Bitcoin Value Weekly Outlook

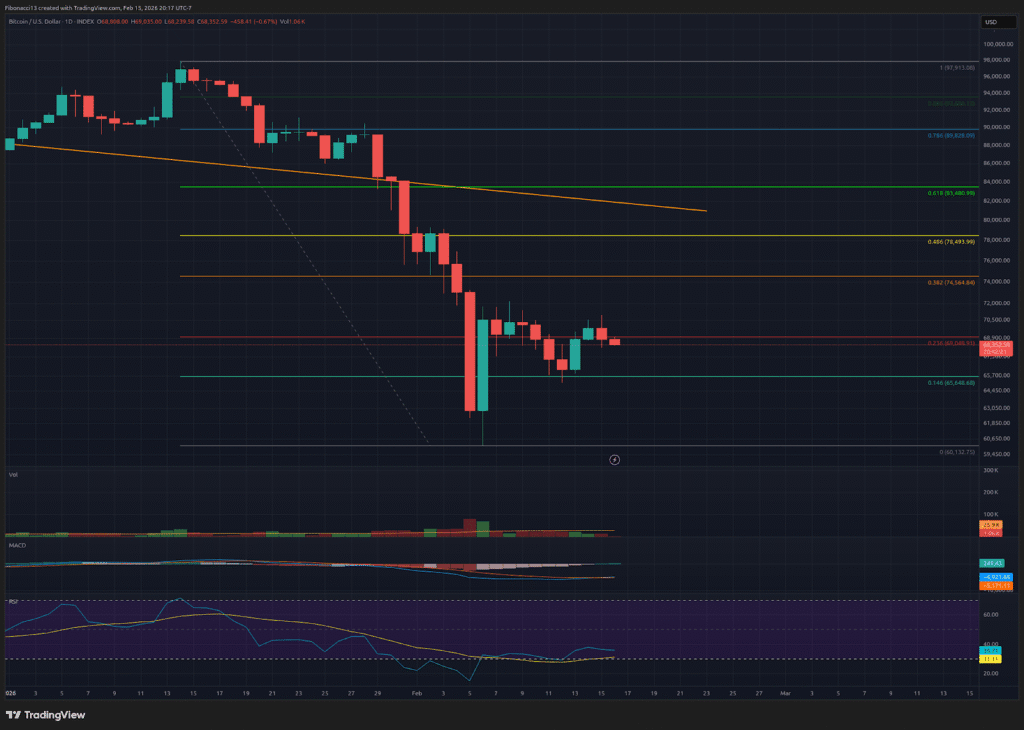

The previous week’s value motion has been moderately lackluster for Bitcoin. After seeing a giant bounce from $60,000, the worth did not get above short-term resistance at $71,800 final week. As a substitute, the worth examined the short-term help at $65,650 earlier than bouncing again as much as shut the week out at $68,811. Whereas the weekly chart is exhibiting some shopping for energy beneath $66,000, the shortage of follow-through for consumers on the bounces thus far is an indication of weak spot. Search for the worth to float in direction of the $60,000 lows this week if the bulls can’t maintain it above $71,000 on a every day near problem increased ranges.

Key Assist and Resistance Ranges Now

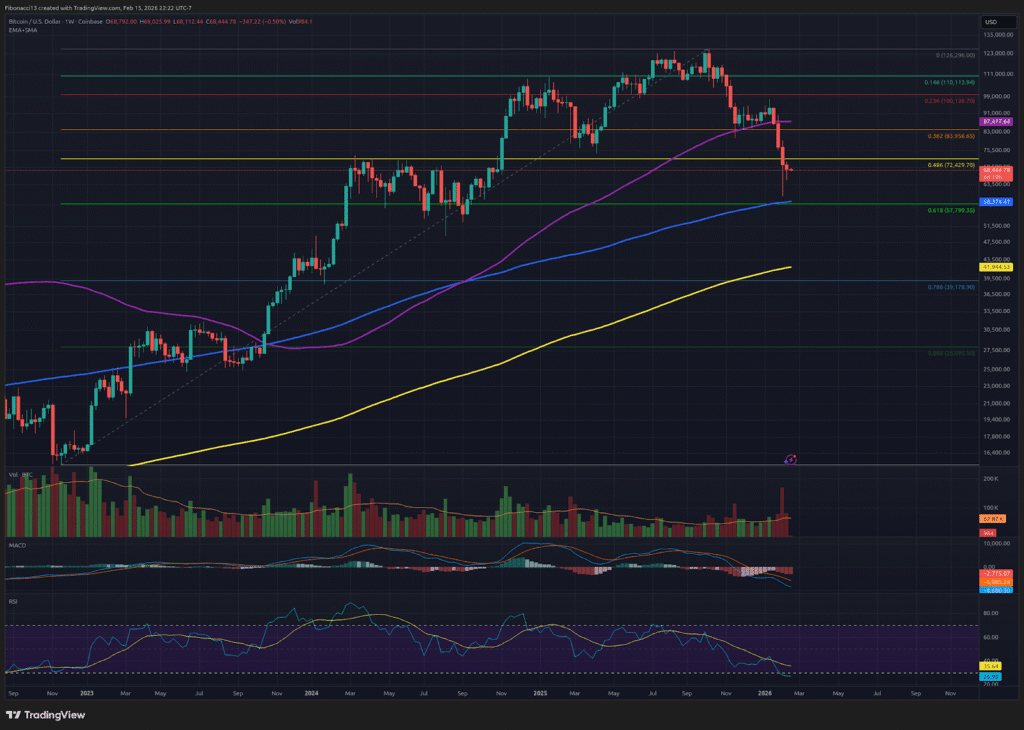

Final week, $65,650 proved to be legitimate short-term help as the worth dipped slightly below it earlier than rallying shortly again above it. If a day closes beneath $65,650, search for $63,000 to behave as help. Under $63,000, now we have the 0.618 Fibonacci retracement at $57,800. This can be a key stage to carry as there isn’t a lot help beneath till $44,000.

If the bulls can muster up some energy, resistance nonetheless sits overhead at $71,800. Closing above this stage results in $74,500, with $79,000 resistance above right here. If the bulls can one way or the other handle to get above $79,000 (unlikely), $84,000 stays as a really sturdy barrier up above.

Outlook For This Week

The outlook for this week is a troublesome one to name. U.S. markets are closed on Monday, so don’t count on an excessive amount of motion till Tuesday morning. We actually might go both means from this $68,800 shut. I’d search for the $67,000 stage to be examined early this week, and if we see help close to there, we could possibly push previous $71,000 later into the week. If $67,000 is misplaced, although, search for the low $60,000 to be challenged as soon as once more.

Market temper: Very bearish – The worth couldn’t handle to achieve any upward momentum final week in any respect. The bears are in full management.

The following few weeks

As I discussed final week, the worth might vary within the space from $60,000 to $80,000 for some time, with perhaps a wick right down to the 0.618 Fibonacci retracement at $57,800. In the meanwhile, this ceiling might be lowered to $74.5k. There isn’t a telling precisely when the upcoming “Crypto Invoice” might be handed by Congress, or precisely what it should entail for the crypto area as an entire. It’s not assured to end in increased costs for bitcoin when it will definitely passes, both, so for now, we should depend on the technicals to information us. In the interim, the bias continues to be bearish, and if we lose $57,800, the bitcoin value will seemingly take the subsequent leg down.

Terminology Information:

Bulls/Bullish: Consumers or traders anticipating the worth to go increased.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or help stage: A stage at which the worth ought to maintain for the asset, no less than initially. The extra touches on help, the weaker it will get and the extra seemingly it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of help. The extent that’s more likely to reject the worth, no less than initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios primarily based on what is named the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).