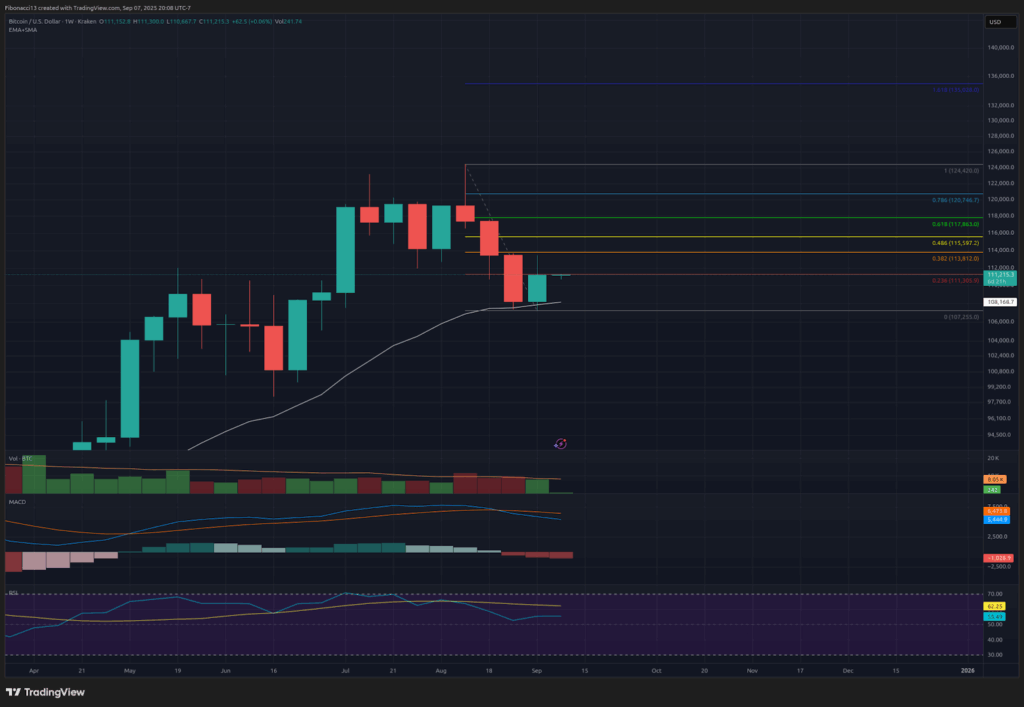

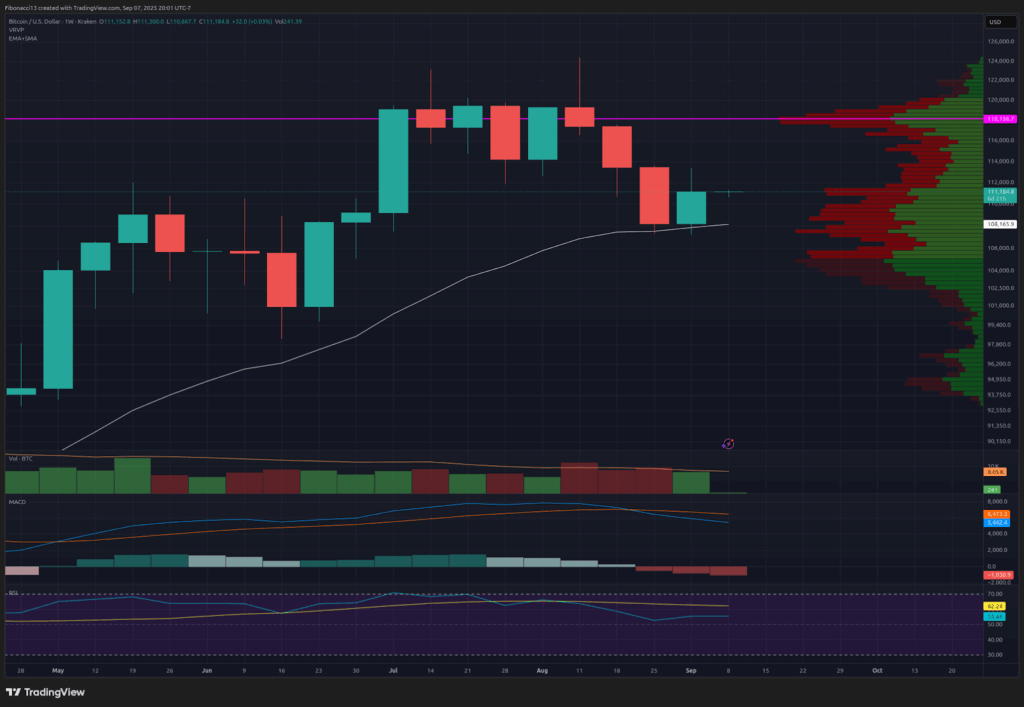

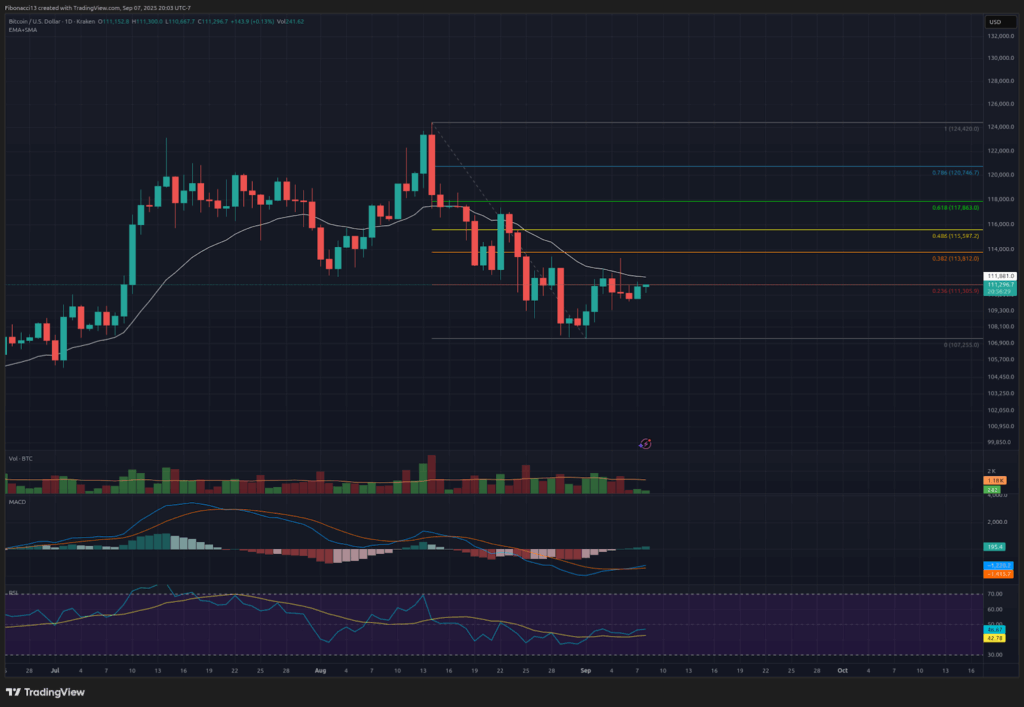

Bitcoin Value discovered assist on the 21-day EMA final week, avoiding a deeper slide after closing on the prior week’s lows. Bulls managed to defend the $107,000 stage, however momentum stalled slightly below resistance. From Wednesday by way of Friday, Bitcoin failed to shut above $112,500 and ended the week at $111,162.

The shortcoming to reclaim $112,500 highlighted a pause within the current restoration. Nonetheless, holding above $107,000 has saved the bias barely to the upside for now. Merchants are carefully watching whether or not this consolidation develops right into a base or a continuation of the downtrend.

Key Assist and Resistance Ranges Now

At current, $107,000 is crucial line of protection for Bitcoin Value. A breakdown beneath there would shift the main focus to decrease assist zones at $105,000, $102,500, and probably $96,000.

On the upside, $112,500 is the primary resistance that should flip into assist. If bulls handle to shut the every day above that stage, the subsequent goal is $115,500. Past there lies $118,000 — a formidable barrier that would wish a weekly shut to substantiate a renewed uptrend.

Outlook For This Week

The week forward may deliver extra volatility. On Thursday, September eleventh, U.S. inflation knowledge is due at 8:30 AM Japanese. A warmer-than-expected print might spark risk-off sentiment and drag Bitcoin decrease, whereas a softer quantity may present reduction for bulls.

If Bitcoin Value can reclaim $112,500 early within the week, a push towards $115,500 is probably going. Failure to take action retains the market weak to a different check of the $107,000 low.

Market temper: Impartial, leaning bullish — assist is holding, however resistance stays agency.

The subsequent few weeks

Trying additional out, Bitcoin should ultimately clear $118,000 with conviction to re-establish the uptrend and fend off bears. A decisive weekly shut above this stage would seemingly attract momentum consumers and enhance sentiment into October.

If $107,000 breaks as an alternative, the trail opens towards $105,000 and $102,500, with the opportunity of a sweep as little as $96,000 earlier than a sturdy backside is discovered. Given the sample of current closes, some analysts warning that another dip can’t be dominated out.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the worth to go larger.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or assist stage: A stage at which worth ought to maintain for the asset,at the very least initially. The extra touches on assist, the weaker it will get and the extra seemingly it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent which is more likely to reject the worth, at the very least initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the worth.

EMA: Exponential Shifting Common. A shifting common that applies extra weight to current costs than earlier costs, decreasing the lag of the shifting common.