Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

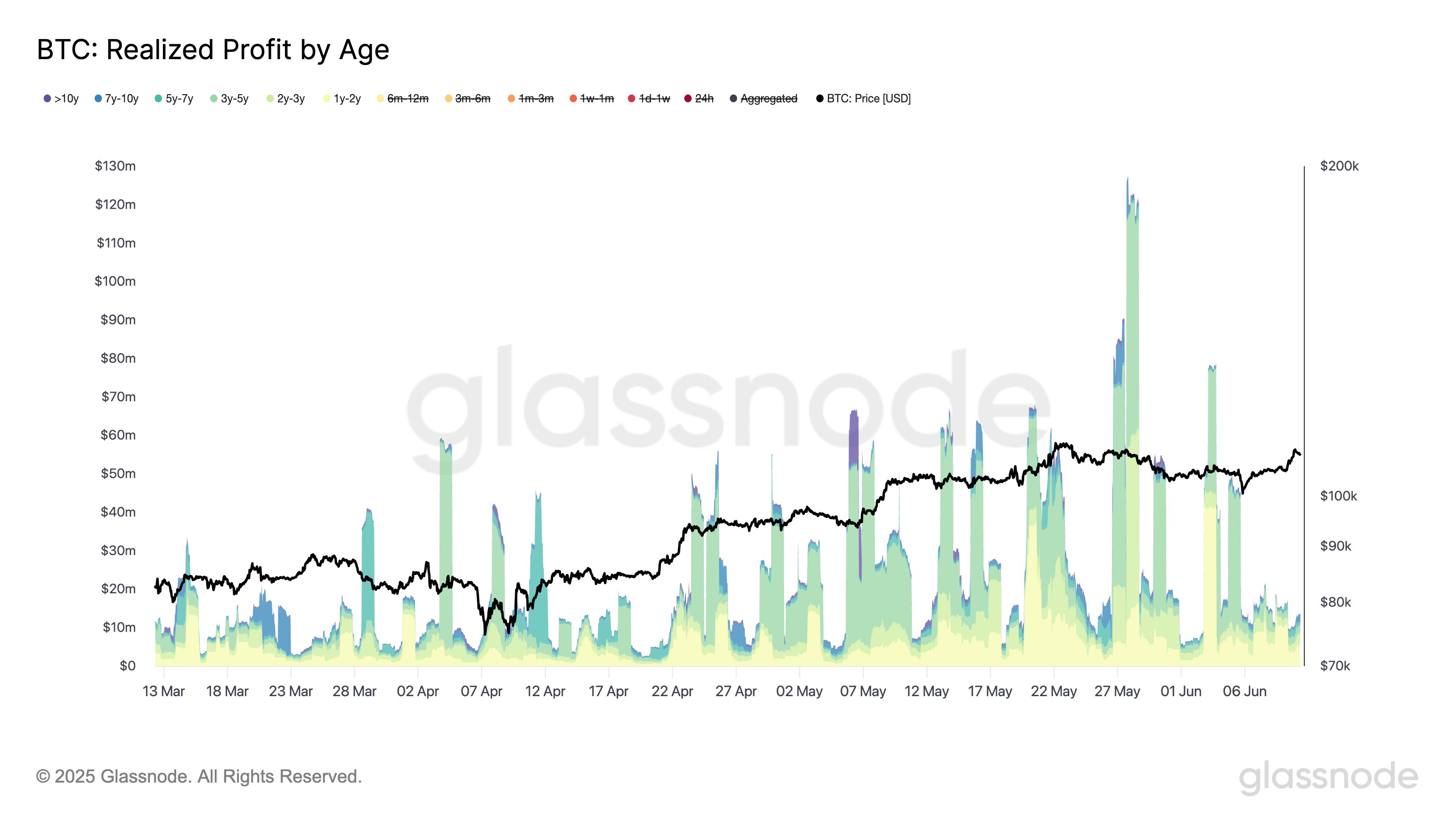

On-chain knowledge reveals the veterans of the Bitcoin market are taking 89% much less income in comparison with the Might peak, regardless of costs being comparable now.

Bitcoin Realized Revenue For 1Y+ Fingers Is Comparatively Low Proper Now

In a brand new post on X, the on-chain analytics agency Glassnode has talked in regards to the newest pattern within the Realized Revenue of the seasoned palms on the Bitcoin community. The “Realized Profit” refers to an indicator that measures, as its title implies, the quantity of revenue that the BTC traders are realizing via their promoting.

The metric works by going via the switch historical past of every coin being transacted or ‘offered’ on the chain to see what value it was moved at previous to this. If the earlier promoting worth is lower than the present value for any token, then that specific token’s sale is contributing to revenue realization.

Associated Studying

The quantity of revenue realized within the sale is of course equal to the distinction between the 2 costs. The Realized Revenue sums up this worth for all tokens being transferred to seek out the full for the community as an entire.

Within the context of the present matter, the Realized Revenue of your entire userbase isn’t of curiosity, however simply that of a particular a part of it: the 1+ yr holders. These are the traders who’ve been holding onto their cash since greater than a yr, with out having concerned them in a transaction even as soon as.

Statistically, the longer an investor holds onto their tokens, the much less seemingly they turn into to promote them sooner or later. As such, this a part of the userbase with its important holding time would come with the resolute diamond hands of the market.

Now, right here is the chart shared by Glassnode that reveals the pattern within the Bitcoin Realized Revenue for these HODLers over the previous couple of months:

As displayed within the above graph, the Bitcoin Realized Revenue of the 1+ yr traders noticed an enormous spike in late Might. This sharp profit-taking spree from these seasoned palms got here as BTC surged to $110,000 following its publish all-time high (ATH) pullback.

Shortly after the selloff from this cohort, BTC began on a decline. Throughout the previous day, although, the asset has appeared to have lastly shoved off this bearish momentum, because it has as soon as extra returned above the $109,000 mark.

This time, nevertheless, there hasn’t been any important response from the diamond palms. At present, the 24-hour easy transferring common (SMA) of the group’s Realized Revenue sits at $13.6 million, which is 89% down in comparison with the $126 million peak from final month.

Associated Studying

It’s doable that the veterans of the market assume there may be extra to come back within the newest Bitcoin rally, so they’re selecting to HODL sturdy.

BTC Value

On the time of writing, Bitcoin is floating round $109,100, up greater than 2% within the final seven days.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com