Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

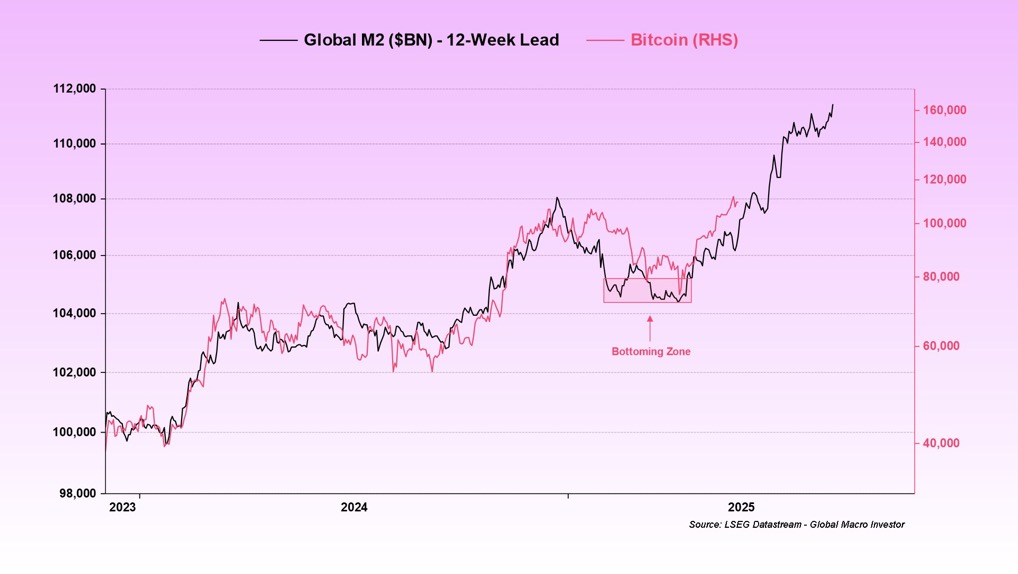

Invoice Barhydt, the founder and chief government of crypto-banking platform Abra, set Crypto-X alight over the weekend by reposting a collage of world M2-versus-Bitcoin charts first popularised by macro investor Raoul Pal and researcher Julien Bittel. “I’ve seen over a dozen posts with completely different variations of the worldwide liquidity M2 vs Bitcoin worth chart – I’ve hooked up a number of right here. Credit score @RaoulGMI and his colleague @BittelJulien for locating the development,” he wrote.

“Most of those charts predict a dip over the approaching days to round $100 okay after which a transfer to new ATH of $130 okay in August/September … Or this might all be horseshit. No matter.”

Will Bitcoin Observe M2?

Increasing on the macro backdrop, Barhydt argued that “international liquidity must rise considerably within the coming months. Bitcoin stays the mom of all liquidity (re: debasement) sponges.” He framed the asset’s reflexivity in stark phrases: as fiat provide grows, Bitcoin absorbs the financial extra, and the ensuing good points “will probably spill over into different L1 platforms after which finally speculative alts – the proverbial alt season.”

Associated Studying

Even so, he cautioned merchants in opposition to complacency. “Watch your leverage, contact grass and please please be civil,” Barhydt suggested, noting that the anticipated pull-back may very well be a mild pause or a swift capitulation towards $95,000 earlier than any summer time rally materialises.

When a follower fretted that the mannequin may already be overcrowded, Barhydt dismissed the concept that positioning had reached important mass: “I’ve thought of that however we’re speaking about trillions of {dollars} and billions of individuals. There may be 1000’s of individuals centered on this however no more. Even then retail writ giant isn’t centered on crypto proper now.”

Associated Studying

A second critic complained that the liquidity knowledge “just isn’t collected on a timeframe that may predict day by day strikes.” Barhydt concurred, replying: “I fully agree. Therefore the ‘no matter’ reference. It’s macro directional on a weekly scale at greatest. However in that regard it’s been an excellent instrument.”

The liquidity-first thesis nonetheless has heavyweight backers. Pal not too long ago informed Actual Imaginative and prescient subscribers that “liquidity is the only most necessary driver of all asset costs,” estimating that rising world-money provide accounts for as much as 90% of Bitcoin worth motion, whereas Bittel’s newest replace pegs global M2 close to a report $111 trillion – a stage he says leaves Bitcoin “nonetheless going greater.”

Whether or not these macro tailwinds propel Bitcoin to the $130,000 goal or show, in Barhydt’s personal phrases, to be “horseshit” will rely on how briskly central banks resume balance-sheet growth and the way aggressively merchants deploy leverage within the weeks forward. For now, Barhydt’s name serves as each roadmap and actuality verify: the following swing may very well be explosive, however the mannequin is just nearly as good because the liquidity it tracks.

At press time, BTC traded at $104,625.

Featured picture created with DALL.E, chart from TradingView.com