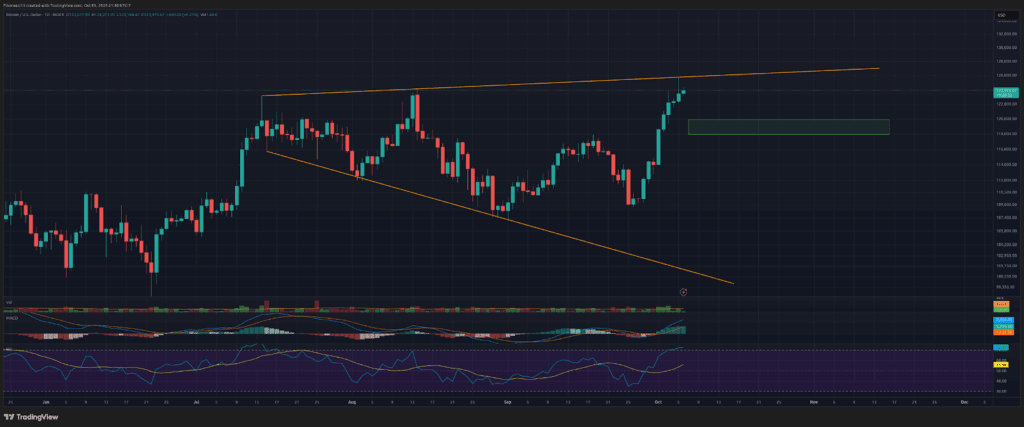

Wow, what a distinction every week makes! Bitcoin began final week out slightly below resistance, then blasted proper on by it, with some very sturdy shopping for strain all through the week. The bulls are again in management after taking out all short-term resistance ranges. Bitcoin worth is now in what’s known as a “blue sky breakout”, the place the value reaches a brand new all-time excessive and goes into worth discovery mode as all consumers who didn’t promote on the correction at the moment are in revenue. It has actually been a powerful week for the bulls, producing the best weekly closing worth bitcoin has ever seen at $123,515.

Key Assist and Resistance Ranges Now

Now that the value has reached new highs, figuring out the place resistance could are available is a really tough activity. We’ve no prior worth ranges to deal with, so any ranges we do provide you with utilizing technical evaluation might be extra theoretical than sensible. Utilizing Fibonacci extensions from the latest pullbacks, nonetheless, we will see that $131,000 could act as a little bit of a barrier if this breakout continues. Above there, we now have some minor confluence at $135,000 and once more at $140,000. If these ranges are damaged, we will look to the two.618 Fibonacci extension from the 2021 excessive to 2022 low, resting at $155,000.

If worth pulls again from right here, we’ll look all the way down to the $118,000 degree as help, with a great likelihood that degree might be front-run by grasping consumers if we do see any vital dip again down. Closing every week under this degree would open up $114,000 as the subsequent help degree, the place the bullish pattern might nonetheless resume if it held. A worth closing under $114,000 would flip the general market construction to bearish, and we’d be trying all the way down to the $105,000 degree for help, whereas as soon as once more questioning if the market prime is in for the foreseeable future.

Outlook For This Week

Inspecting the every day chart, we will see that the broadening wedge sample is now totally established. Sunday evening noticed the value hit the higher pattern line resistance of this sample, so it’s potential we see a shallow pullback over the approaching days earlier than the value can escape of this sample. So, be cautious of a dip by Tuesday/Wednesday right here, but when it comes, we should always anticipate the $120,000 to $118,000 zone to carry as help. If worth can handle to shut a few days above the higher pattern line later this week, we should always see worth acceleration into the $130,000s.

Market temper: Bullish — Bitcoin worth moved above all outlined resistance ranges to shut at a brand new all-time weekly excessive. Bulls at the moment are firmly in management, and the bears are again on their heels.

The following few weeks

Bitcoin doesn’t appear to care in regards to the authorities shutdown, and the case may very well be made that Bitcoin is even stronger due to the shutdown. Over the approaching weeks, we should always anticipate the bitcoin worth to proceed increased. Final week’s shut introduced the weekly RSI again above the 13 SMA, and it’s as soon as once more in bullish posture. The MACD oscillator is near crossing bullish as effectively, and can accomplish that if bitcoin closes above $125,000 to finish this week. Each of those oscillators will solely add extra causes for buyers and merchants to stay lengthy bitcoin. Bears might want to see some heavy promoting quantity and costs under $118,000 to be able to attempt to regain management from the bulls over the subsequent a number of weeks. The bears will need to see an enormous miss for October’s CPI report, or another kind of macro bearish occasion, to be able to stand an opportunity of holding again the bulls right here over the approaching weeks.

Bulls/Bullish: Patrons or buyers anticipating the value to go increased.

Bears/Bearish: Sellers or buyers anticipating the value to go decrease.

Assist or help degree: A degree at which the value ought to maintain for the asset, not less than initially. The extra touches on help, the weaker it will get and the extra seemingly it’s to fail to carry the value.

Resistance or resistance degree: Reverse of help. The extent that’s more likely to reject the value, not less than initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the value.

SMA: Easy Transferring Common. Common worth based mostly on closing costs over the desired interval. Within the case of RSI, it’s the common power index worth over the desired interval.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart sample consisting of an higher pattern line appearing as resistance and a decrease pattern line appearing as help. These pattern traces should diverge away from one another to be able to validate the sample. This sample is a results of increasing worth volatility, usually leading to increased highs and decrease lows.

Oscillators: Technical indicators that adjust over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold situations) and a excessive degree (usually representing overbought situations). E.G., Relative Power Index (RSI) and Transferring Common Convergence-Divergence (MACD).

MACD Oscillator: Moving Average Convergence-Divergence is a momentum oscillator that subtracts the distinction between two transferring averages to point pattern in addition to momentum.

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the value and modifications within the pace of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is under 30, it’s thought-about to be oversold.