Constancy Digital Belongings launched a brand new report that reveals that for the primary time in historical past, extra bitcoin is coming into “historic provide,” which refers to cash which have remained unmoved for 10 years or extra, than are being mined.

As of June 8, a median of 566 BTC per day is crossing the ten yr threshold, whereas solely 450 BTC is being issued each day following the 2024 halving. 3

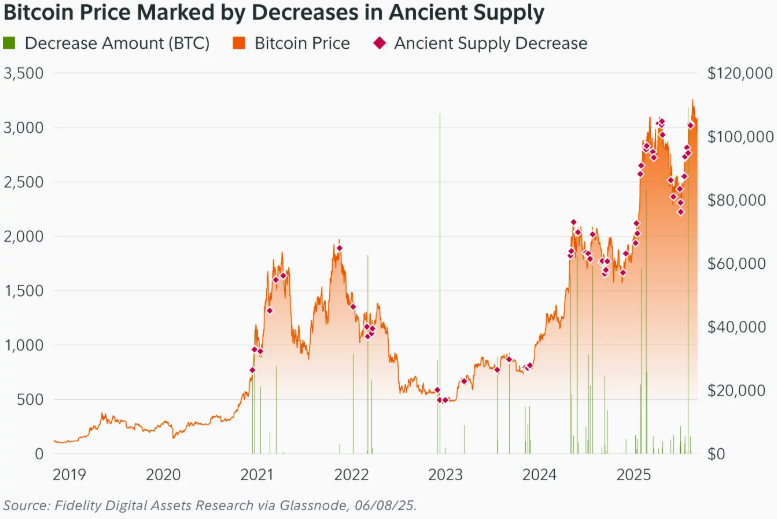

“The share of historic provide additionally tends to extend every day, with each day decreases noticed lower than 3% of the time,” the report says. “In distinction, that quantity will increase to 13% when the brink is lowered to bitcoin holders of 5 years or extra.”

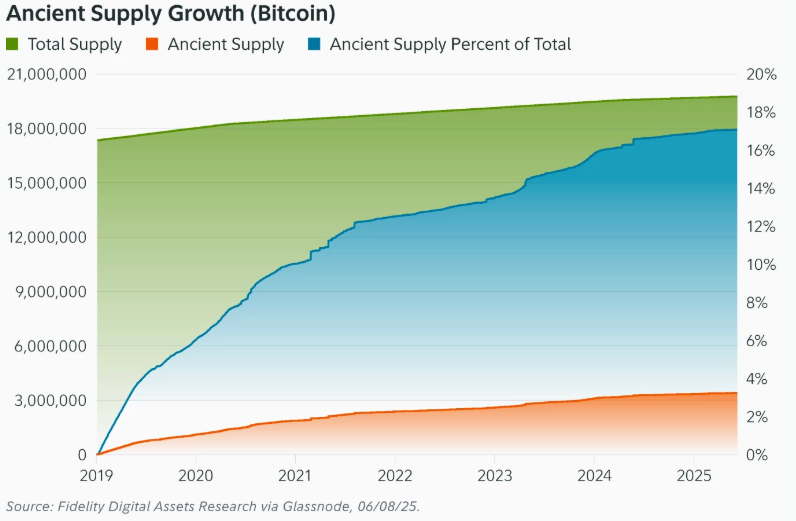

Bitcoin’s historic provide has grown since January 1, 2019, when Satoshi Nakamoto turned the primary 10 yr holder. Immediately, over 3.4 million BTC fall into this class, value greater than $360 billion. Round 1/3 is believed to belong to Nakamoto.

Regardless of their rising worth, long-term holders are usually not cashing out. Historic provide makes up over 17 p.c of all bitcoin, and that share continues to develop.

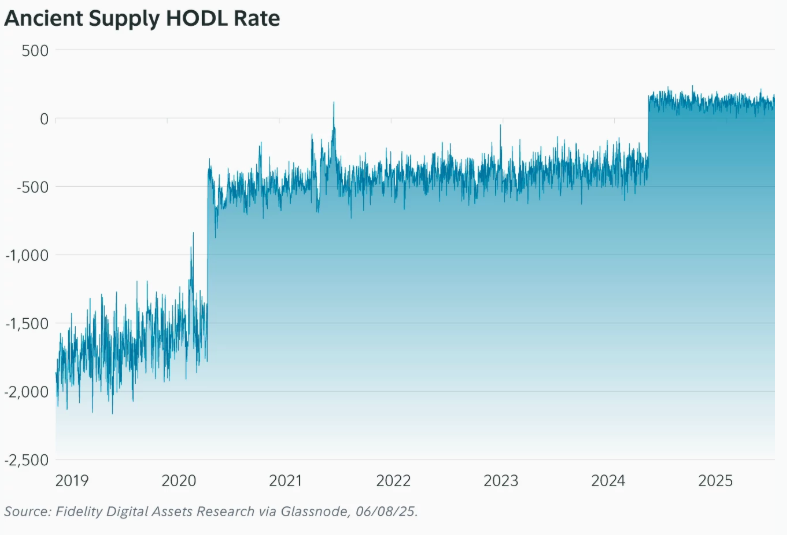

For the reason that 2024 halving, the variety of cash coming into historic provide has persistently outpaced the variety of new cash being mined, based on the report. This shift highlights rising long-term conviction amongst holders and displays a broader tightening of bitcoin’s liquid provide.

Following the 2024 U.S. election, historic provide declined on 10% of days, which is almost 4 occasions greater than the historic common. Motion among the many holders was much more pronounced, with each day declines occurring 39% of the time.

To higher observe this development, Constancy makes use of a metric known as the traditional provide HODL charge. It measures what number of cash are coming into the ten yr class every day, adjusted for brand new issuance. This charge turned constructive in April 2024 and has remained that approach, reinforcing the long-term provide shift.

Trying forward, Constancy Digital Belongings projections that historic provide may attain 20 p.c of whole bitcoin by 2028 and 25 p.c by 2034. If public corporations holding no less than 1,000 BTC are included, it may attain 30 p.c by 2035.

As of June 8, 27 public corporations maintain greater than 800,000 BTC mixed, based on the report. This rising institutional presence might additional tighten provide and improve the affect of long-term holders over time.