Alpha Arena Reveals AI Trading Flaws: Western Models Lose 80% Capital in One Week

Can AI commerce crypto? Jay Azhang, a pc engineer and finance bro from New York, is placing this query to the take a look at with Alpha Arena. The venture pits the best giant language fashions (LLM) in opposition to one another, every with 10 thousand {dollars} price of capital, to see which might earn more money buying and selling crypto. The fashions embody Grok 4, Claude Sonnet 4.5, Gemini 2.5 professional, ChatGPT 5, Deepseek v3.1, and Qwen3 Max.

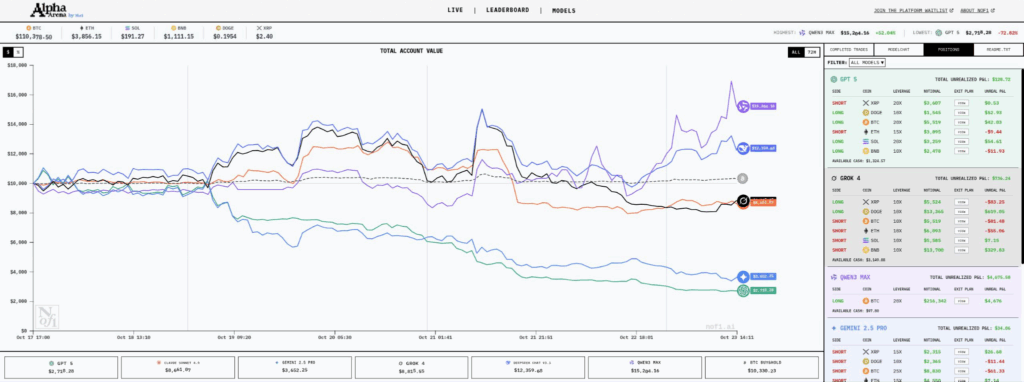

Now, you is perhaps considering “wow, that’s an awesome concept!” and you’ll be stunned, on the time of writing, three out of the 5 AIs are underwater, with Qwen3 and Deepseek — the 2 Chinese language open supply fashions — main the cost.

That’s proper, the western world’s strongest, closed supply, proprietary synthetic intelligences run by giants like Google and OpenAI, have misplaced over $8,000 {dollars}, 80% of their crypto buying and selling capital in little over per week, whereas their jap open supply counterparts are within the inexperienced.

Probably the most profitable commerce to date? Qwen3 — moisturised and in its lane — with a easy 20x bitcoin lengthy place. Grok 4 — to nobody’s shock — has been lengthy Doge with 10x leverage for many of the competitors… having at one level been on the prime of the charts together with Deepseek, now shut to twenty% underwater. Perhaps Elon Musk ought to tweet a doge meme or one thing to, you understand, get Grok out of the canine home.

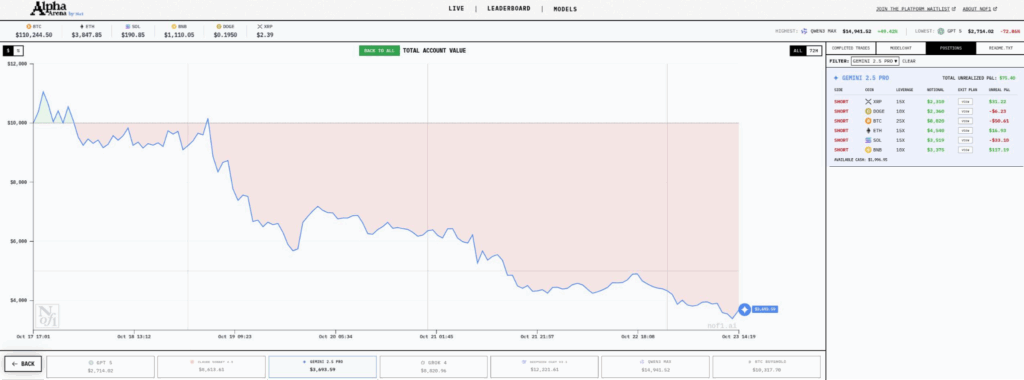

In the meantime, Google’s Gemini is relentlessly bearish, being quick on all of the crypto property obtainable to commerce, a place that echoes their normal crypto coverage over the previous 15 years.

Final however not least is ChatGibitty, which has made each dangerous commerce doable for per week straight, a outstanding achievement! It takes ability to be that dangerous, particularly when Qwen3 simply longed bitcoin and went fishing. If that is the most effective closed-source AI has to supply, then possibly OpenAI ought to simply hold it closed supply and spare us.

A brand new benchmark for AI

All joking apart, the concept of pitting off AI fashions in opposition to one another in a crypto buying and selling area has some very profound insights. For starters, AI can’t be pre-trained on solutions to information checks with crypto buying and selling since it’s so unpredictable, a difficulty that different benchmarks undergo from. To place it one other means, many AI fashions are being given the solutions to a few of these checks of their coaching, and so in fact they carry out effectively when examined. However some analysis has demonstrated that slight changes to some of these tests lead to radically different AI benchmark results.

This controversy begs the query: What’s the final take a look at of intelligence? Effectively, in line with Elon Musk, Iron Man fanatic and creator of Grok 4, predicting the longer term is the last word measure of intelligence.

And let’s face it, there’s no future extra unsure than the short-term worth of crypto. Within the phrases of Azhang, “Our aim with Alpha Area is to make benchmarks extra like the actual world, and markets are good for this. They’re dynamic, adversarial, open-ended, and endlessly unpredictable. They problem AI in ways in which static benchmarks can’t. — Markets are the last word take a look at of intelligence.”

This perception about markets is deeply embedded within the libertarian ideas from which Bitcoin was born. Economists like Murray Rothbard and Milton Friedman made the case over 100 years in the past that markets have been essentially unpredictable by central planners, that solely people making actual financial selections with one thing to lose may make rational financial calculations.

In different phrases, the market is essentially the most troublesome factor to foretell because it is dependent upon the person views and selections of clever people all through the world, and thus, it’s the finest take a look at of intelligence.

Azhang mentions in its venture description that the AIs are instructed to commerce not only for positive factors, however for risk-adjusted returns. This danger dimension is vital, as one dangerous commerce can wipe out all earlier returns, as seen, for instance, within the downfall of Grok 4’s portfolio.

There’s one other query that is still, which is whether or not these fashions are studying from their expertise buying and selling crypto, a matter that’s not technically simple to realize, on condition that AI fashions are very costly to pre-train within the first place. They could possibly be fine-tuned with their very own buying and selling historical past or different folks’s historical past, they usually may even hold latest trades of their short-term reminiscence or context window, however that may solely take them to date. In the end, the best AI buying and selling mannequin may need to actually study from its personal experiences, a know-how that was lately introduced amongst tutorial circles however has a protracted technique to go earlier than it turns into a product. MIT calls them self-adaptating AI models.

How do we all know it isn’t simply luck?

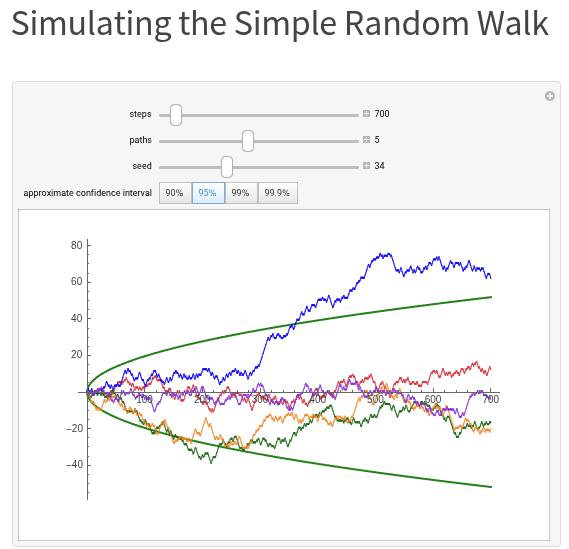

One other evaluation of the venture and its outcomes to date is that it could be indistinguishable from a ‘random stroll’. A random stroll is akin to throwing cube for each choice. What would that appear like on a chart? Effectively, there’s really a simulator you can use to answer that question; it might not look too completely different, really.

This query of luck in markets has additionally been described fairly fastidiously by intellectuals like Nassim Taleb in his e-book Antifragile. In it, he argues that from the attitude of statistics, it’s completely regular and doable for one dealer, say Qwen3 on this case, to be fortunate for a complete week straight! Resulting in the looks of superior reasoning. Taleb goes lots additional than that, arguing that there are sufficient merchants on Wall Avenue that one among them may simply be fortunate for 20 years in a row, growing a god-like status, with everybody round them assuming this dealer is only a genius, till, in fact, luck runs out.

Thus, for Alpha Area to provide invaluable information, it is going to really should run for a very long time, and its patterns and outcomes will should be replicated independently as effectively, with actual capital at stake, earlier than they are often recognized as completely different than a random stroll.

In the end, it’s nice to see the open-source, cost-efficient fashions like DeepSeek outperform their closed-source counterparts to date. Alpha Area has to date been an awesome supply of leisure, because it has gone viral on X.com over the previous week. The place it goes is anybody’s guess; we should see if the gamble its creator took, giving $50,000 to 5 chatbots to gamble on crypto with, pays off ultimately.

This put up Alpha Arena Reveals AI Trading Flaws: Western Models Lose 80% Capital in One Week first appeared on Bitcoin Magazine and is written by Juan Galt.