Bitcoin Worth Weekly Outlook

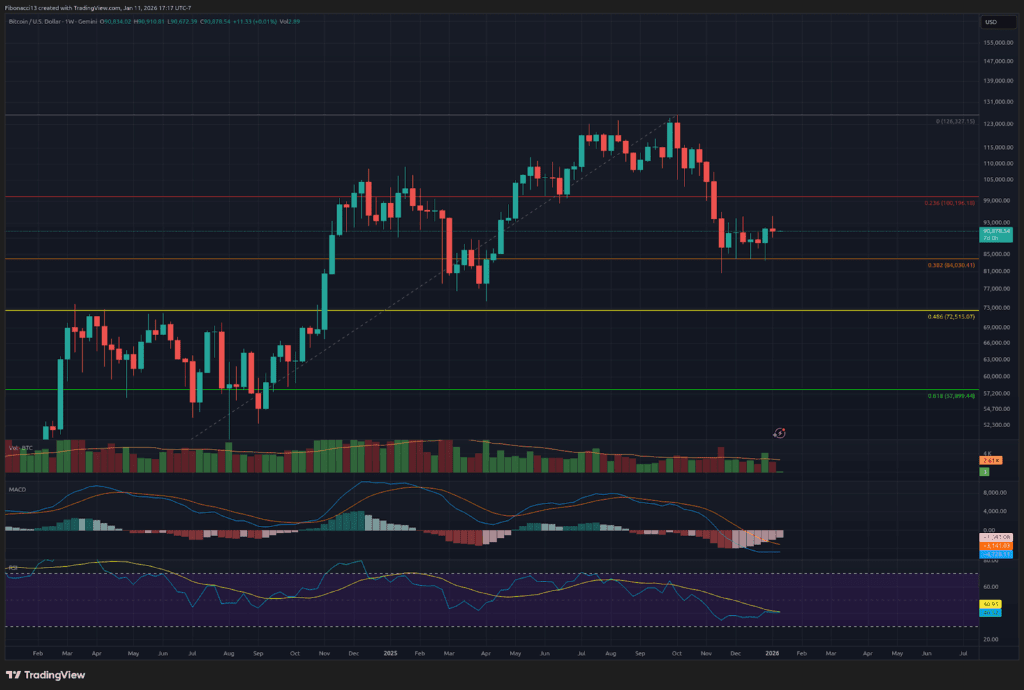

Bitcoin consumers made a pleasant push to $94,000 resistance once more final week, however the value promptly bought off once more from this stage to shut the week out at $90,891. Sunday’s shut gave us a doji candle, indicating indecision and a possible reversal again within the bears’ favor. The bulls are as soon as once more trying torpid as they lack the follow-through essential to overtake resistance. Bears are within the driver’s seat heading into this week. Search for them to attempt to push the worth down by the $87,000 help stage to make one other try at breaking $84,000 help.

Key Assist and Resistance Ranges Now

The bulls are in search of help on the $87,000 stage to carry if bears handle to maintain the push decrease going right here. $84,000 nonetheless sits as sturdy help under right here, however will weaken with any additional strain. If the bears can handle to interrupt this help, the worth is certain to speed up right down to the low $70,000 space, with a detailed under $68,000 required to lose this help stage. Beneath this zone, bulls will look to achieve some type of power off the 0.618 Fibonacci retracement at $58,000.

Bears will look to defend the $91,400 stage as resistance over the quick time period right here. The resistance at $94,000 has completed its job up to now, however it will likely be underneath heavy strain if bulls can muster the power to get the worth again up there. Above $94,000, there’s a resistance zone that stretches from $98,000 as much as $103,500. Above right here, now we have one other resistance zone from $106,000 as much as $109,000 on the 0.618 Fibonacci retracement from the drop from the highest right down to $80,000.

Outlook For This Week

Wounded bulls want some assist to hold on to momentum this week. Search for the bears to push the worth right down to $87,000 early within the week and presumably under it. Bulls will attempt to cease the worth from closing any days under $87,000. If the bears handle a each day shut under right here, $84,000 help will probably be underneath heavy risk, and the bulls will want consumers to step as much as the plate with some huge quantity to carry this help stage as soon as once more.

Market temper: Bearish – After a weekly taking pictures star doji candle shut, the bulls’ momentum has light. The bears have tilted management barely of their favor to start out this week.

The following few weeks

Worth motion might stay uneven and confined inside a spread over the subsequent few weeks. Bulls must see a detailed above $94,000 to interrupt above this vary and search for upward momentum, whereas bears must see a detailed under $84,000 to attempt to break down under this main help stage. Between $94,000 and $84,000 is now a impartial zone, the place bulls and bears might battle forwards and backwards. Neither aspect is poised to take agency management of the worth motion till both of those boundaries is damaged.

Bulls/Bullish: Patrons or traders anticipating the worth to go larger.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or help stage: A stage at which the worth ought to maintain for the asset, at the very least initially. The extra touches on help, the weaker it will get and the extra seemingly it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of help. The extent that’s prone to reject the worth, at the very least initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the worth.

Taking pictures Star Candle: A candlestick that happens after an uptrend, marked by a protracted wick upwards above the candle physique and a smaller wick (or no wick) to the draw back. The lengthy wick up signifies sturdy promoting close to the highs. This candle can usually point out the tip of an uptrend.

Doji Candle: A candlestick that closes at practically the identical value at which it opened. This candle signifies indecision, and may sign a reversal in value motion if it happens after an uptrend or downtrend.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).