On-chain knowledge reveals the ‘Trade Stablecoins Ratio’ for Bitcoin has shot up just lately. Right here’s what it might imply for the asset’s worth.

Bitcoin Trade Stablecoins Ratio Has Damaged Above 5

As defined by an analyst in a CryptoQuant Quicktake post, the Bitcoin Trade Stablecoins Ratio has registered a rise alongside the most recent rally within the cryptocurrency’s worth.

The Trade Stablecoins Ratio right here refers to an on-chain indicator that retains observe of the ratio between the Trade Reserves of BTC and the stablecoins. The “Exchange Reserve” is of course the whole quantity of the asset that’s sitting within the wallets of all centralized exchanges.

When the worth of the indicator goes up, it means the Trade Reserve of BTC is rising relative to that of the stablecoins. Alternatively, it taking place implies stables have gotten extra dominant on these platforms.

The Trade Reserve of each of those asset courses represents one thing completely different with respect to the broader sector. Within the case of Bitcoin (and different such unstable belongings), the Trade Reserve will be checked out as a measure of the accessible promoting stress out there.

That is due to the truth that holders normally deposit their cash to those platforms after they intend to commerce them away. The identical stays true for the stablecoins as nicely, however since their worth is ‘steady’ by nature, promoting from traders has no impact on it.

Whereas the promoting of stablecoins doesn’t have any impact on their very own worth, it does maintain implications for the unstable aspect of the market, if the stables are being swapped in favor of tokens like BTC.

The belongings being bought utilizing stables naturally really feel a bullish impact on their worth. As such, the Trade Reserve of the stablecoins could also be thought-about as a illustration of the shopping for stress within the sector.

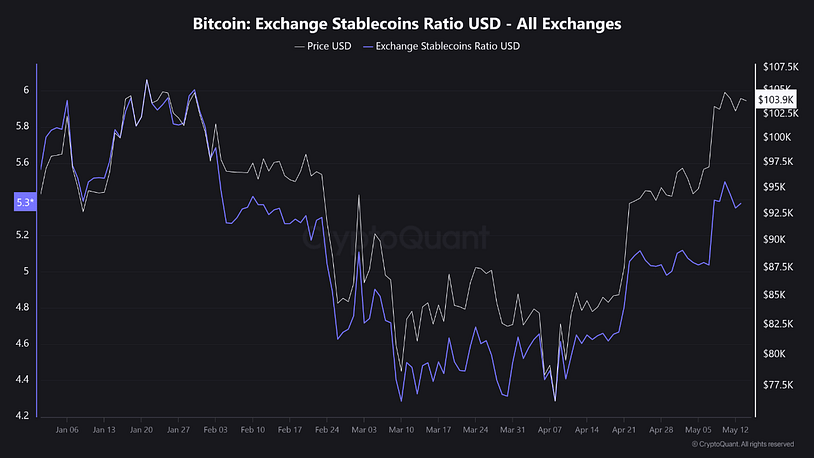

Now, here’s a chart that reveals the development within the Bitcoin Trade Stablecoins Ratio over the previous couple of months:

As is seen within the above graph, the Bitcoin Trade Stablecoins Ratio has been going up just lately, an indication that traders have been depositing BTC at a sooner charge than stablecoins. The metric is presently sitting at a price of 5.3, which suggests the BTC Trade Reserve is greater than 5 instances that of the stablecoin one.

This can be a bearish growth for the cryptocurrency, because it implies the potential promoting stress within the sector notably outweighs the shopping for stress that stables can deliver.

Because the quant says,

This surge above the 5.0 threshold echoes the late-January peak close to 6.1, which preceded a swift correction—implying merchants could also be gearing as much as rotate BTC again into money.

It now stays to be seen whether or not the Bitcoin rally would be capable to hold going no matter this development or not.

BTC Worth

Bitcoin has taken to sideways motion through the previous few days as its worth continues to be floating across the $103,500 mark.

The content published on Finance Insider Today is for informational and educational purposes only. It does not constitute financial advice, investment advice, or any other form of professional advice. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. Finance Insider Today is not responsible for any financial losses resulting from decisions made based on information published on this website. Past performance is not indicative of future results. Financial markets carry significant risk. Never invest more than you can afford to lose.