A pump and dump crypto scheme is among the most typical types of manipulation in crypto markets. It targets new or inexperienced merchants by creating the phantasm of a fast-growing funding alternative. Costs rise rapidly, the information spreads, after which the worth collapses simply as quick. On this article, we are going to find out how pump and dump schemes work and enable you keep away from falling sufferer to them.

What Is a Pump and Dump?

A pump and dump in crypto is a fraudulent observe the place a gaggle of malicious actors artificially inflates an asset’s worth after which sells it for revenue. Throughout the pump part, promoters normally hype a brand new or comparatively nugatory token with exaggerated claims, driving sudden worth spikes and attracting unsuspecting traders. As soon as the value peaks, they set off the dump part—a large sell-off that causes sharp worth decreases, leaving others holding almost nugatory tokens.

The Mechanics of a Pump and Dump Scheme

A pump and dump scheme in crypto normally follows a predictable sample. The purpose stays the identical each time: create synthetic demand, elevate a token’s worth, then promote at a major revenue. These phases are designed to drag in additional potential victims because the scheme progresses.

Section 1: Pre-Pump (Accumulation)

Within the pre-pump part, organizers quietly purchase massive quantities of a token. It’s normally a brand new token or one with out utility, that appears to current no prospects for traders. They usually use a number of accounts to cover their holdings and keep away from detection. At this stage, the token’s liquidity is low, which makes worth manipulation simpler.

Section 2: Pump (Synthetic Inflation)

Subsequent comes the pump part, the place promoters flood social media posts with exaggerated claims and “get wealthy fast” guarantees. This coordinated hype creates sudden worth spikes as demand surges in crypto markets. Because of this, the asset’s worth turns into artificially inflated, drawing in unsuspecting traders who imagine they’ve discovered an actual funding alternative.

Section 3: Dump (Revenue-Taking)

Throughout the dump part, early consumers promote their holdings all of sudden. This large sell-off causes the token’s worth to break down inside minutes or hours. Late consumers are left holding almost nugatory tokens as the worth drops sharply and liquidity disappears.

Some Actual-Life Examples

Pump and dump schemes aren’t theoretical—they present up within the information each time tokens all of a sudden rise and crash, leaving many traders with losses. And that occurs very often. In late 2025, a federal lawsuit accused the creators of the $MELANIA and $TRUMP memecoins of working a pump and dump, when costs first spiked rapidly after which collapsed, allegedly enriching insiders on the expense of others.

One other current case concerned a fake WIRED memecoin promoted by way of a compromised social media account. Hackers used the account to create hype, then executed a fast sell-off that crashed the token’s worth inside minutes, illustrating how social media techniques assist orchestrate these schemes in crypto markets.

Past particular person cash, viral tokens pushed by social media, like $HAWK, have additionally experienced dramatic pump and dump–like habits, with market caps ballooning earlier than steep declines shortly after launching.

Find out how to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero value

Find out how to Determine Pink Flags

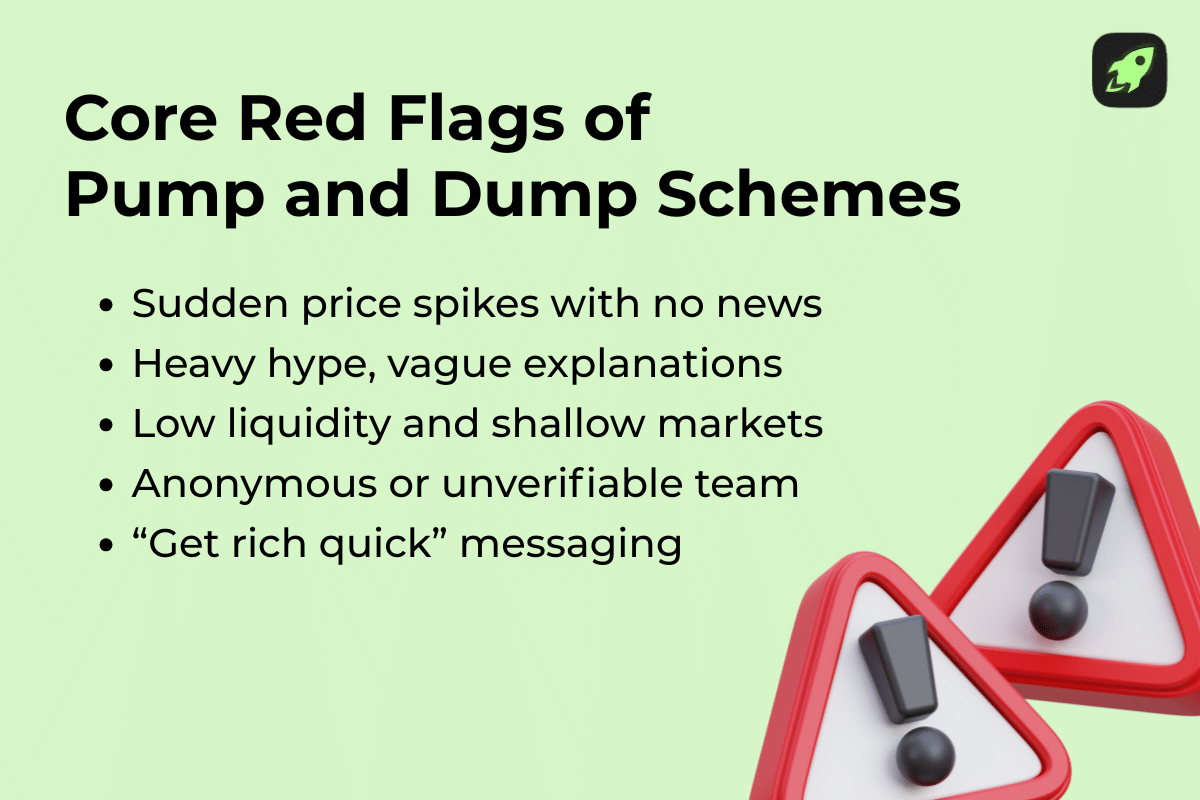

You’ll be able to usually spot a pump and dump scheme early should you take note of frequent warning indicators. These pink flags will help you make an knowledgeable choice on the subject of new or excessively promoted tokens.

- Lack of Regulation

Many pump and dump crypto schemes function outdoors clear regulatory oversight. Crypto markets provide fewer protections than traditional financial markets or the inventory market, and scammers actively exploit that. - Uncommon Value Actions

Sudden worth spikes with no supporting information, product updates, or information usually sign synthetic demand. These strikes normally seem through the pump part and reverse rapidly.

Study extra about market cycles.

- Anonymity

Initiatives with nameless builders or no verifiable background enhance danger. When nobody is accountable, organizers can simply disappear after the dump. - Low Liquidity

Tokens with low liquidity are simpler to control. Small purchase or promote orders could cause massive worth modifications, making large sell-offs extra damaging. - Aggressive Advertising

Heavy promotion by way of social media posts, exaggerated or unsupported claims, and “get wealthy fast” language targets unsuspecting traders. Reputable tasks give attention to transparency and utility.

Find out how to Shield Your self

You’ll be able to scale back the danger of getting concerned in pump and dump schemes by following a couple of sensible guidelines. These steps enable you make knowledgeable funding selections and keep away from emotional trades.

- At all times DYOR: Do Your Personal Analysis

By no means depend on promotion or social media posts alone. Analysis the venture, its improvement group, the token’s provide, and its actual use instances earlier than you make investments. - Use Dependable Coin Trackers

Observe token worth, buying and selling quantity, and historic information utilizing trusted platforms. Constant information helps you notice sudden worth spikes that don’t match actual demand. - Examine Buying and selling Quantity and Liquidity

Low liquidity makes worth manipulation simpler. If small trades trigger large worth strikes, the asset carries greater danger. - Be part of Secure, Respected Crypto Communities

Established communities give attention to training and transparency as a substitute of constructing guarantees they’ll’t fulfill. These areas will help you notice pink flags early and keep away from deceptive info.

Function of Social Media & Influencers

Social media and influencers play a twin function in pump and dump crypto schemes: they usually gasoline curiosity, however in addition they assist expose manipulation after the very fact. Throughout a crypto pump, promoters depend on social media posts, personal teams, and influencer shoutouts to unfold their claims and set off concern of lacking out (FOMO). In some instances, accounts are even hijacked to push pretend tokens. Within the instance above, hackers used a journalist’s X account to advertise a pretend WIRED token.

Influencers may amplify pump and dump schemes with out totally understanding the venture. The Save the Kids token, promoted by a number of gaming influencers, collapsed shortly after launch when insiders bought massive holdings, leaving different traders with almost nugatory tokens.

On the identical time, nonetheless, social media may assist uncover dump schemes. Analysts and journalists observe sudden worth spikes, low liquidity, and on-chain information, then publicly flag false info. That’s why following credible researchers will help you notice pump and dump schemes early and keep away from turning into a sufferer.

Are Pump and Dumps Authorized?

In lots of jurisdictions, pump and dump schemes are illegal, as a result of they contain market manipulation and deception with the purpose of profiting on the expense of traders. Within the US, regulators such because the Securities and Trade Fee (SEC) and the Division of Justice deal with these schemes as violations of securities legal guidelines, both once they contain belongings labeled as securities, or in any other case mislead traders. The SEC actively pursues fraud and market manipulation instances tied to cryptocurrency and different belongings.

A rising variety of high-profile authorized actions exhibit this level. In 2025, a sweeping class action lawsuit accused Pump.enjoyable, Solana Labs, and Jito Labs of orchestrating a coordinated “pump enterprise” that allegedly violated US securities and racketeering legal guidelines by extracting billions from retail crypto merchants by way of synthetic worth inflation and dumping.

One other instance entails private legal action towards the Solana-based M3M3 token launch, the place plaintiffs allege the defendants artificially inflated the token’s worth and dumped their provide for revenue, inflicting vital losses for later consumers.

Even within the comparatively unregulated world of crypto markets, authorized legal responsibility exists when schemes resemble conventional market manipulation, and authorities are more and more treating misleading buying and selling techniques within the business as illegal.

Remaining Ideas

Pump and dump schemes depend on velocity and emotion. They exploit low liquidity, unrealistic claims, and concern of lacking out to maneuver a token’s worth in a short while window. Whereas these techniques might look just like habits seen in conventional monetary markets, crypto markets make manipulation even simpler as a result of decrease oversight and sooner info unfold.

That’s why analysis performs a vital function. For those who perceive the mechanics, acknowledge pink flags, and decelerate earlier than you make investments, you scale back the danger of turning into one of many many traders left holding a nugatory token.

FAQ

How lengthy does a pump and dump normally final?

Most pump and dump schemes transfer rapidly. The pump part can final minutes or hours, whereas the dump usually occurs nearly immediately as soon as early consumers promote massive quantities.

Can pump and dump schemes occur in conventional markets?

Sure. Related schemes have existed in conventional markets for many years, particularly with penny shares on Wall Avenue. Crypto markets face greater danger as a result of tokens launch sooner and oversight is weaker.

How can learners keep away from pump and dump crypto schemes?

You’ll be able to keep away from falling sufferer by doing your individual analysis, checking liquidity and buying and selling quantity, questioning exaggerated claims, and avoiding “get wealthy fast” messaging. Slowing down is usually the most effective protection.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.