Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has spent the vast majority of the previous 24 hours on a notable rally that noticed it value peak at an intraday excessive of $94,320. This rally marks an attention-grabbing change from the tight consolidation vary between $80,000 and $85,000 that had outlined Bitcoin’s trajectory via a lot of April.

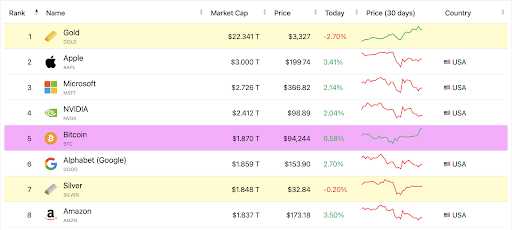

Behind this breakout lies a major uptick in institutional exercise via Spot Bitcoin ETFs, which recorded their highest each day inflows since January. Curiously, this influx surge has helped push Bitcoin into the highest 5 largest belongings globally, surpassing Alphabet, Silver, and Amazon in market capitalization.

Spot Bitcoin ETFs Sees Largest Inflows Since January

In accordance with data from SoSoValue, US-based Spot Bitcoin ETFs raked in $936.43 million in web inflows on Tuesday, April 22 alone, marking their greatest single-day efficiency since January 17 when it registered $1.08 billion. Wednesday, April 23 additionally witnessed comparable efficiency, registering inflows of $916.91 million.

Associated Studying

BlackRock’s iShares Bitcoin Belief (IBIT) led the way in which with a staggering $643.16 million in inflows, adopted carefully by Ark & 21 Shares’ ARKB with $129.5 million. Moreover, Spot Bitcoin ETFs at the moment are on 4 days of consecutive inflows of $100 million or extra. The final time such occurred was within the final week of January.

These inflows into Spot Bitcoin ETFs observe a weeks-long dry spell in ETF exercise, which noticed many merchants query the sustainability of institutional curiosity. Nonetheless, the timing of those inflows couldn’t be extra impactful. Bitcoin’s value surged in tandem with latest ETF exercise, displaying the the sturdy impact these ETFs have come to have on the spot value of Bitcoin.

BTC Surpasses Amazon And Google To Turn into Fifth Largest Asset Worldwide

The ETF inflows lit the spark and the ensuing market response pushed Bitcoin’s stand up the worldwide rankings. In accordance with knowledge from CompaniesMarketCap, Bitcoin’s whole market worth climbed to over $1.87 trillion because it crossed over $94,000 for the first time in eight weeks.

Associated Studying

This attention-grabbing transfer allowed it to overhaul each Google (Alphabet) and Amazon in market cap rankings, particularly contemplating these inventory costs have been on a notable decline in a 30-day timeframe.

This improvement positions BTC not solely as a number one cryptocurrency but additionally as a top-tier macroeconomic asset, competing on the global stage with conventional tech and commodity giants. Because it stands, Bitcoin is now outperforming the NASDAQ 100, and analysts are pointing to indicators of decoupling from traditional indices.

Now that Bitcoin is buying and selling above $90,000 once more, the following focus is on where it goes from here. The bullish trajectory could be on the $100,000 value stage, and whether or not BTC can break above this stage earlier than the tip of April. That stated, the $94,000 area is now shaping as much as act as an early resistance band, and short-term profit-taking may trigger pullbacks which may liquidate purchase orders.

Featured picture from Pixabay, chart from Tradingview.com