Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After an eventful begin to the week marked by a pointy downward swing under $100,000, the Bitcoin worth has recovered excellently, returning above the $107,000 mark to shut the week. Regardless of Bitcoin’s recent recovery, there appears to be a distinct sentiment available in the market which, apparently, has been rising over time. Right here’s how the present rising sentiment may have an effect on the premier cryptocurrency’s future trajectory.

Quick Positions Surge Over The Previous 7 Days — What This Means

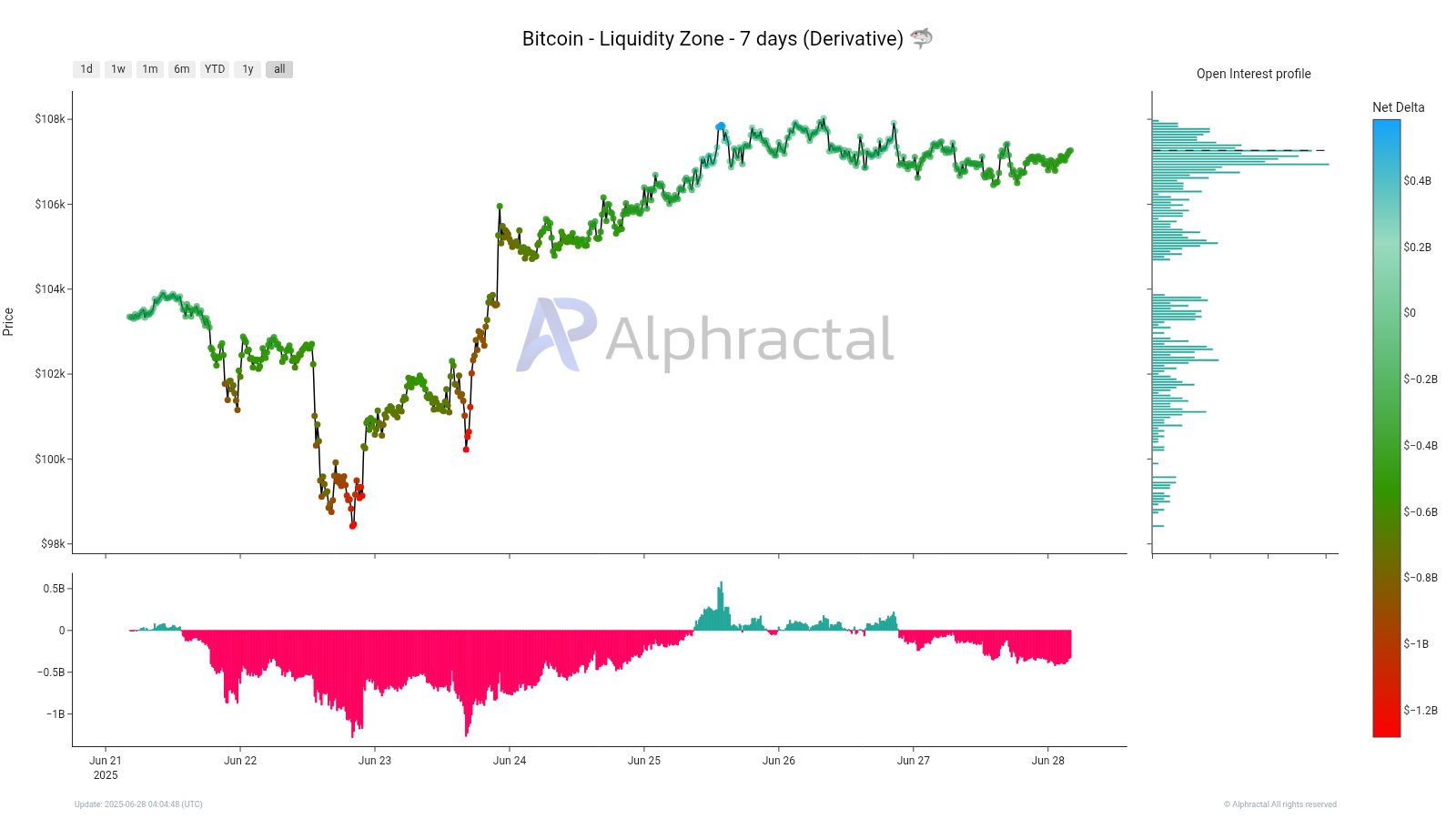

In a June twenty eighth submit on social media platform X, cryptocurrency analytics agency Alphractal shared an attention-grabbing on-chain growth within the Bitcoin market.

Associated Studying

This on-chain remark relies on the Liquidity Zone (7 Days) indicator, which measures three essential information: on one hand, it’s used to watch the worth motion of Bitcoin; on one other, the Internet Delta of open curiosity or positions; and, lastly, it exhibits the distribution of open curiosity at varied worth ranges.

For a bit context, the open curiosity Internet Delta measures the distinction between lengthy and quick open positions available in the market. If the Internet Delta reads constructive, it means the patrons populate the market extra. However, a detrimental studying means there are extra quick positions open than longs.

Within the submit on X, Alphractal pointed out that, over the span of seven days, extra positions have been opened in a wager towards the worth of BTC. From the chart under, the purple bars symbolize a detrimental Internet Delta. As has been previously defined, what this implies is that the quick merchants presently dominate the market.

Apparently, the shorts-dominated market doesn’t precisely assure that we are going to expertise a sell-off within the close to future. It is because the excessive detrimental Internet Delta was recorded at a time when Bitcoin’s worth remains to be at a secure degree, even with little progress.

When promote positions are opened in a secure however bullish market, this often signifies that the bears may be getting trapped. If, finally, the Bitcoin worth overcomes the promote resistance, a phenomenon often known as a brief squeeze will happen.

On this situation, sellers will likely be compelled to buy back at higher prices, thereby pushing the Bitcoin worth to the upside. This upward momentum will then additional liquidate quick positions.

What’s Subsequent For Bitcoin?

There are uncertainties as as to whether the Bitcoin market would possibly break the promote resistance, or go in favour of the sellers. Because of this, Alphractal warns that these with bearish sentiment must be cautious about their subsequent transfer.

Associated Studying

As of this writing, Bitcoin appears caught inside a uneven vary over the previous day and is presently valued at $107,309. The flagship cryptocurrency’s measly progress of 0.2% previously 24 hours pales compared to its seven-day rise of 5.2%.

Featured picture from IStock, chart from TradingView