitcoin and the altcoins plunged to zero was again in Might, and what adopted was a value leap for the asset. In January, the identical pattern marked the market top as an alternative.

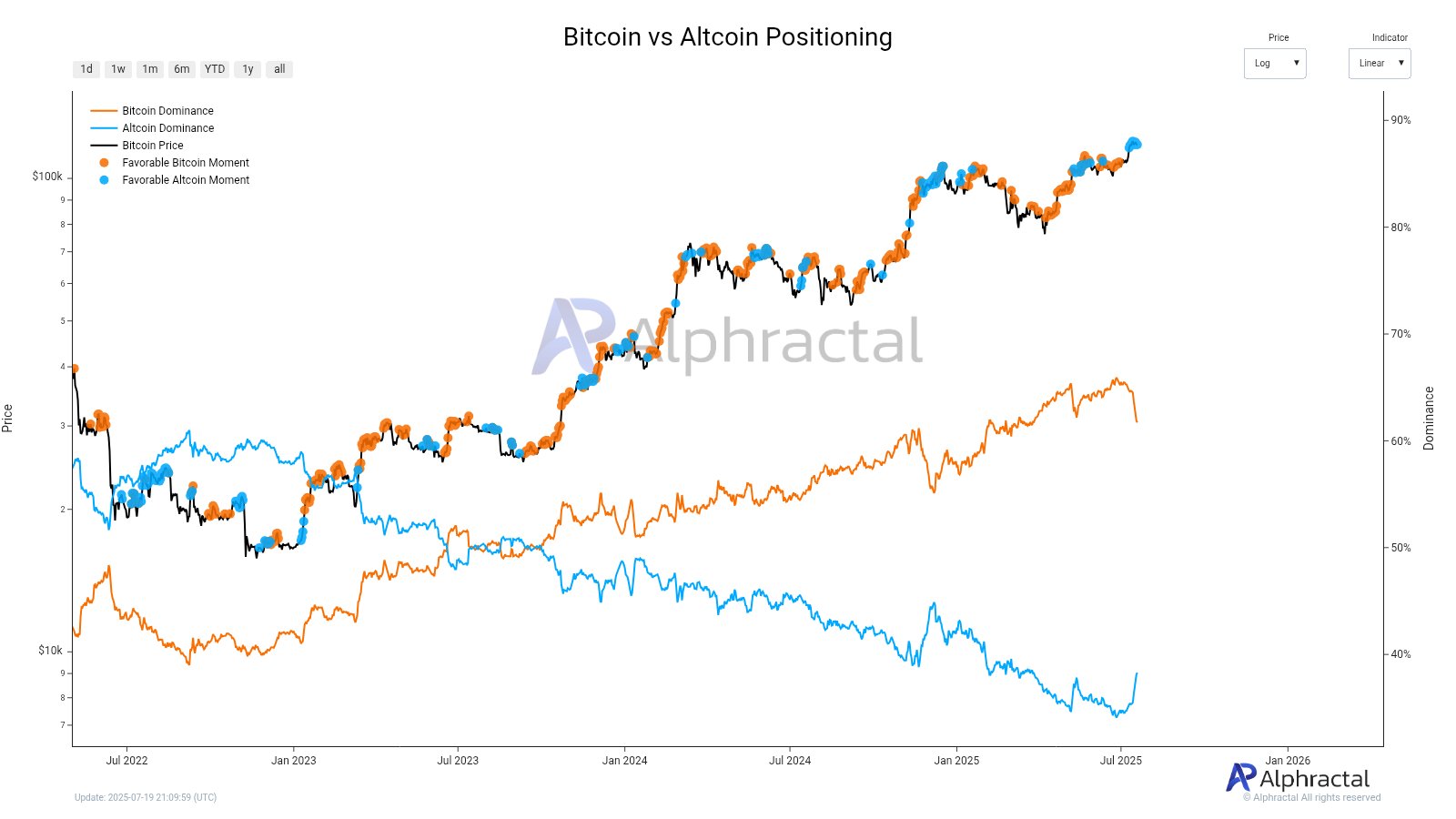

The most recent low Correlation between BTC and the alts has come as numerous belongings have damaged out and market dominance has seen a shakeup.

“Altcoins have been outperforming Bitcoin in latest days, with day by day indicators suggesting it’s been extra worthwhile to remain positioned in altcoins somewhat than BTC,” notes Alphractal.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $118,000, down greater than 2.5% within the final week.