Amboss, a frontrunner in AI-driven options for the Bitcoin Lightning Community, at the moment introduced Rails, a groundbreaking self-custodial Bitcoin yield service. In accordance with a press launch despatched to Bitcoin Journal, it’s designed to empower corporations, custodians, and excessive web value people. This enables contributors to earn a yield on their Bitcoin.

Rails additionally launched a safe means for Liquidity Suppliers (LPs) to carry all custody of their Bitcoin whereas producing returns from liquidity leases and fee routing, though they aren’t assured. The implementation of Amboss’ AI know-how, Rails strengthened their Lighting Network with extra reliable transactions and bigger fee volumes.

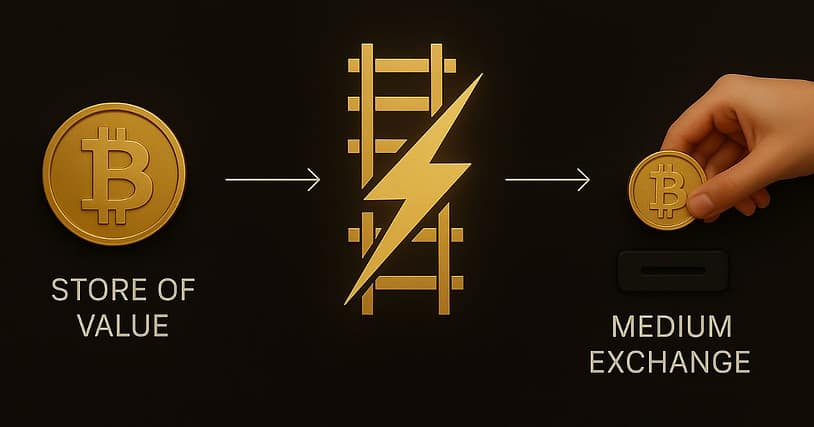

“Rails is a transformative power for the Lightning Community,” mentioned the CEO and Co-Founding father of Amboss Jesse Shrader. “It’s not nearly yield—it’s about enabling companies to strengthen the community whereas incomes on their Bitcoin. This can be a important step in Bitcoin’s evolution as a worldwide medium of trade.”

The service presents two choices:

- Rails LP is designed for top web value people, custodians, and firms with Bitcoin treasuries, requiring a minimal dedication of 1 BTC for one yr.

- Liquidity subscriptions are designed for companies that obtain Bitcoin funds, with charges beginning at 0.5%.

Amboss partnered with CoinCorner and Flux (a three way partnership between Axiom and CoinCorner), to convey Rails to the market. CoinCorner has included it into each its trade platform and each day fee providers within the Isle of Man. Flux is collectively targeted on advancing the Lightning Community’s presence in international funds. Their participation highlights rising trade belief in Rails as a software to scale Bitcoin successfully.

“Rails presents a sensible means for companies like ours to take part within the Lightning Community’s development,” mentioned the CFO of CoinCorner David Boylan. “We’ve been utilizing the Lightning Community for years, and Rails offers a structured strategy to participating with its economic system, significantly by liquidity leasing and fee routing. This aligns with our objective of creating Bitcoin extra accessible and sensible for on a regular basis use.”