Bitcoin has lengthy adopted a predictable sample pushed by its halving occasions, which happen roughly each 4 years. These halving events, the place the block reward for miners is halved, have traditionally been adopted by vital Bitcoin price surges. Nonetheless, as we transfer towards the following halving in 2028, many are questioning whether or not the previous 4-year cycle will proceed or if Bitcoin is on the cusp of a extra elementary change. On this article, we delve into the present state of Bitcoin’s market dynamics, how the 4-year cycle has formed its historical past, and what the long run holds for this revolutionary asset.

The 4-12 months Cycle: The Historic Surge Sample Of The Bitcoin Worth

Halving occasions have been pivotal moments in its historical past, instantly impacting the bitcoin price. Every halving reduces the block reward for miners by 50%, resulting in a lower within the issuance price of bitcoin. The result’s usually a big worth enhance because the decreased provide of latest cash drives up demand. Traditionally, Bitcoin has skilled substantial worth surges within the 12 months following every halving occasion, albeit with some variation between cycles.

Within the first halving occasion in 2012, the reward dropped from 50 BTC to 25 BTC per block, resulting in a surge in bitcoin’s worth that reached a peak in 2013. The second halving in 2016, which decreased the reward from 25 BTC to 12.5 BTC, was adopted by a big bull run, culminating in bitcoin’s meteoric rise to just about $20,000 in December 2017. The third halving in 2020, decreasing the reward to six.25 BTC, preceded a rally that noticed bitcoin’s worth surpass $60,000 in 2021.

A 12 months After the 2024 Halving: A Softer Worth Motion Than Anticipated

Nonetheless, the newest halving in April 2024 has seen a distinct form of worth motion. Whereas there was some optimistic appreciation in bitcoin’s price, the huge exponential progress that many anticipated has been notably absent. As of the one-year mark after the halving, bitcoin’s worth has risen by about 40%, which, whereas optimistic, is much beneath the explosive returns seen in previous cycles, such because the 2020-2021 rally.

Traditionally, Bitcoin’s worth has skilled a interval of consolidation following every halving occasion, the place the market adjusts to the brand new inflation price. After this adjustment section, a considerable rally normally ensues inside the subsequent 12 to 18 months. Provided that bitcoin has proven some optimistic motion, many nonetheless anticipate the value to rise considerably within the second half of 2025, following the everyday post-halving cycle.

Bitcoin’s Hashrate and Miner Income: An Necessary Sign

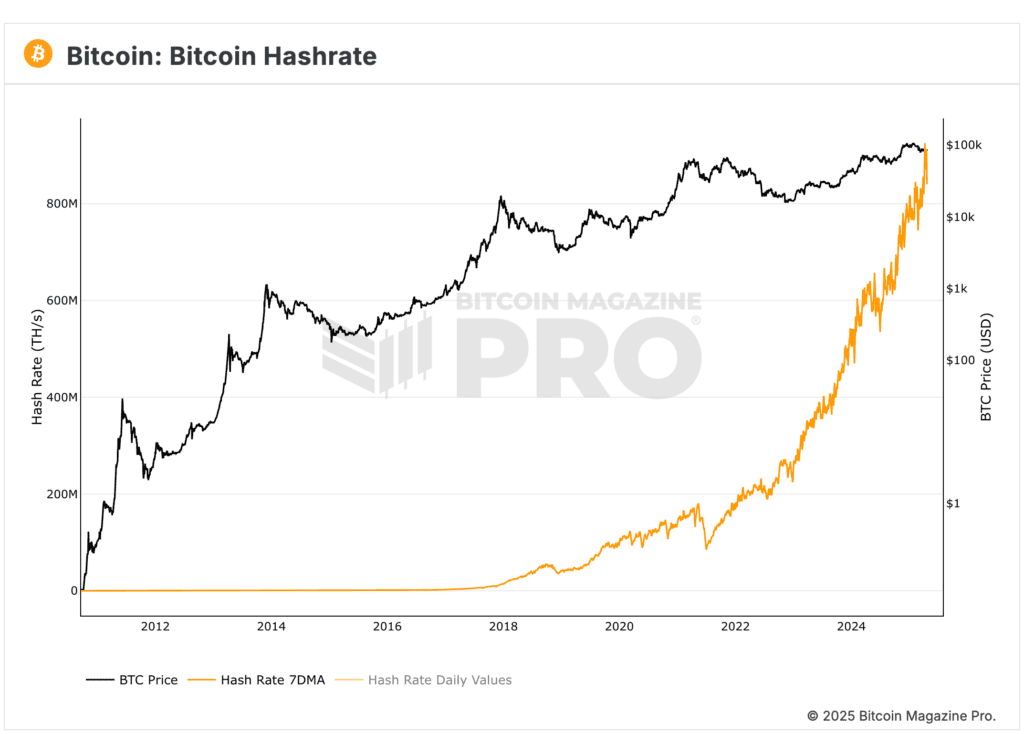

One of many extra necessary indicators of Bitcoin’s well being post-halving is its hashrate, which refers back to the whole computational energy of the community. For the reason that halving occasion in 2024, Bitcoin’s hashrate has continued to climb. In truth, the hashrate has surged by nearly 50%, regardless of the discount in miner rewards. This can be a testomony to the rising power of Bitcoin’s community and the rising competitors amongst miners to safe the block rewards.

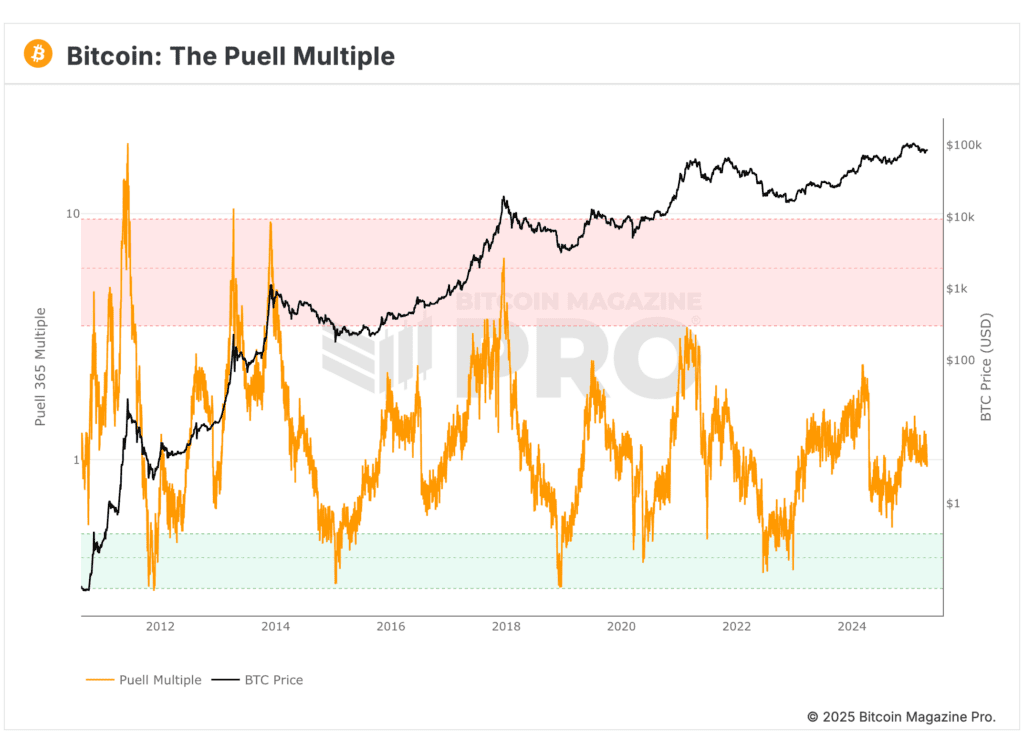

Moreover, Bitcoin’s Puell multiple, which measures miner income relative to the community’s worth, additionally dropped considerably after the halving. Nonetheless, it has since rebounded, signaling that the market is stabilizing and making ready for the following section of the cycle. These indicators counsel that Bitcoin’s elementary community power is undamaged, even because the market adjusts to a decrease block reward.

The Finish of the 4-12 months Cycle: What’s Altering?

Regardless of the power of Bitcoin’s community and the continued institutional curiosity, there are indicators that the normal 4-year halving cycle could now not be as related sooner or later. As of now, 94.5% of Bitcoin’s whole provide has already been mined, and by the point of the following halving in 2028, practically 97% of all Bitcoin might be in circulation.

The decreased move of latest BTC into the market signifies that the value could now not be as influenced by the halving occasions. The quantity of latest BTC being mined each day after the 2028 halving might be minimal—solely round 225 BTC per day, a quantity that can barely register on each day inflows in comparison with present ranges of tens of hundreds of BTC.

Because the inflation price of Bitcoin continues to lower, it’s seemingly that Bitcoin’s worth motion will more and more be pushed by macroeconomic components somewhat than the halving cycle. Institutional curiosity in Bitcoin has grown considerably in recent times, and it will seemingly proceed to affect the value. Moreover, Bitcoin’s correlation with conventional belongings just like the S&P 500 has strengthened, suggesting that Bitcoin’s worth might start to observe extra standard liquidity and enterprise cycles.

The Affect of Macroeconomics: Bitcoin’s Shift Towards Conventional Enterprise Cycles

Bitcoin’s relationship with conventional monetary markets, significantly the S&P 500, has change into considerably aligned in recent times. This correlation grew considerably after the 2020 COVID-induced market downturn, as large liquidity injections from central banks led to a pointy rise in asset costs, together with bitcoin.

Wanting ahead, it’s seemingly that Bitcoin will change into extra aligned with international liquidity cycles and enterprise cycles. Slightly than being solely pushed by the halving occasions, Bitcoin’s worth could begin to mirror broader financial developments, significantly as institutional traders change into an much more dominant pressure out there.

If Bitcoin follows these conventional enterprise cycles, the function of halvings in driving worth motion could diminish. As a substitute, Bitcoin might expertise extra gradual worth actions, influenced by components such because the enlargement and contraction of worldwide liquidity, investor sentiment, and market cycles which are acquainted to conventional belongings.

The 2028 Halving and Past: A New Period for Bitcoin

The upcoming 2028 halving occasion is anticipated to be a vital turning level for Bitcoin. By this level, the community may have reached practically its most provide, and the block reward might be decreased to only 1.5625 BTC per block. This can mark a big shift in Bitcoin’s inflation price, as the quantity of latest bitcoin coming into circulation might be minimal.

It’s seemingly that the 2028 halving would be the final to have a profound affect on Bitcoin’s worth. After this, Bitcoin could now not expertise the normal post-halving worth surges which have characterised its historical past. As a substitute, Bitcoin’s worth motion will seemingly be pushed by a mix of institutional curiosity, international liquidity cycles, and conventional market forces.

In Conclusion: A Altering Panorama for Bitcoin

Bitcoin’s conventional 4-year halving cycle has been a elementary driver of its worth historical past, however the market is evolving. Because the block reward decreases and Bitcoin’s circulating provide nears its most, the affect of halving’s on worth motion will seemingly diminish. As a substitute, Bitcoin will most likely observe extra standard enterprise and liquidity cycles, much like different main belongings. This shift might be pushed by the rising institutional curiosity in Bitcoin, its rising correlation with conventional markets, and the evolving function of Bitcoin within the broader financial panorama.

As we look forward to the 2028 halving and past, it’s clear that Bitcoin’s future needs to be formed by macroeconomic developments somewhat than the previous cycle-driven mannequin. Whereas this may occasionally change the way in which we method Bitcoin funding and evaluation, it additionally opens up thrilling prospects for Bitcoin’s function within the international financial system.

To discover dwell knowledge and keep knowledgeable on the newest evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding selections.