DeFi comes and goes, however the newest developments within the sector have shocked even skilled gamers.

The perpetual DEX (decentralized change) sector has entered a cooling part. Complete worth locked (TVL) declined from an all-time excessive of about $6.1B on September 13 to roughly $5.1 B by September 22.

Nonetheless, with beneficial properties of 600% and 2100%, respectively, two new entrants – Avantis ($AVNT) and Aster ($ASTER) – are shortly gaining traction, resisting the broader downturn with spectacular will increase in each token worth and protocol adoption.

Avantis: Speedy however Regular Progress

Avantis’s native token ($AVNT) elevated by 66% in only one week, rising from about $1.25 to $2.05. Its TVL additionally grew by almost 27%, going from $17.7M to $22.6M in the identical interval.

Avantis, a product of Coinbase, emphasizes revolutionary derivatives merchandise and user-friendly interfaces as key elements attracting new liquidity. In contrast to some older protocols, Avantis has personalized options particularly for retail merchants in search of alternate options to centralized platforms.

The regular but speedy development signifies a sustainable inflow of capital slightly than mere speculative fever. With the token’s worth rising 641% over the previous month, buyers are in search of additional beneficial properties forward.

Aster: A Breakout Story

Aster’s rally has been far more explosive. Its token surged 2213% in a month, leaping from $0.20 to $1.90 inside that interval.

Much more outstanding was its TVL development – a 228% enhance from $370M to $1.21B between September 14 and 22.

In Aster’s case, a key endorsement from Changpeng Zhao boosted credibility and visibility throughout the crypto neighborhood.

Hyperliquid’s $HYPE token dropped about 9.3%, with TVL down 3.3%, whereas Jupiter noticed an 8% token decline and TVL fell 5.6%. The image is of Avantis and Aster benefiting on the expense of established tasks, as capital is reallocated towards up-and-coming tasks that seem to supply extra upside.

The Larger Image: Sustainable Progress or Quick-Lived Hype?

Whereas the emergence of Avantis and Aster highlights the dynamism of the DeFi derivatives panorama, questions stay about sustainability.

Surging TVL and token costs usually correlate with speculative momentum, and historical past exhibits that hype can fade shortly as soon as the preliminary pleasure cools – as Hyperliquid found this previous week.

Can Bitcoin Hyper introduce a word of stability by opening the door for Bitcoin’s integration into the DeFi world?

Bitcoin Hyper ($HYPER) – Unlocking Bitcoin-Native DeFi Functions

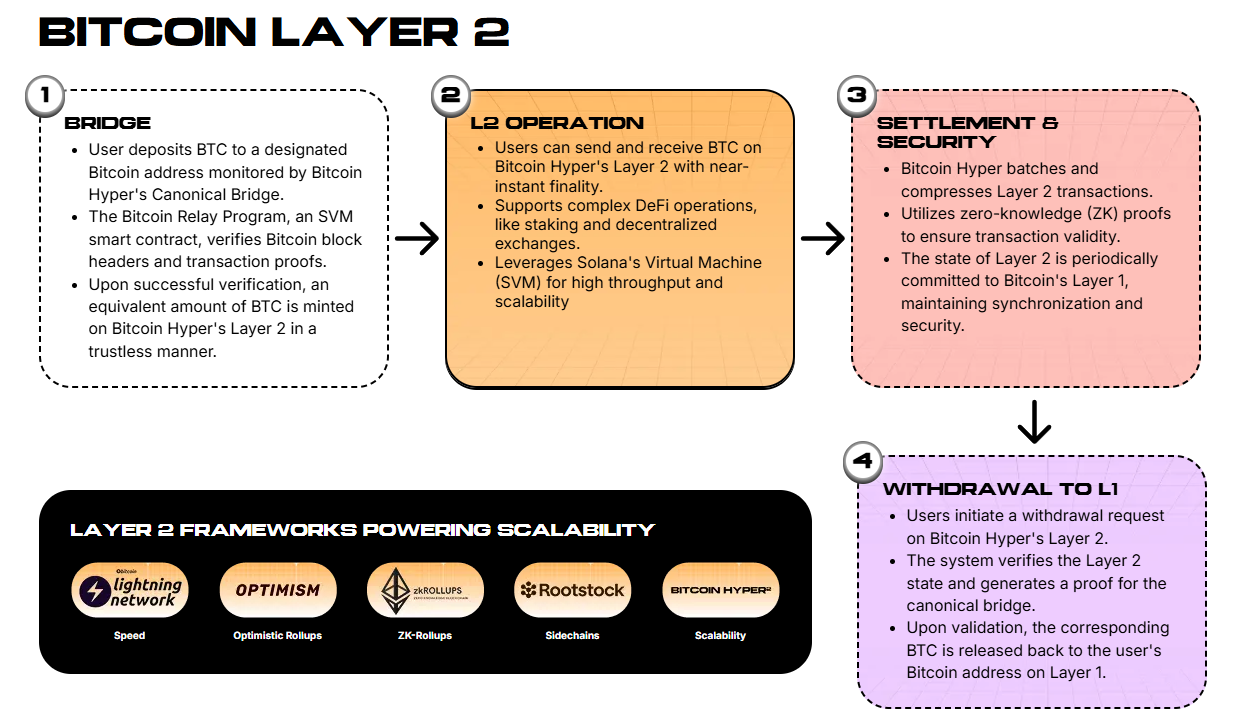

With Bitcoin Hyper ($HYPER), there’s a probability for Bitcoin to reinvent itself. Now not merely a retailer of worth, on the Hyper Layer 2, wrapped Bitcoin may be swapped at Solana-fast speeds. Microtransactions turn out to be possible, with low charges and excessive throughput.

And since remaining settlement stays on the Bitcoin Layer 1, there’s no sacrifice of pace and stability.

$HYPER token holders get entry to dApps constructed on the Hyper Layer 2, pre-sales, and all early-stage options.

The presale roared previous $17M as buyers realized simply how much potential Bitcoin Hyper holds. The success of $AVNT and $ASTER helps reinforce the potential $HYPER holds; be taught how to buy $HYPER with our information.

Visit the presale page to learn more.

The beneficial properties spotlight an even bigger development: new protocols appeal to merchants by promising innovation, improved consumer experiences, and better potential returns, whilst the general perpetual DEX market consolidates.

Whether or not Avantis and Aster can maintain their momentum stays unsure, however $HYPER could be right here for the long term.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/binance-aster-soars-1800-in-a-week/