Quantum computing has turn out to be the newest all-purpose clarification for Bitcoin’s latest drawdown, however NYDIG says the numbers don’t again the narrative. In a Feb. 17 analysis word, NYDIG analysis head Greg Cipolaro argues that “quantum fears” are loud, however not a major driver of the sell-off once you have a look at search conduct, cross-asset correlations, and broader danger positioning.

Quantum Panic Didn’t Sink Bitcoin

NYDIG frames “Cryptographically Related Quantum Computer systems” because the theoretical endgame danger buyers hold circling. The issue is that market conduct doesn’t appear to be a repricing of an imminent existential threat.

First, Cipolaro factors to Google Tendencies. Search curiosity for “quantum computing bitcoin” did rise, he wrote, however the timing issues. “Search curiosity for ‘quantum computing bitcoin’ has risen, however notably this occurred alongside bitcoin’s rally to new all-time highs, not forward of sustained weak point,” the word stated.

“In different phrases, heightened searches about quantum risk coincided with worth power quite than weak point. If the market had been repricing bitcoin on an imminent technological risk, we might count on search depth to guide or amplify draw back danger, not accompany a interval of good points.”

Associated Studying

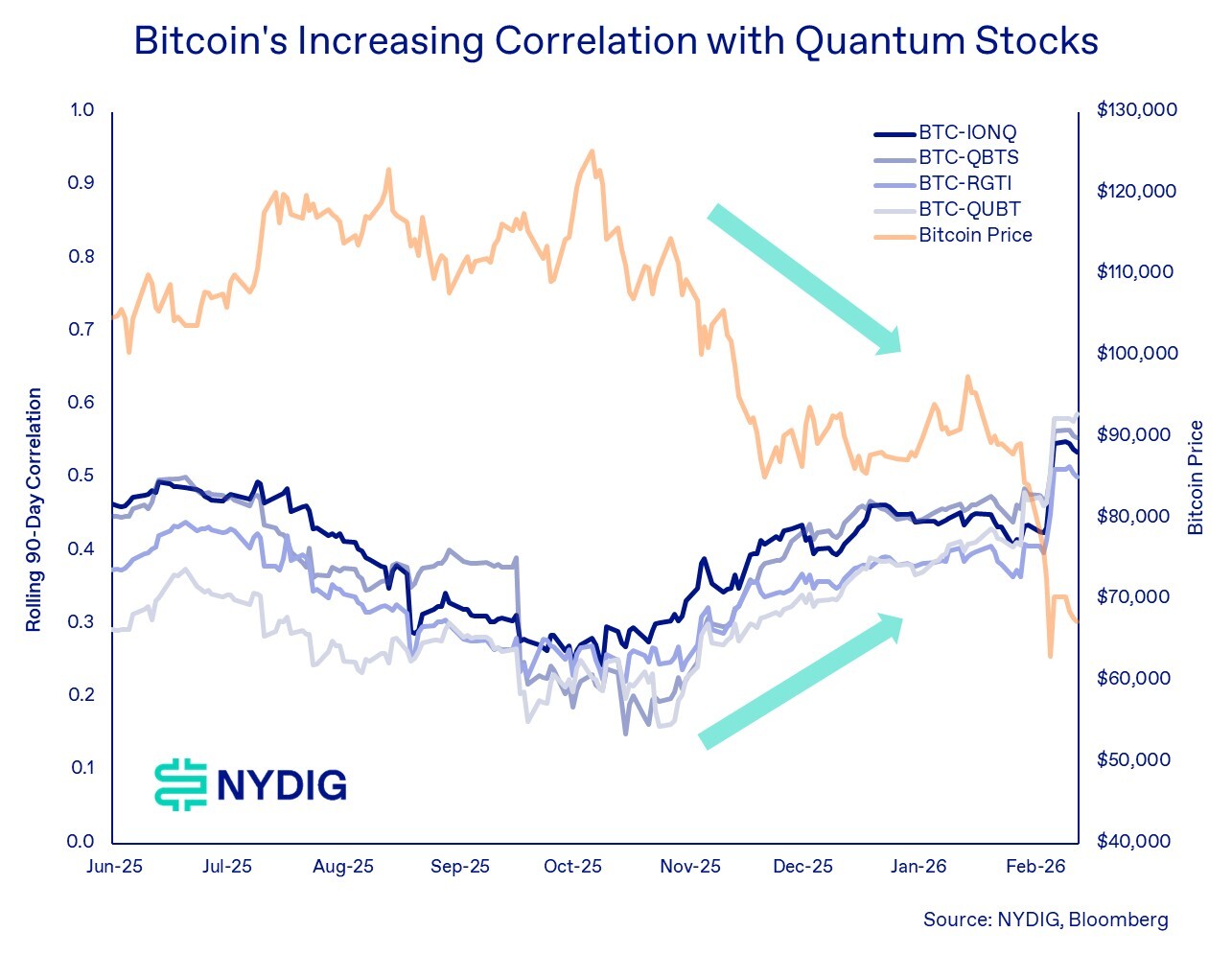

Second, NYDIG seems at how Bitcoin traded versus publicly listed quantum computing equities, particularly IONQ, QBTS, RGTI, and QUBT. If buyers had been rotating out of Bitcoin as a result of quantum advances had been “catching up,” you’d count on quantum-linked shares to diverge positively as Bitcoin falls. NYDIG says it noticed the other. Bitcoin was positively correlated with these equities, and people correlations strengthened throughout the drawdown, suggesting a shared driver quite than a direct quantum-to-Bitcoin causality.

NYDIG’s conclusion is blunt on that time. “The information gives no proof that quantum computing is the proximate reason behind bitcoin’s weak point, even when it’s the dominant danger narrative in the mean time,” Cipolaro wrote. “The extra believable clarification is a broader macro repricing of danger throughout long-duration, expectation-driven property. Bitcoin’s latest drawdown seems extra in keeping with shifts in general danger urge for food than with any discrete technological catalyst.”

Associated Studying

The mechanism NYDIG highlights is acquainted to anybody watching liquidity regimes. Quantum computing corporations, it argues, are long-duration, expectation-driven property with minimal revenues and excessive EV/income multiples. Bitcoin, whereas structurally completely different, usually trades as a long-duration wager on future adoption and monetary dynamics. When danger urge for food contracts, each can get hit collectively.

In the meantime, NYDIG flags a divergence in derivatives markets that, in its view, higher captures the present tape than quantum headlines. The 1-month annualized foundation on CME has “persistently traded above” Deribit, which NYDIG makes use of as a proxy for onshore US institutional positioning versus offshore positioning.

Structurally greater CME foundation implies US desks have remained extra constructive, whereas the sharper decline in Deribit’s 1-month foundation factors to rising warning offshore and diminished urge for food for leveraged lengthy publicity.

At press time, Bitcoin traded at $66,886.

Featured picture created with DALL.E, chart from TradingView.com