The current slide of Bitcoin has punched a gap in short-term holders’ wallets and left loud questions on the place costs may settle subsequent. Markets are jittery; individuals who purchased excessive are taking losses. Some sellers reacted quick, and that rush exhibits up in on-chain numbers.

Realized Losses Hit Historic Ranges

In response to CryptoQuant and an analyst writing below the identify IT Tech, Bitcoin’s seven-day common of realized internet losses climbed to about $2.3 billion — a determine that places this sell-off among the many largest loss occasions on document.

“This is without doubt one of the largest capitulation occasions in BTC historical past, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction,” IT Tech stated.

This spike in losses means many merchants bought at a loss over the span of every week, not only a day.

Value Motion And Market Context

Studies say Bitcoin fell sharply from its current peak and has been bouncing between help strains that merchants watch carefully. After topping close to $126,000, the token traded as little as about $60,000 earlier within the month and has been seen round $66,600 on current checks. That hole is giant, and it explains why panic promoting pushed realized losses so excessive.

Indicators Pointing To Capitulation

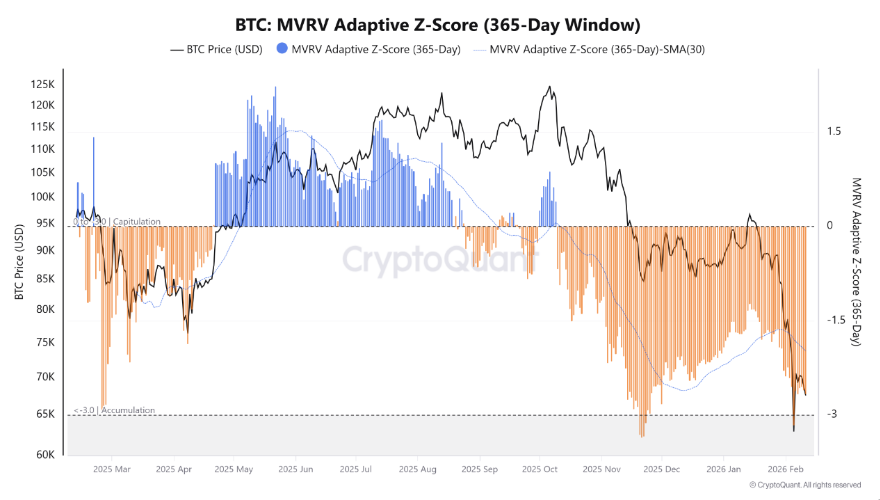

Studies notice that on-chain indicators tied to revenue and loss present losses are rising sooner than beneficial properties. One contributor at CryptoQuant, GugaOnChain, flagged a Z-Rating studying that he describes as in line with deep capitulation — a section the place extra holders quit than purchase. When that occurs, markets usually grow to be chaotic first and regular later.

What Analysts Are Saying Now

Studies say some market commentators count on stress to proceed for some time. Nic Puckrin, an funding analyst, described the market as being in “full capitulation mode,” and warned promoting might persist for months earlier than clearer footing seems. Others level out that heavy losses may also clear the best way for affected person consumers later.

The place Bottoms Have Lived Earlier than

Studies have disclosed that CryptoQuant’s measure of the “realized value” sits close to $55,000 — a degree that has been linked in previous cycles to the top of massive sell-offs and the beginning of sideways consolidation.

That doesn’t imply a ground has shaped this time; it solely marks a area the place previous consumers, on common, stopped dropping cash on their holdings. Markets have traded properly beneath comparable marks earlier than they steadied, so historical past affords patterns, not ensures.

What This Means For Merchants And Traders

Brief time period, count on wild swings. Some days will carry sharp rallies that reverse rapidly. Different days will drag, and realized losses might preserve rising as extra traders pull out.

Long run, if institutional demand returns or huge holders cease forcing gross sales, value stability might comply with. Proper now the market is clearing out positions and testing whether or not help ranges maintain.

Featured picture from Gemini, chart from TradingView