Over time, the UAE has elevated its Bitcoin holdings by way of mining and ETF purchases, with publicity now exceeding $1 billion.

Changpeng Zhao (CZ), founder and former CEO of the world’s largest crypto alternate, Binance, has revealed his position within the United Arab Emirates’ (UAE) Bitcoin adoption.

In a tweet highlighting data that the UAE has formally acknowledged bitcoin (BTC) as a retailer of worth just like gold, CZ disclosed that his advocacy contributed to the event.

CZ Influenced the UAE’s Bitcoin Adoption

“I might need performed a tiny little bit of advocacy for this,” the Binance founder stated.

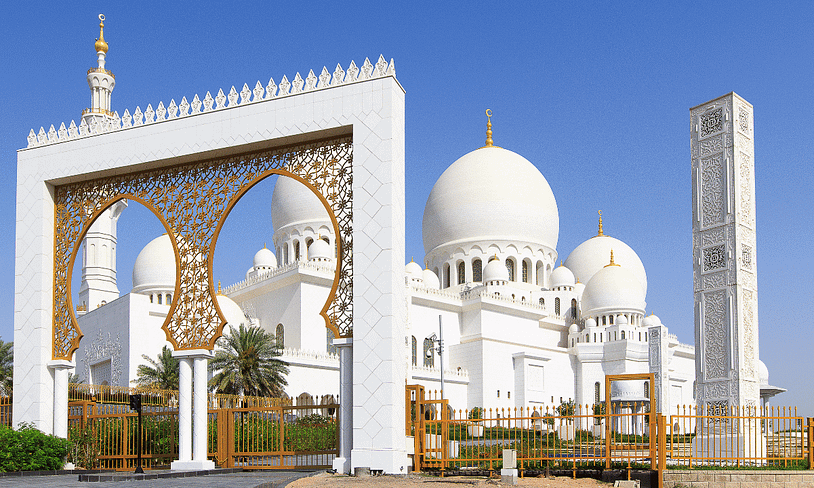

It’s no information that CZ established his main residence in Dubai in 2021, as a result of metropolis’s pro-crypto and forward-thinking atmosphere. His presence within the metropolis and influence on outstanding figures have definitely affected their stance on Bitcoin and the crypto business as an entire.

Over time, the UAE has elevated its Bitcoin publicity by way of mining and the acquisition of exchange-traded funds (ETFs). By 2022, Abu Dhabi’s royal household had ventured into Bitcoin mining by way of its affiliated agency, Citadel Mining. The royal household, by way of Citadel, established large-scale mining operations on AI Reem Island and has since amassed over $450 million in bitcoin.

Earlier in the present day, the market intelligence platform, Arkham, revealed that the UAE has mined $453.6 BTC. On-chain knowledge reveals the entity has been holding the vast majority of BTC produced, with its final outflow recorded 4 months in the past. The royal household is now $344 million in revenue on their BTC, minus power prices.

UAE’s Bitcoin Publicity Crosses $1B

In addition to the Bitcoin mining ventures, two main Abu Dhabi sovereign wealth entities, particularly Mubadala Funding Firm and Al Warda Investments, have bought thousands and thousands of shares in spot Bitcoin ETFs. By the tip of 2025, the businesses had amassed greater than $1 billion in mixed holdings of BlackRock’s iShares Bitcoin Belief (IBIT).

Separate 13F filings with the U.S. Securities and Trade Fee (SEC) revealed that by the tip of final 12 months, Mubadala held over 12.7 million shares in IBIT. Alternatively, Al Warda owned a minimum of 8.21 million shares of the identical product. The shares have been price $631 million and $408 million, respectively.

You may additionally like:

Though the worth of the ETF shares has plummeted alongside bitcoin’s value, the mixed Bitcoin publicity for the UAE stays effectively above $1 billion. With the federal government recognizing BTC as a retailer of worth, the cryptocurrency is more likely to be handled as a everlasting reserve asset going ahead.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in unique BingX Trade rewards (restricted time provide).