In a turbulent second quarter (Q2) for the cryptocurrency market, Avalanche (AVAX), a layer-1 blockchain platform continuously thought-about a competitor to Ethereum (ETH), reported a combined bag of economic metrics.

Avalanche Value Declines However Consumer Engagement Soars

A current analysis from information agency Messari revealed that AVAX’s value fell 4.2% quarter-over-quarter, dropping from $18.77 to $17.99. This decline got here alongside a 2.6% lower in its circulating market cap, which fell from $7.8 billion to $7.6 billion.

The affect of this value drop was additionally mirrored in AVAX’s market rating, which fell from fifteenth to sixteenth amongst all cryptocurrencies. Nonetheless, not all metrics have been damaging.

Transaction charges for AVAX surged by practically 29% through the quarter, growing from 58,300 to 75,170. When it comes to income, transaction fees in USD additionally rose barely, going from $1.50 million to $1.54 million, indicating a rising consumer base and elevated exercise on the platform.

Associated Studying

A very vibrant spot for Avalanche in Q2 2025 was the numerous development in every day transactions throughout its C-Chain and different layer-1s. Common every day transactions skyrocketed by 169.91%, reaching 10.1 million in comparison with 3.7 million within the earlier quarter.

This was complemented by a dramatic improve in every day lively addresses, which surged by 210.45% to 519,954, suggesting a sturdy uptick in consumer engagement.

Consistent with this development, Avalanche additionally diminished its common transaction charges by 42.7%, from $0.05 to $0.03. This discount is basically attributed to the Octane upgrade, which launched a dynamic price mechanism on Avalanche’s C-Chain, permitting for real-time price changes to boost consumer expertise and cut back prices.

C-Chain Transactions And DeFi TVL Soar

The C-Chain particularly noticed spectacular utilization development, with common every day transactions leaping 493.4% from 244,995 on the finish of Q1 to 1.4 million by the tip of Q2.

Each day lively addresses additionally skilled a wholesome improve of 57% quarter-over-quarter, rising from 29,554 to 46,397. Notably, there was a spike to 419,619 every day lively addresses on Could 11.

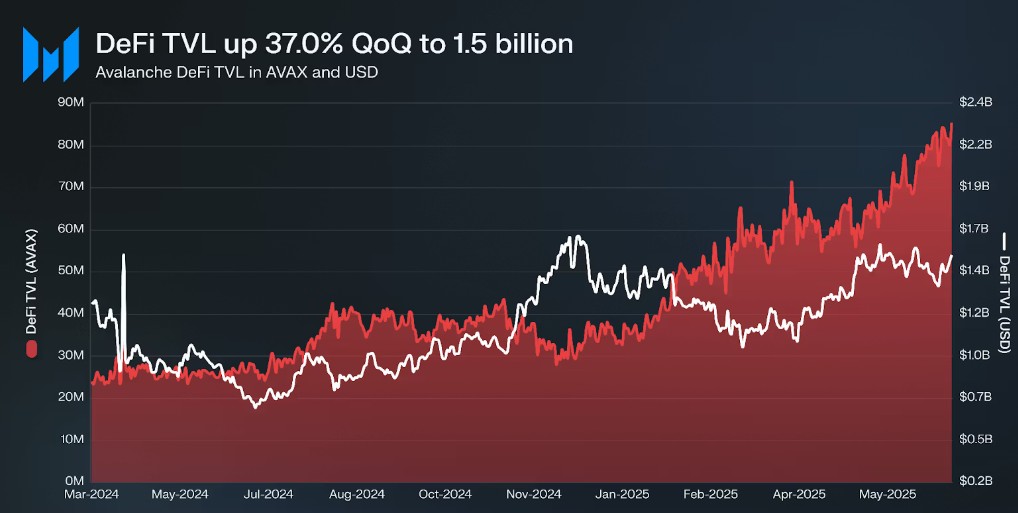

As seen within the chart above, Avalanche’s total value locked (TVL) in decentralized finance (DeFi) rose 37.1%, climbing from $1.1 billion to $1.5 billion. Nonetheless, the stablecoin market cap on Avalanche noticed a major decline of 23.8%, dropping from $1.9 billion to $1.5 billion.

Associated Studying

The rise in every day lively addresses throughout Avalanche’s layer-1 platforms was notably noteworthy. The common every day lively addresses surged by 444.8% quarter-over-quarter, from 68,723 to 374,402.

As of this writing, AVAX’s value has recovered from Q2 lows towards the $23 zone, rising 35% previously thirty days as a result of current bullish sentiment that led Bitcoin (BTC), the market’s main crypto, to succeed in a brand new all-time excessive above $123,000.

Featured picture from DALL-E, chart from TradingView.com