Markets are quiet and uneasy. Bitcoin costs have pulled again, and large holders are maintaining a cool face whereas the charts wobble. Reviews notice that one outspoken investor frames the market in stark phrases: it both fails utterly or turns into much more worthwhile than folks now think about.

Associated Studying

Saylor’s Binary Wager

Based on Michael Saylor, Bitcoin has solely two believable last outcomes: nugatory, or price $1 million per coin. That’s not a fast buying and selling thought. It’s a long-running view about shortage and demand.

Saylor argues {that a} fastened provide paired with rising institutional shopping for and broader custody instruments makes a way forward for large worth positive factors attainable. He factors to extra banks, extra spot ETFs and larger company allocations as proof that demand has matured.

If it’s not going to zero, it’s going to one million. $BTC

— Michael Saylor (@saylor) February 20, 2026

A Warning From The Different Facet

Reviews notice that not everybody agrees. Mike McGlone of Bloomberg has sketched a darker path, one the place worth strain and macro shocks might push values a lot decrease — even towards $10,000.

That view is rooted in historical past: markets can fall a great distance earlier than confidence returns. Quick-term strikes may be savage. Longer swings may be slower to get better. Each views are true on their very own phrases, as a result of they reply totally different questions on time and threat.

Stability Sheet And Funding

Primarily based on experiences, the agency backing Saylor’s posture holds a really massive stake: 717,131 BTC purchased at a median value of $76,027 a coin. That place is underwater for now. Nonetheless, financing decisions matter. Strategy depends on fairness, convertible notes, and most well-liked shares to fulfill money wants.

Arkham Intelligence has mapped out that most well-liked dividends are non-obligatory and redemptions are usually not computerized, which lowers the possibility of pressured gross sales immediately. That setup buys time, although it doesn’t erase publicity if costs keep low for an extended stretch.

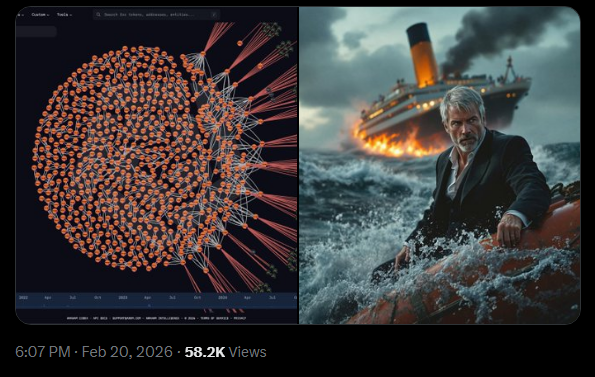

SAYLOR IS UNDERWATER. BUT WILL HE SELL BTC?

Saylor is over 10% underwater from his common buy worth. However what might really power him to promote Bitcoin?

Right here’s an explainer of how, when and why Technique may be pressured to promote BTC. pic.twitter.com/uKbJ3ivO54

— Arkham (@arkham) February 20, 2026

Provide, Demand And The Large Numbers

Saylor’s $1 million projection is pushed by a provide argument: there are solely 21 million cash. If sufficient establishments and treasuries hold shopping for, the maths pushes the worth up.

He has mentioned that with a selected share of complete cash held by his agency, values might transfer into the thousands and thousands, and he has sketched a fair larger, $10 million risk beneath stronger focus eventualities.

Associated Studying

These are usually not forecasts you may deal with like short-term targets. They’re conditional fashions — attainable provided that adoption, regulation and market conduct all line up for years.

The trail ahead shouldn’t be simple. Bitcoin might crawl larger, stumble and commerce in slim ranges for years, or shoot up as new patrons enter. Politics, regulation and world liquidity will form which route unfolds. Institutional entry has modified the market construction, however it has not eliminated the danger of huge drawdowns.

Featured picture from Pixabay, chart from TradingView