On-chain information reveals the Ethereum Every day Lively Addresses metric has shot up just lately. Right here’s what this might imply for the cryptocurrency.

Ethereum Every day Lively Addresses Close to Highest Degree In 2 Years

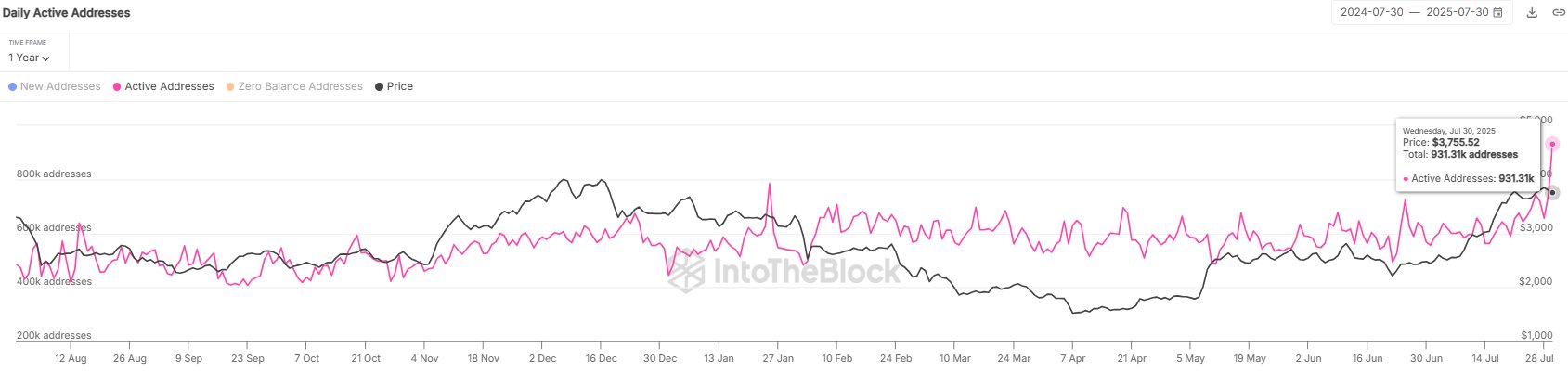

Based on information from institutional DeFi options supplier Sentora, the Ethereum blockchain has seen exercise mild up just lately. The “Daily Active Addresses” is an on-chain indicator that retains observe of the full variety of ETH addresses which might be collaborating in some sort of switch exercise day by day.

When the worth of this metric rises, it means a better variety of customers are making strikes on the community. Such a pattern implies the buying and selling curiosity within the cryptocurrency could also be going up.

Alternatively, the indicator observing a drop suggests investor exercise goes down on the blockchain. This sort of pattern could be a potential signal that spotlight is shifting away from the asset.

Now, here’s a chart that reveals the pattern within the Every day Lively Addresses for Ethereum over the previous 12 months:

The worth of the metric seems to have shot up in latest days | Supply: Sentora on X

As displayed within the above graph, the Ethereum Every day Lively Addresses noticed deviation above its latest consolidation degree of 600,000 with the newest rally, implying the value motion introduced curiosity within the asset.

Curiously, the pattern has accelerated in the previous couple of days, with the indicator registering a pointy spike. This fast enhance has taken its worth to 931,310, which is the best every day degree in virtually two years.

Traditionally, excessive transaction exercise from the customers has usually been a precursor to volatility. Any worth motion rising out of the buying and selling can, in idea, go both manner, because the Every day Lively Addresses incorporates no details about whether or not shopping for or promoting is dominant, simply that the buyers are making strikes.

It will seem that the spike within the Ethereum Every day Lively Addresses could have led into volatility this time as effectively, because the cryptocurrency’s worth has plunged because it has appeared.

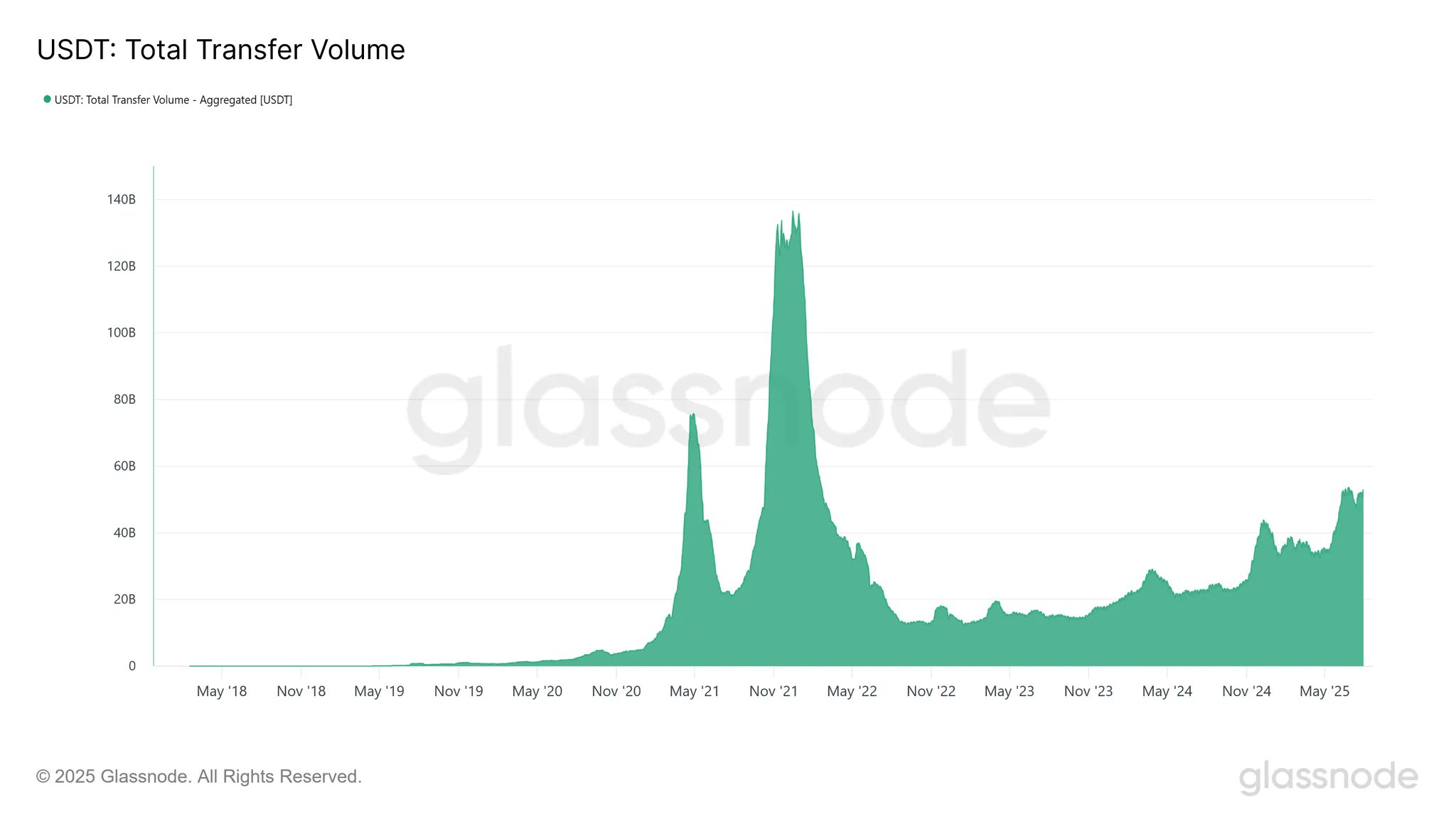

In another information, stablecoin USDT has seen its 30-day transferring common (MA) transfer volume get well to the $52.9 billion mark just lately, as on-chain analytics agency Glassnode has defined in an X post.

The pattern within the USDT switch quantity over the previous couple of years | Supply: Glassnode on X

As displayed within the above graph, the USDT switch quantity has steadily been recovering because the 2022 crash. “This gradual climb displays a sluggish however constant restoration in stablecoin velocity and market exercise,” notes Glassnode.

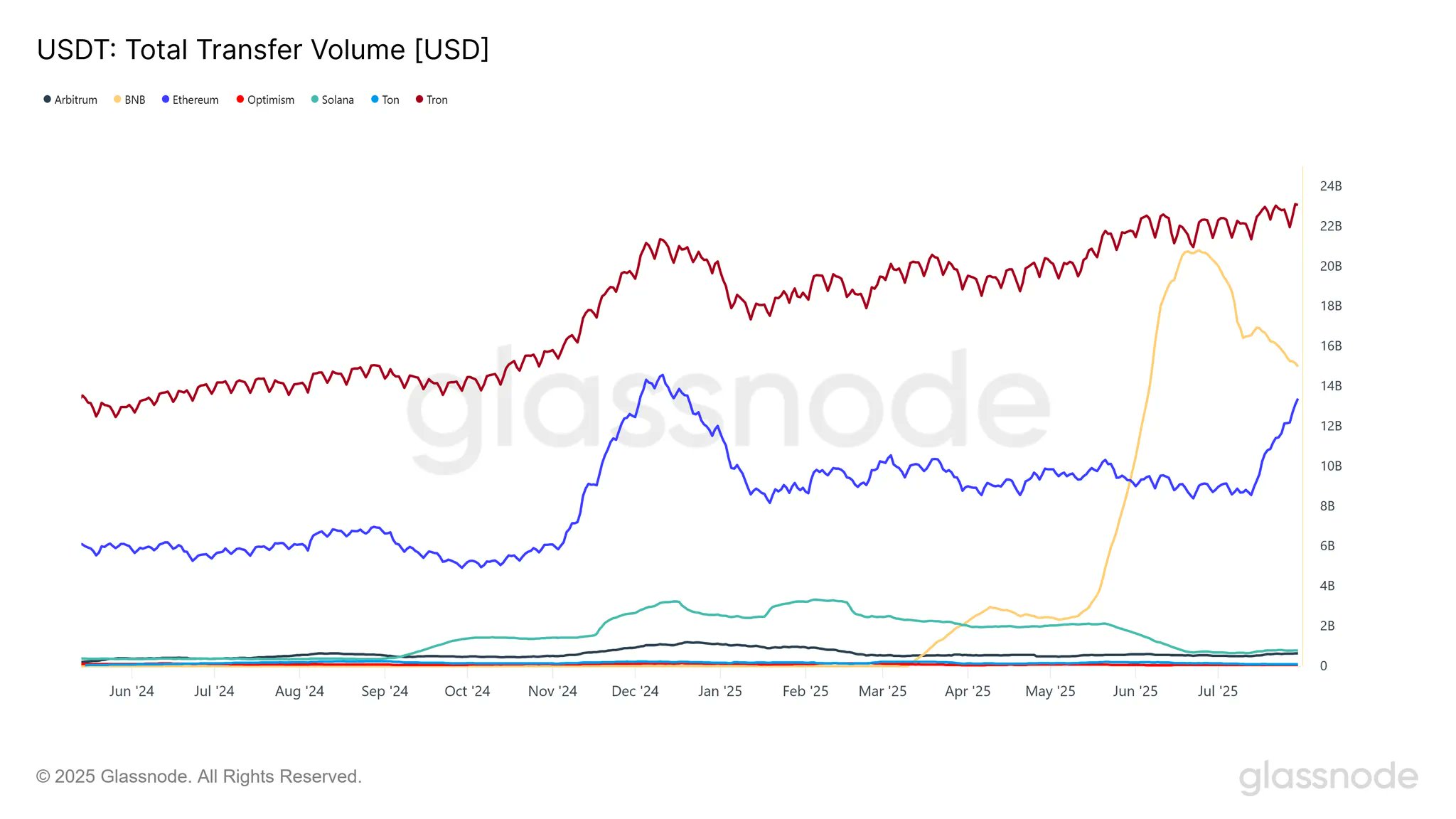

Curiously, Ethereum has not even been among the many prime two networks that occupy the biggest share of the secure’s quantity.

The information of the USDT Switch Quantity throughout main networks | Supply: Glassnode on X

Tron and BNB are the 2 networks main in USDT quantity, with the metric sitting at $23 billion and $14.9 billion, respectively.

ETH Worth

On the time of writing, Ethereum is buying and selling round $3,650, down round 3.5% within the final 24 hours.

Appears to be like like ETH has simply taken a success | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.