Ethereum is displaying indicators of short-term exhaustion after a robust impulsive rally. Though the consumers have managed to interrupt by way of main resistance ranges, the value is presently stalling round a key construction and may very well be liable to an area high if momentum fades.

Technical Evaluation

The Each day Chart

ETH has decisively damaged above the 100-day transferring common, situated across the $2,100 space, and can also be attempting to reclaim the 200-day transferring common close to the $2,600 mark. Furthermore, the RSI is hovering within the overbought territory, signalling that the rally is likely to be overextended within the brief time period.

At the moment, the asset is consolidating slightly below the decrease boundary of the beforehand damaged long-term ascending channel. A each day shut above this degree would invalidate the concept of a pullback and open the door towards the $3,000 zone, which coincides with a previous provide space. On the draw back, the $2,150 zone now acts as stable help and will function a possible re-entry level for consumers if the market pulls again.

The 4-Hour Chart

The 4-hour timeframe reveals ETH consolidating inside a slender vary across the $2,600 degree. The worth is sustaining its good points following the breakout from a descending channel and a sequence of bullish imbalances stuffed alongside the way in which.

The RSI has additionally cooled off, displaying a decline in bullish momentum however no fast indicators of bearish divergence. If ETH can break and maintain above the $2,600 zone, it could collect sufficient energy to run towards the important thing $3,000 resistance degree quickly.

Onchain Evaluation

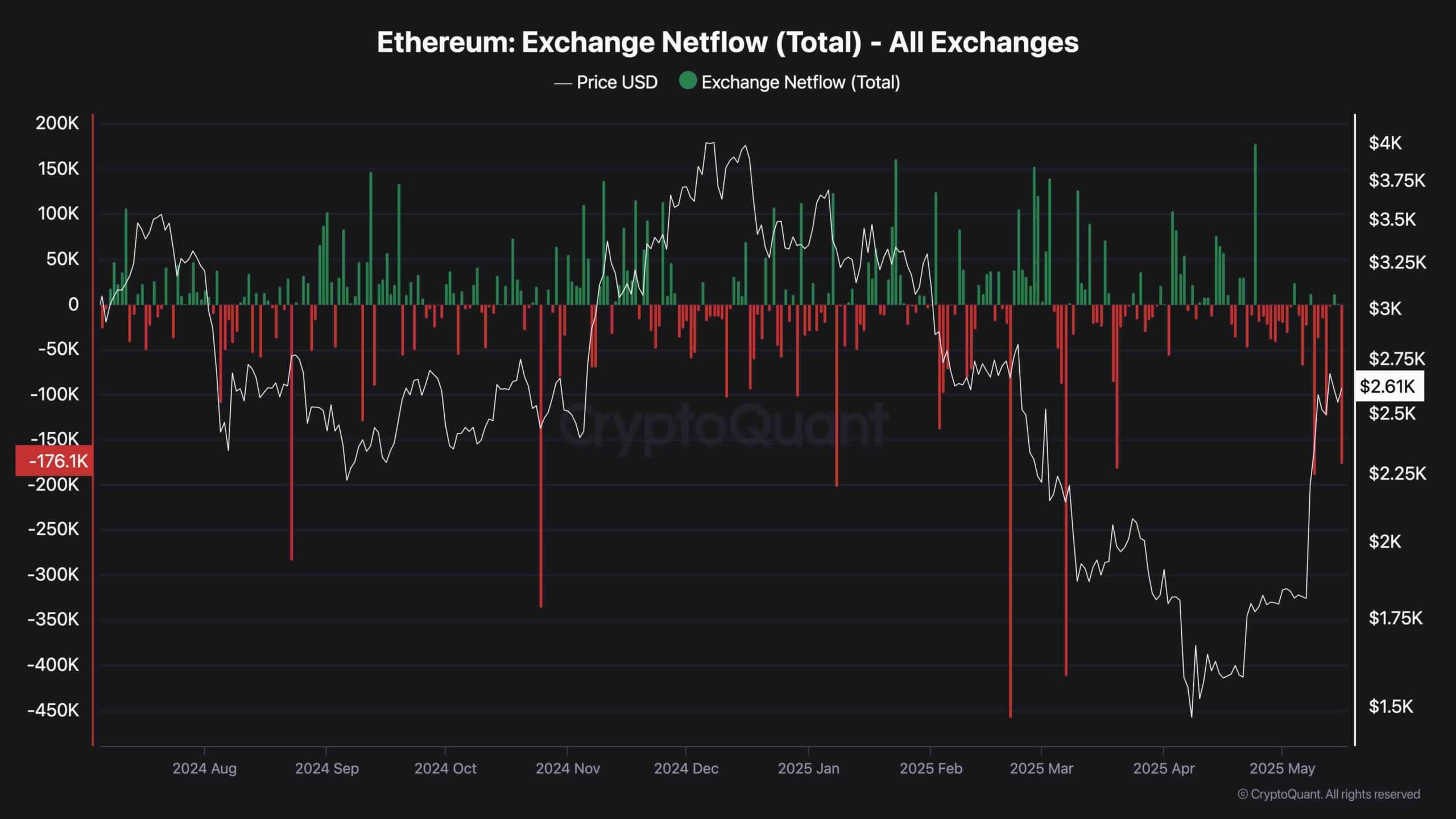

Alternate netflows stay detrimental on mixture, with a current studying displaying a web outflow of over 170K ETH. This means a broader development of accumulation and long-term holding, as cash proceed to go away centralized exchanges and transfer into self-custody. Persistent outflows throughout a worth rally usually help the case for bullish continuation as they replicate a scarcity of intent to promote.

Nonetheless, it’s value noting that this conduct additionally raises warning, as excessive bullish positioning can result in sharp corrections if the sentiment turns into too one-sided. Merchants ought to monitor modifications in netflows intently, particularly if inflows start to spike round main resistance ranges, as that might mark native tops and sign profit-taking.

The publish Ethereum Price Analysis: What Lies Ahead for ETH on its Way to $3K? appeared first on CryptoPotato.