What to Know:

- Binance’s $300M SAFU buy indicators a shift towards arduous belongings, making a ‘risk-on’ surroundings for the broader crypto market.

- Bitcoin Hyper merges Bitcoin’s safety with the Solana Digital Machine (SVM), enabling high-speed good contracts and low-cost transactions.

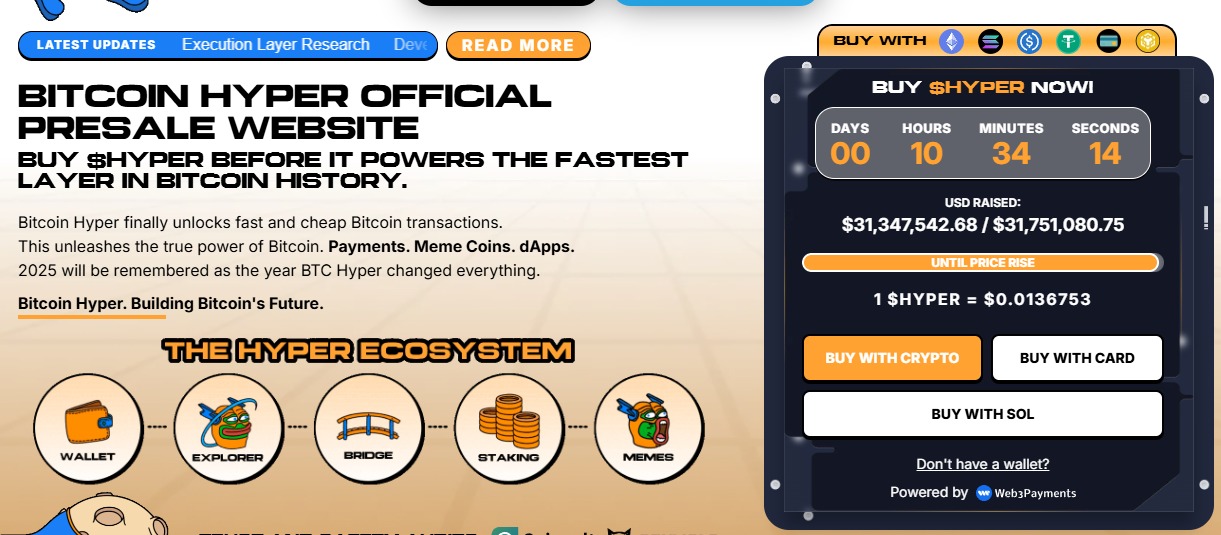

- Institutional curiosity is rising, with whale wallets accumulating $1M in $HYPER tokens as the whole elevate surpasses $31.3M.

- The rotation from L1 asset accumulation to L2 infrastructure performs highlights the market’s demand for programmable Bitcoin.

Binance’s Safe Asset Fund for Customers (SAFU) has traditionally served as a pulse test for crypto market well being.

But the recent disclosure that the fund executed a strategic reallocation of $300M into Bitcoin indicators a profound shift in exchange-level threat administration.

It’s not nearly bolstering reserves. It’s a tacit admission that within the present macro local weather, arduous on-chain belongings have gotten the popular collateral over stablecoins.

The market response was swift, but nuanced. Whereas spot costs for $BTC noticed a modest uptick, the true story lies within the second-order results. When trade giants like Binance take in liquidity, they successfully elevate the ground worth, decreasing floating provide and squeezing shorts.

That creates a ‘risk-on’ surroundings for the broader ecosystem. Institutional capital is securing the bottom layer. In the meantime, speculative quantity is cascading into infrastructure performs promising to unlock Bitcoin’s dormant capital.

(The circulation of funds right here follows a traditional sample: L1 security first, adopted by an aggressive rotation into L2 scalability options.)

Because the legacy community solidifies its place as digital gold, the race to make that gold programmable has intensified. Frankly, the hole between Bitcoin’s trillion-dollar market cap and its lack of DeFi utility is the most important arbitrage alternative in crypto at present.

This liquidity rotation is now discovering a house in high-performance infrastructure, making a direct tailwind for Bitcoin Hyper ($HYPER), a challenge quickly turning into the focus of the Bitcoin Layer 2 narrative.

Fixing The Scalability Trilemma With SVM Integration

Bitcoin’s main bottleneck has by no means been safety, it’s at all times been execution. Conventional Layer 2 options usually depend on optimistic rollups affected by latency points or sidechains that compromise belief. Bitcoin Hyper ($HYPER) is breaking this development by integrating the Solana Digital Machine (SVM) straight as its execution surroundings. It marks the primary real try we’ve seen to marry Bitcoin’s settlement assurance with Solana’s sub-second finality.

Utilizing the SVM, Bitcoin Hyper permits builders to write down good contracts in Rust. This opens the door for high-frequency buying and selling, gaming dApps, and complicated DeFi protocols that had been beforehand unattainable on the Bitcoin community. The structure depends on a single trusted sequencer with periodic L1 state anchoring, making certain that whereas transactions happen at SVM speeds, the ultimate fact at all times resides on Bitcoin.

This technical leap addresses the ‘programmability hole’ forcing Bitcoin holders to wrap belongings and bridge to Ethereum or Solana for yield. With a Decentralized Canonical Bridge, customers can transfer belongings seamlessly into an surroundings the place gasoline charges are negligible. Throughput rivals conventional finance cost rails.

For builders, the proposition is easy: construct with the velocity of Solana, however faucet into Bitcoin’s liquidity.

Check out the Bitcoin Hyper presale.

Whales Accumulate Over $1M As Funding Tops $31.3M

Whereas the structure offers the basic thesis, on-chain flows recommend good cash is already positioning for the Token Era Occasion (TGE). In keeping with the official presale web page, Bitcoin Hyper has raised over $31.3M, a determine inserting it among the many largest infrastructure raises of the present cycle.

The capital influx isn’t simply retail quantity. On-chain knowledge from Etherscan reveals that 3 whale wallets have collected over $1M ($500K, $379.9K, $274K) in current transactions. That degree of pre-market positioning sometimes indicators excessive confidence within the asset’s post-launch efficiency, significantly given the vesting incentives.

Presale contributors are coming into at $0.0136753 per token. The challenge’s tokenomics mannequin contains excessive APY staking incentives accessible instantly after TGE, with a modest 7-day vesting interval for presale stakers. That construction goals to mitigate rapid promote strain whereas rewarding long-term alignment.

With the Bitcoin L2 sector heating up, early accumulation knowledge suggests traders view $HYPER not simply as a token, however as a leveraged guess on your complete Bitcoin DeFi ecosystem.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. Cryptocurrency investments, together with presales and Layer 2 tokens, carry inherent dangers. At all times carry out your individual due diligence earlier than deploying capital.