Crypto market researcher Dom (@traderview2) says he’s recognized what seems to be like a persistent, algorithmic XRP vendor on South Korea’s Upbit: one which, by his estimates, has offloaded roughly 3.3 billion XRP into the XRP/KRW order e-book over the previous 10 months. If the evaluation holds, it reframes Upbit’s XRP stream as a venue-specific phenomenon slightly than a easy reflection of worldwide risk-on/risk-off sentiment.

XRP/KRW Noticed $5 Billion in Web Promoting

Dom analyzed “82 million trades on Upbit XRP/KRW” and mapped their internet imbalance over time. His headline conclusion: “A $5 billion one directional promoting pipeline operating 24/7 for nearly a yr.”

Dom mentioned the work started after an intense intraday stretch that compelled a more in-depth take a look at the tape. “It began with yesterday’s worth motion. -57M XRP in CVD over 17 hours. It appeared insane,” he wrote. “So I ran forensic queries – bot fingerprinting, iceberg detection, wash commerce checks. The promoting was actual. Algorithmic. 61% of trades fired inside 10ms. Single bot operating 17 hours straight with one 33 second pause.”

Associated Studying

As a substitute of treating that -57 million XRP cumulative quantity delta as an outlier, Dom mentioned he zoomed out and located it matched a longer-running sample. “-57M isn’t an anomaly,” he wrote. “Upbit XRP/KRW has been internet unfavorable each single month for 10 months,” itemizing a number of months with giant internet promoting: “Apr: -165M,” “Jul: -197M,” “Oct: -382M,” and “Jan: -370M.” In complete, he put the determine at “3.3 BILLION XRP in internet promoting. ~$5B.”

He additionally argued the stream is unusually constant. “Only one week out of 46 was constructive. One,” Dom wrote, including that there’s “no weekday/weekend distinction” and “no time of day the place shopping for outweighs promoting in combination.” That persistence is a part of why he framed it as one thing nearer to execution infrastructure than discretionary buying and selling. “This isn’t a dealer,” he wrote. “It’s infrastructure.”

A key a part of the thread is the cross-venue comparability. Dom mentioned Binance’s XRP/USDT market confirmed materially much less promote strain throughout the identical home windows—“2-5x much less promote strain on the identical coin,” he wrote, pointing to a June interval the place “Binance was internet constructive whereas Upbit bled -218M.”

He additionally flagged a weak relationship between the 2 venues’ hour-by-hour stream, claiming “the hourly correlation between the 2 venues is simply 0.37,” which might suggest Upbit’s internet promoting is being pushed by native components slightly than merely mirroring world positioning.

XRP Traded Cheaper In Korea For Months

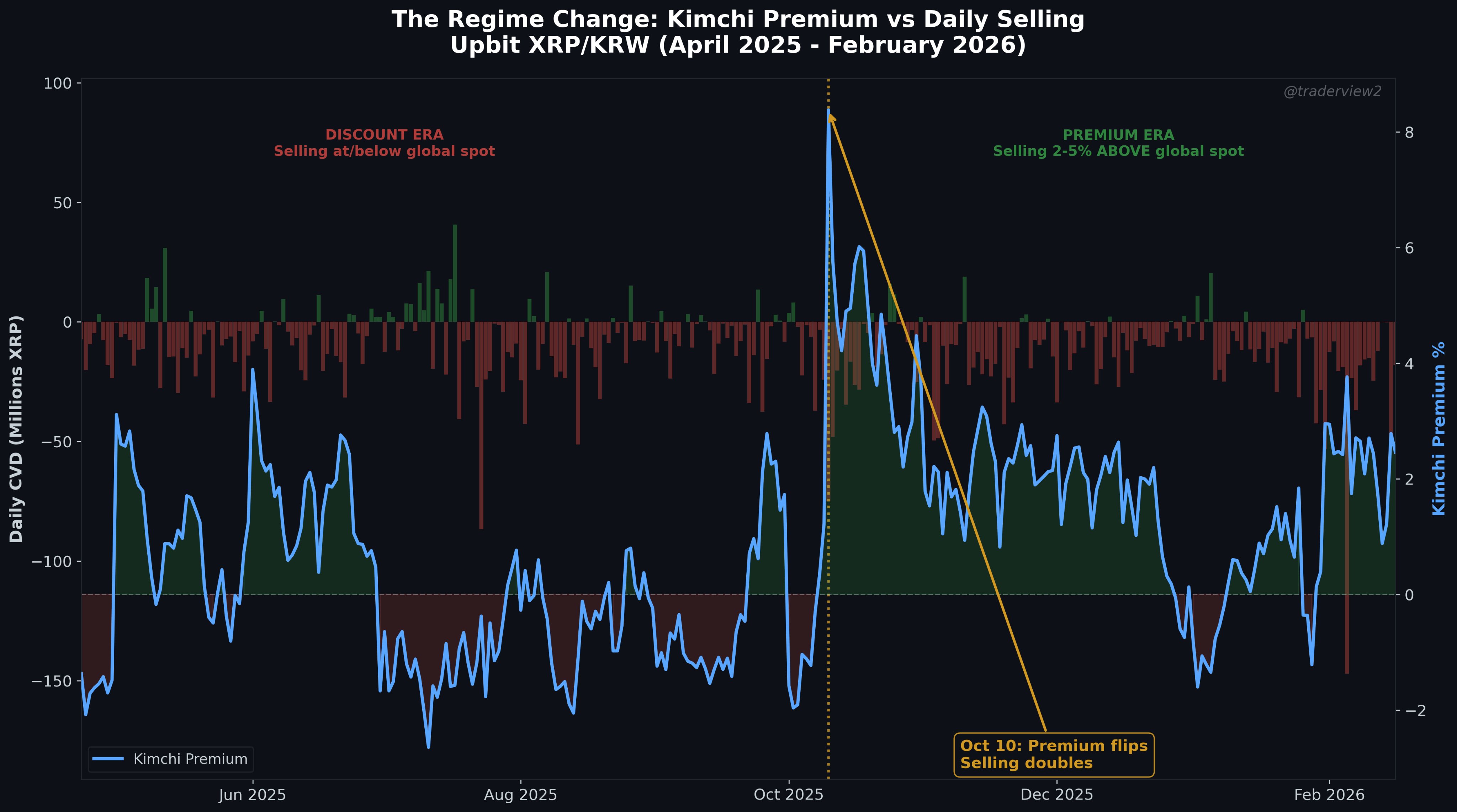

Dom’s pricing observations added one other layer. He mentioned that from April via September, Upbit XRP traded “3-6% BELOW Binance,” calling it a “reverse Kimchi discount.” In his view, that element issues as a result of it suggests the vendor was keen to just accept persistently worse execution than what was accessible elsewhere.

“The sellers had been accepting 6% worse fills than accessible on world markets, for a lot of months,” Dom wrote. “They don’t care concerning the worth. They want KRW, are mandated to make use of Upbit, and/or are Korean holders taking revenue…”

Associated Studying

He then pointed to what he described as a structural break round Oct. 10. “Korean retail went insane. Premium flipped from -0.07% to +2.4% in a single day. Trades 5x’d to 832K,” Dom wrote, including that the premium “has solely briefly gone unfavorable since.” The vendor, in his telling, didn’t again off—if something, the tempo elevated. “And the sellers? They doubled their each day price. From -6.3M/day to -11.2M/day.”

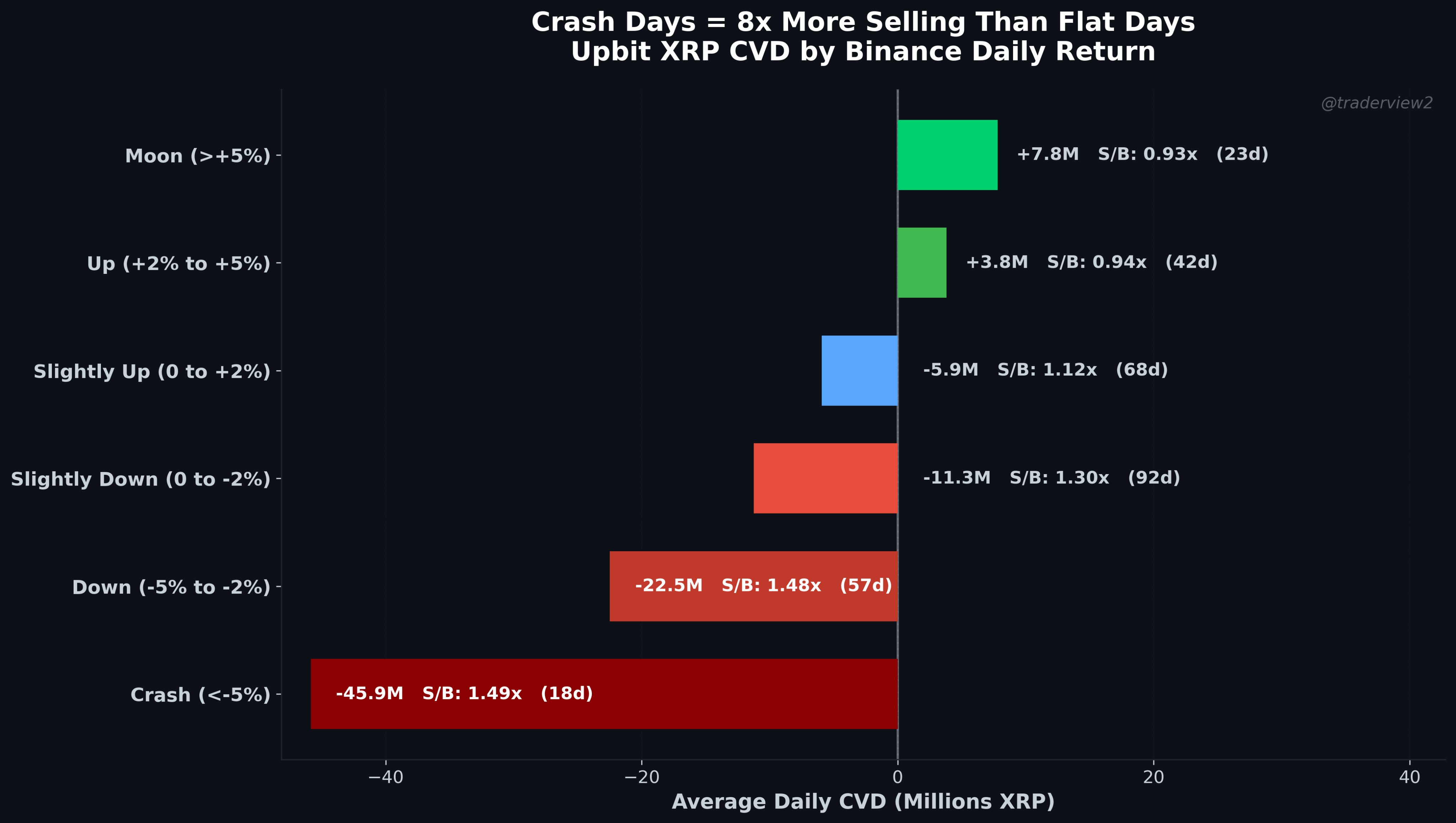

Dom tried to attach that conduct to market regimes by “bucket[ing] every single day by what XRP did on Binance globally,” reporting that Upbit stream skews closely unfavorable on down days and particularly on crash days.

He summarized the dynamic as suggestions between a scientific vendor and retail conduct: “On moon days, Korean retail turns into a NET BUYER. They’re accumulating,” he wrote. “On crash days, promote depth is 8x heavier. The systematic vendor + retail panic amplify one another. Korean retail buys each rip. The pipeline sells into all of it.”

To help the “machine versus retail” framing, Dom contrasted order-size fingerprints on each side of the tape. He claimed the promote aspect repeatedly used round-number clips—“10, 50, 100, 500, 1000 XRP”—with “57-60% of all trades fireplace inside 10ms,” whereas the purchase aspect confirmed a big fraction of “tiny fractional sizes,” resembling “2.535, 3.679, 2.681 XRP,” which he argued is per KRW-denominated retail tickets like shopping for a set received quantity of XRP. “One aspect seems to be like retail,” he wrote. “The opposite seems to be like a machine.”

The dimensions declare can be central to why the thread traveled. Dom mentioned “3.3 billion XRP” represents “5.4% of XRP’s whole circulating provide,” moved via “a single buying and selling pair, on a single alternate, in 10 months.” He emphasised he’s working from trade-level datasets: “This evaluation used tick commerce knowledge I collected from Upbit and Binance,” he wrote, citing “82M Upbit trades + 444M Binance trades.”

Dom stopped in need of naming a selected entity behind the promoting, as a substitute posing a query he framed as the following investigative step: who can maintain “300-400M per thirty days for a yr straight,” seemingly “doesn’t care about 6% reductions,” and “wants KRW particularly or is in some walled backyard and may solely use Upbit?”

At press time, XRP traded at $1.45.

Featured picture created with DALL.E, chart from TradingView.com