Bitcoin is sitting at a “essential level,” with merchants cut up between two acquainted scripts: a full capitulation occasion, or the early innings of a sturdy bottoming course of. In a Feb. 15 video explainer, CryptoQuant analyst Maartunn argued the information is beginning to line up for the latter, however with a transparent caveat that any backside is extra prone to be a grind than a snapback.

Is The Bitcoin Backside In?

Bitcoin is presently buying and selling roughly 50% under its all-time excessive, a drawdown that appears extreme in isolation however nonetheless smaller than the 70%+ declines seen in prior bear markets, Maartunn said. The extra actionable query, in his framing, shouldn’t be whether or not the market can go decrease however whether or not the components that often precede a flip are showing.

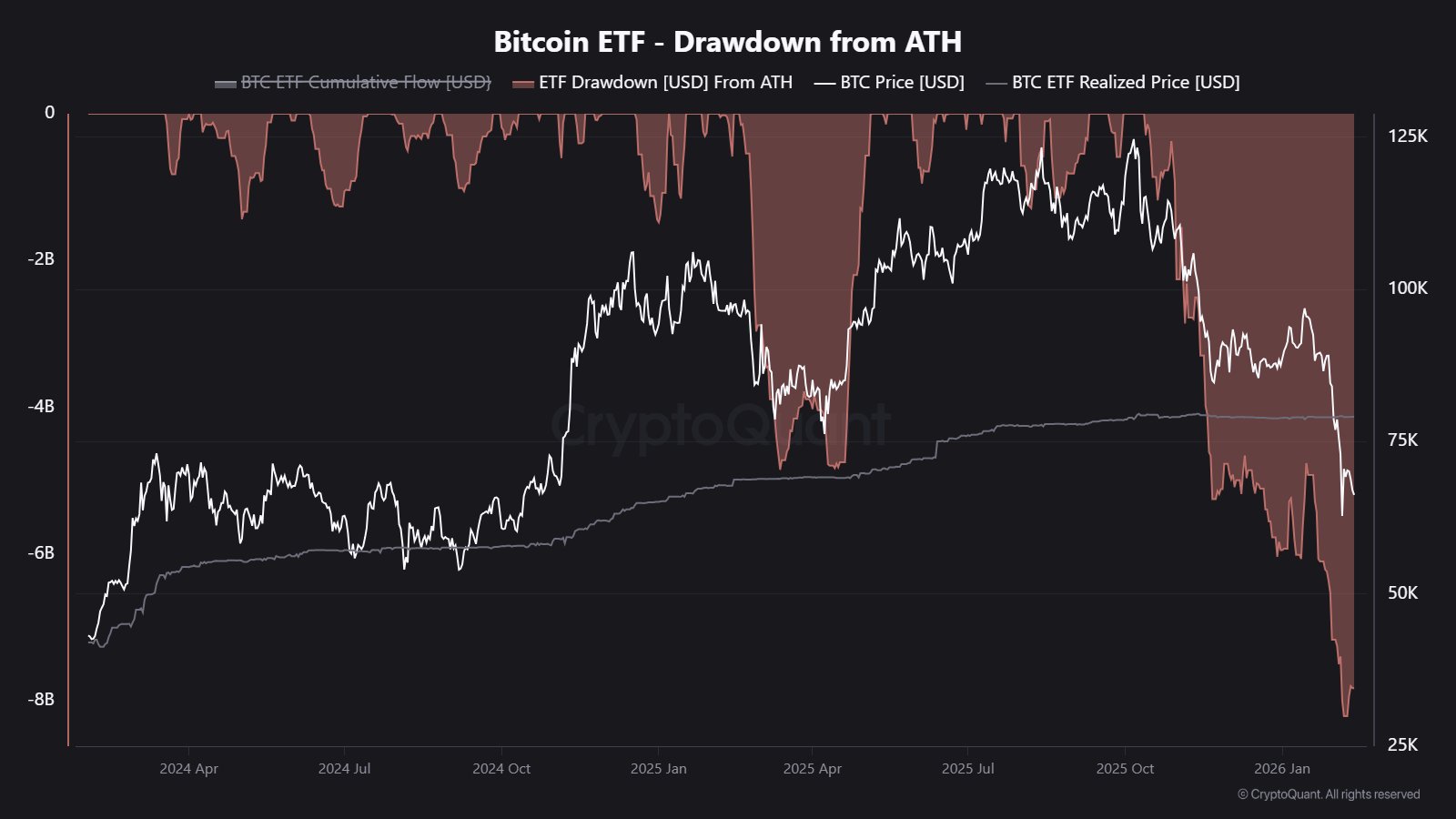

Maartunn factors first to what he describes as “structural selling pressure” tied to spot ETFs. In response to his figures, the brand new spot ETFs have posted an $8.2 billion drawdown from peak holdings, “the most important on document”, creating persistent promote strain. He provides that the present value is round 17% under the typical shopping for value for ETF holders, placing a significant slice of that cohort underwater and probably incentivized to chop publicity.

Associated Studying

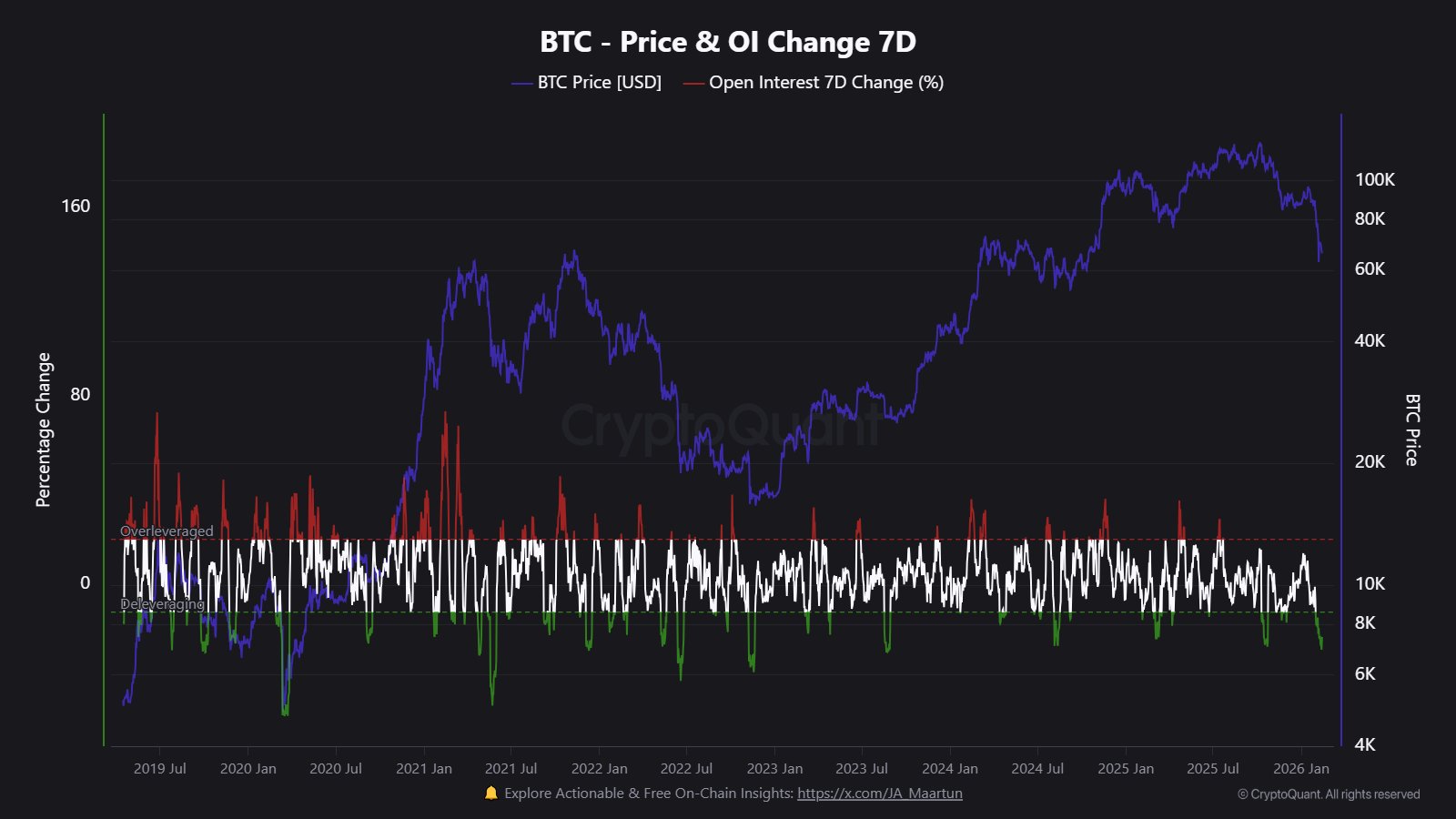

He then pairs that circulate story with a mechanical reset in derivatives. Open interest has been “sliced by greater than half,” falling from $45.5 billion to $21.7 billion, with a 27% drop in open curiosity within the final week alone. Maartunn describes this as a broad deleveraging occasion, painful in actual time, however traditionally according to circumstances that enable a backside to kind.

“Look, it’s positively painful for anybody who’s overleveraged, however eliminating all that hypothesis is a fully obligatory step to kind an actual sustainable market backside,” he stated. “This can be a sign of a significant wash out of speculative extra.”

To gauge whether or not the drawdown is translating into capitulation-like stress, Maartunn focuses on short-term holders. He cites the short-term holder MVRV ratio at 0.72, implying the typical short-term holder is down about 28%, “deep underwater” as a gaggle. In his telling, that’s not a routine studying: it’s the bottom degree for the reason that July 2022 backside, and a band that has traditionally aligned with intervals of most monetary ache.

“This degree of economic stress is fairly uncommon traditionally, and it often occurs during times of main capitulation,” Maartunn stated. “Now, positive, might this ratio go even decrease? Completely. However what historical past reveals us is that after we get down into these ranges, the risk-to-reward profile for Bitcoin begins to look lots higher.”

Associated Studying

Maartunn additionally frames the present construction as a retest of a significant help cluster — the place the earlier cycle’s all-time excessive intersects the higher boundary of an older buying and selling vary — a zone that has usually mattered in previous cycle transitions. From there, he strikes to time-based analogs, suggesting prior bear-market durations suggest a broad window between June and December 2026, with the final two cycles clustering most tightly between September and November.

His closing level is that bottoms are not often single-day occasions. In his view, ETF-driven structural promoting, the leverage flush, stress amongst short-term holders, and the retest of key ranges can all coexist inside an extended bottoming course of — with sentiment as the ultimate inform.

“An actual market backside… that’s often marked by simply apathy,” he stated. “When engagement on social media is completely lifeless, your timeline is quiet, and truthfully, no person appears to care anymore. That interval of whole disinterest is usually the purpose of most monetary alternative.”

General, the implication of Maartunn’s framework is easy: the information could also be shifting towards early backside formation indicators, however the confirming proof, significantly round flows and sentiment, might nonetheless arrive in phases, with volatility and additional stress assessments alongside the best way.

At press time, Bitcoin traded at $68,710.

Featured picture created with DALL.E, chart from TradingView.com