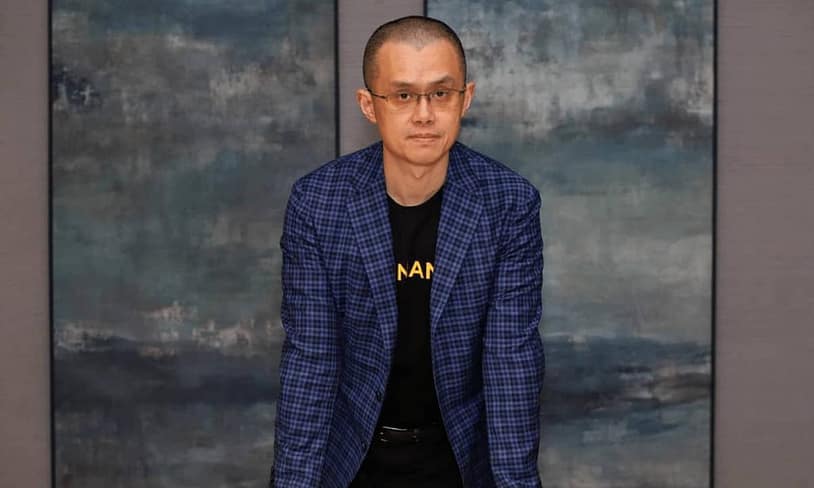

Changpeng Zhao (CZ) has filed a movement to dismiss a $1.76 billion lawsuit introduced in opposition to him by the FTX chapter belief.

He says the court docket has no authorized authority over him as a result of he lives within the United Arab Emirates (UAE).

CZ’s Defence

Based on a Bloomberg report, his authorized crew submitted the movement on Monday to the U.S. Chapter Court docket for the District of Delaware, asserting that the accusations fall outdoors the court docket’s attain.

“The claims are to date faraway from Delaware and even the USA that the statutes at situation, which lack extraterritorial software, don’t even apply,” his attorneys wrote within the submitting.

Lodged in November 2024, the lawsuit accuses Zhao, Binance, and several other former executives of receiving billions of {dollars} in funds that have been wrongfully moved by FTX founder Sam Bankman-Fried (SBF). It focuses on a July 2021 deal the place the trade sold again its fairness in FTX’s worldwide and US-based entities. Based on the belief, Binance held a 20% stake in FTX’s worldwide unit and 18.4% within the U.S. arm.

Court docket data present that Alameda Ltd, an organization registered within the British Virgin Islands, transferred the funds for FTX. Alternatively, the Binance entities concerned have been registered in Eire, the Cayman Islands, and the British Virgin Islands. CZ’s authorized crew argues this makes the transaction international and outdoors the attain of U.S. chapter legal guidelines. In addition they declare he was a “nominal counterparty” within the deal, that means he was not deeply concerned within the course of.

Zhao’s submission additionally described the connection between FTX and Binance as solely short-term. They ended their partnership on account of private disagreements, after which Binance’s fairness in Bankman-Fried’s enterprise was exchanged for cryptocurrency.

The crypto entrepreneur claims the lawsuit unfairly blames him and Binance for the collapse of FTX, which he described took place on account of SBF’s misconduct. He additionally argued that serving authorized papers via U.S.-based attorneys shouldn’t be legitimate below chapter regulation when the defendant lives overseas. His crew says the belief is attempting to stretch its claims past U.S. borders in methods that aren’t supported by the regulation. They are saying the fraud claims don’t meet the requirements required for cover below federal guidelines tied to securities contracts.

Former Binance Executives Additionally Looking for Dismissal

This growth follows related motions filed final month by former Binance executives Samuel Wenjun Lim and Dinghua Xiao, who’re additionally named within the FTX go well with and are searching for to be faraway from the case.

CZ accomplished a four-month jail sentence in September final 12 months after pleading responsible to U.S. anti-money-laundering violations. In the meantime, Sam Bankman-Fried is serving 25 years for fraud and conspiracy.

Elsewhere, the defunct trade announced it is going to begin distributing the following batch of creditor claims on September 30. As of August 2025, it has returned roughly $6.2 billion to former prospects throughout two main rounds.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome supply on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!