Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to aim to breach the $95,000 barrier with traders looking for indicators that it’d certainly accomplish that. The digital cash has did not breach the purpose of resistance at this stage since final Friday, market knowledge revealed.

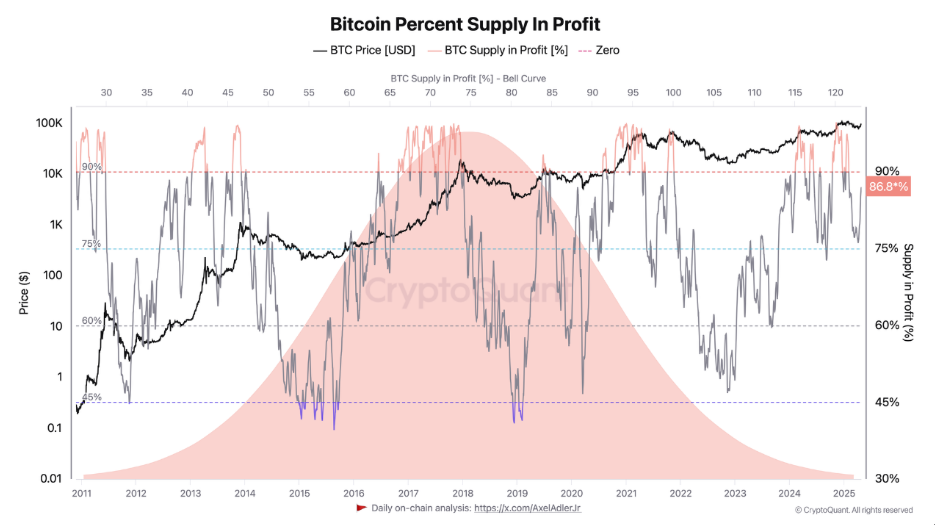

Nonetheless, regardless of this pressure, a really spectacular 91% of whole provide of Bitcoins are within the black, reflecting what market strategists describe because the “euphoria section” of market exercise.

Associated Studying

Income Soar As Market Rebounds

The sturdy proportion of profitable Bitcoin holdings is throughout a latest market restoration, in accordance with knowledge from analytics agency CryptoQuant. Technical professional Darkfost notes that when Bitcoin provide in revenue is over 90%, it typically represents the final section of a bull market.

This section often sees massive value rises earlier than any correction takes place. Throughout latest value drops, the availability in revenue practically fell to 75%, a stage that analysts imagine might have triggered widespread promoting if breached.

Market Stress Eases On Holders

The present context supplies room to breathe for Bitcoin holders. For the reason that majority of holdings are in revenue, traders are much less pressed to dump their cash throughout occasions of market uncertainty.

This diminished stress may help in sustaining Bitcoin’s value stability close to the $95,000 stage and gaining steam for future upside potential. As per varied specialists, this era of diminished promoting stress tends to result in vital value motion in cryptocurrency markets.

Analysts Challenge Potential $250,000 Bitcoin

Some establishments have made some high-profile Bitcoin price predictions. Customary Chartered is predicting that the cryptocurrency will hit $120,000 by the second quarter of 2025.

Different market analysts have predicted larger costs, within the vary of $200,000 to $250,000, earlier than the yr’s finish. These are among the predictions as Bitcoin traded at $94,900, just under the psychological $95,000 mark that has been difficult to crack.

Historical past Signifies Warning Following Euphoria

Though the market temper is constructive right this moment, CryptoQuant cautions that historical past signifies a sample of corrections after these euphoria intervals.

Historic knowledge from previous Bitcoin bull cycles counsel that after such intervals of excessive profitability, corresponding huge value declines often ensued.

Associated Studying

In earlier cycles, the proportion of Bitcoin provide in revenue has dropped to roughly 50% at these occasions of correction – a attribute of bear market conditions.

The euphoria section will not be everlasting, with CryptoQuant CEO Ki Youn Ju intimating such intervals often final from three to 12 months earlier than the corrective motion units in.

The continuing Bitcoin cycle has witnessed constant development over the previous few months, driving the share of worthwhile holdings to ranges that point out each alternative and warning.

As traders observe the $95,000 resistance stage, many are asking whether or not historical past will repeat itself in one other spectacular value spike earlier than an eventual correction.

With 91% of Bitcoin presently in revenue, the market is at a crucial level that can problem each bullish forecasts and historic developments within the coming months.

Featured picture from Gemini Imagen, chart from TradingView