Ethereum is at present buying and selling above the $3,000 degree, providing a surface-level sense of stability after weeks of volatility. Nevertheless, beneath this worth resilience, market sentiment stays decisively bearish. Many analysts are overtly calling for decrease ranges within the coming months, citing weakening momentum, macro uncertainty, and protracted promoting strain throughout danger belongings. Excessive concern dominates positioning, with traders displaying little conviction that the latest restoration can evolve right into a sustained uptrend.

This pessimistic backdrop makes latest institutional-linked exercise stand out. Amid widespread warning, knowledge means that Bitmine—an entity related to Fundstrat’s co-founder Tom Lee—has elevated its publicity to Ethereum.

Bitmine is a digital asset mining and funding car targeted on long-term participation in blockchain infrastructure, combining mining operations with strategic accumulation of main crypto belongings. Somewhat than buying and selling short-term worth swings, entities like Bitmine sometimes function with a multi-year horizon, emphasizing community fundamentals and uneven upside.

The distinction is notable. Whereas retail and short-term members stay defensive, longer-term capital seems prepared to step in in periods of concern. Historically, such divergence between sentiment and positioning has typically emerged close to transitional phases available in the market cycle.

Bitmine Expands Ethereum Publicity Amid Market Worry

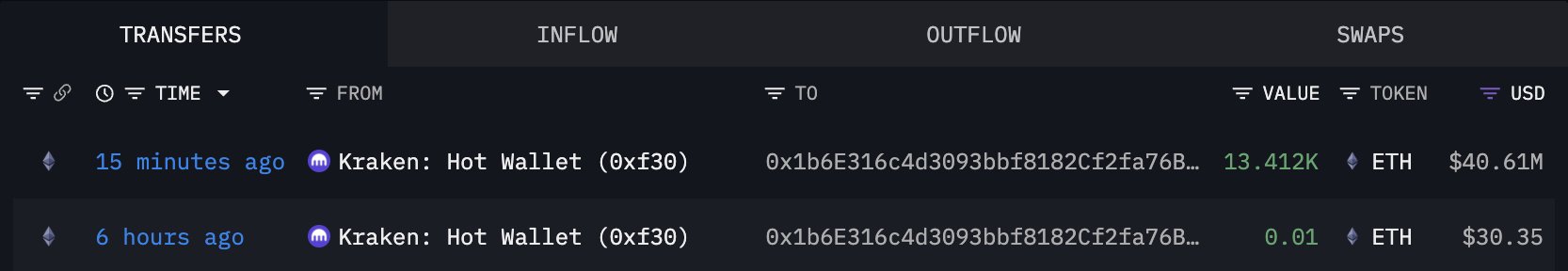

On-chain data from Arkham confirms that Bitmine has added one other 13,412 ETH to its holdings, an acquisition valued at roughly $40.61 million at present market costs. The acquisition comes at a time when Ethereum sentiment stays deeply bearish, reinforcing the distinction between short-term market concern and long-term capital positioning.

Following this newest accumulation, Bitmine’s complete Ethereum holdings now stand at roughly 3.769 million ETH, with an estimated market worth of round $11.45 billion. This locations Bitmine among the many largest recognized Ethereum holders globally, highlighting the size and conviction behind its technique.

Such positioning is just not in line with short-term hypothesis. As a substitute, it displays a deliberate method centered on long-duration publicity to Ethereum’s community worth and future position throughout the digital asset ecosystem.

Bitmine’s accumulation habits suggests confidence in Ethereum’s long-term fundamentals regardless of near-term volatility and widespread pessimism. Traditionally, large-scale purchases in periods of utmost concern have typically occurred when costs commerce beneath perceived intrinsic worth.

Whereas this exercise doesn’t remove the chance of additional draw back within the coming months, it alerts that structurally affected person capital continues to deploy. The rising divergence between bearish sentiment and aggressive accumulation underscores a market surroundings the place positioning, fairly than headlines, could provide clearer perception into longer-term expectations.

Some traders are utilizing present pessimism as a chance to construct publicity, reinforcing the concept that fear-driven environments also can appeal to structurally affected person patrons.

Ethereum Worth Struggles to Rebuild Bullish Construction

Ethereum is at present buying and selling simply above the $3,000 degree, making an attempt to stabilize after a protracted corrective section. The chart reveals that ETH stays beneath its key medium-term shifting averages, with the 50-day and 100-day MAs nonetheless performing as dynamic resistance overhead. Every latest try to push larger has been met with promoting strain, highlighting the market’s issue in reclaiming bullish momentum.

Structurally, the worth motion because the October peak displays a transparent sequence of decrease highs and decrease lows, confirming that ETH continues to be working inside a bearish pattern on the every day timeframe. Though the latest bounce from the $2,800–$2,900 zone suggests the presence of demand, quantity stays muted in comparison with earlier growth phases, indicating an absence of conviction from patrons. This helps the view that the present transfer is corrective fairly than the beginning of a brand new impulsive rally.

From a help perspective, the $2,900 space is now vital. A sustained lack of this degree would expose ETH to a deeper retracement towards the $2,600–$2,700 area, the place prior consolidation occurred. On the upside, bulls would want a decisive every day shut above the descending shifting averages close to $3,300 to invalidate the bearish construction.

Total, the chart factors to consolidation beneath resistance fairly than pattern reversal. Till ETH reclaims key shifting averages with increasing quantity, worth motion suggests ongoing distribution and elevated danger of additional draw back.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.