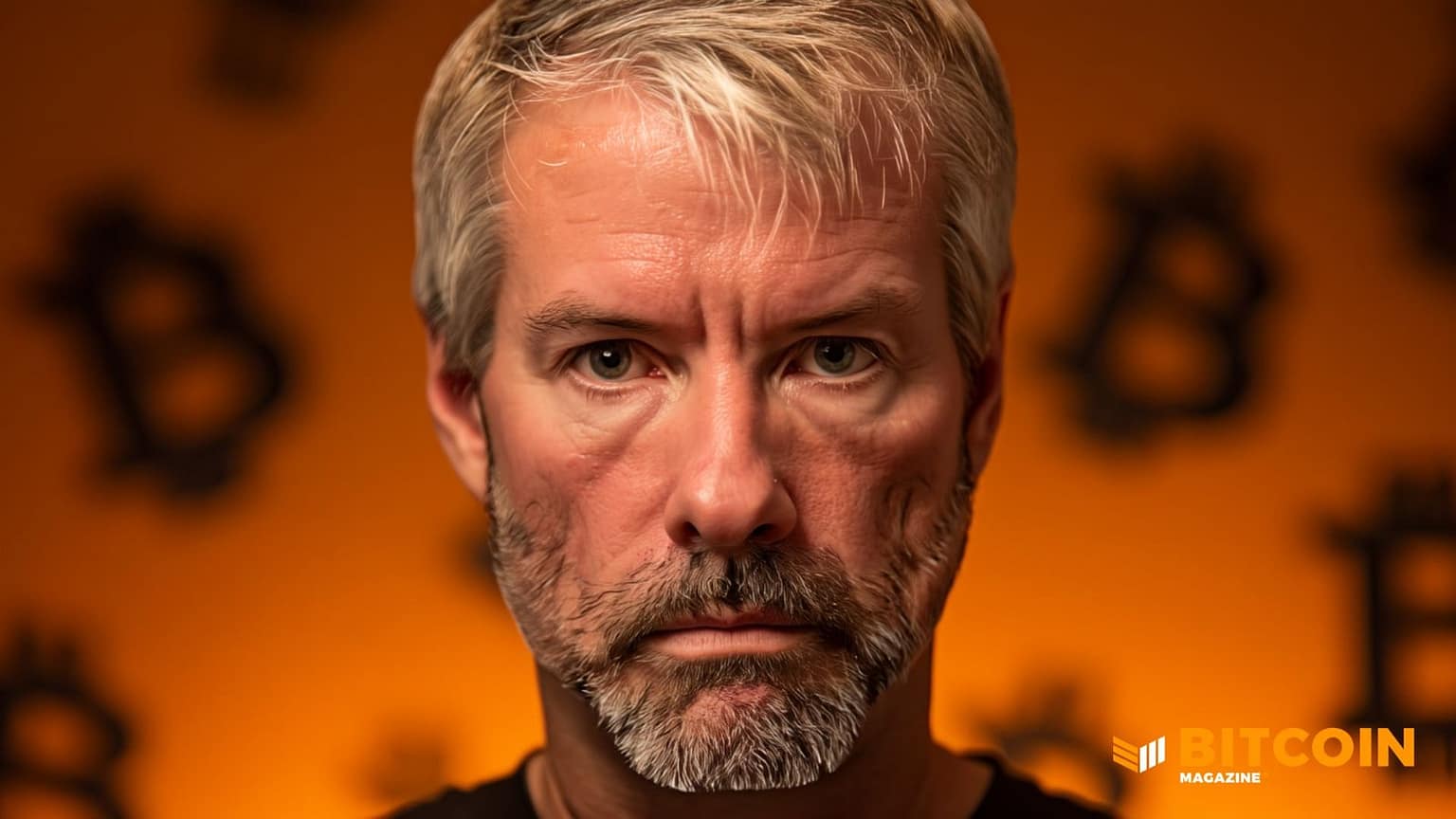

Michael Saylor pushed again on current experiences warning that Technique may face billions in passive outflows if MSCI excludes the corporate from main fairness indices.

In an announcement on X, Saylor said that Technique is “not a fund, not a belief, and never a holding firm.” He described the agency as a publicly traded working firm with a $500 million software program enterprise and a singular treasury technique that makes use of Bitcoin as productive capital.

Saylor highlighted the corporate’s current exercise, together with five public offerings of digital credit securities — $STRK, $STRF, $STRD, $STRC, and $STRE — representing over $7.7 billion in notional worth.

He additionally pointed to Stretch ($STRC), a Bitcoin-backed credit score instrument that provides variable month-to-month USD yields to institutional and retail buyers.

“Funds and trusts passively maintain belongings. Holding firms sit on investments. We create, construction, situation, and function,” Saylor wrote. “No passive car or holding firm may do what we’re doing.”

He described Technique as a brand new type of enterprise: a Bitcoin-backed structured finance firm innovating in each capital markets and software program.

Saylor added that index classification doesn’t outline the corporate. “Our technique is long-term, our conviction in Bitcoin is unwavering, and our mission stays unchanged: to construct the world’s first digital financial establishment on a basis of sound cash and monetary innovation.”

Will Technique get faraway from Nasdaq 100?

The assertion comes as JPMorgan analysts warned that MSCI’s potential exclusion of Technique from main indices may set off $2.8 billion in outflows, rising to $8.8 billion if different index suppliers observe.

Technique’s market cap sits round $59 billion, with almost $9 billion held in passive index-tracking automobiles. Analysts stated any exclusion may improve promoting strain, widen funding spreads, and cut back buying and selling liquidity.

Technique’s inclusion in indices such because the Nasdaq 100, MSCI USA, and MSCI World has lengthy helped channel the Bitcoin commerce into mainstream portfolios. Nonetheless, MSCI is reportedly evaluating whether or not firms with giant digital-asset holdings ought to stay in conventional fairness benchmarks.

Market members more and more see digital-asset-heavy firms as nearer to funding funds, that are ineligible for index inclusion.

Regardless of all of the current bitcoin volatility and issues about potential outflows, the corporate continues to pursue its long-term imaginative and prescient of a Bitcoin-backed monetary enterprise, aiming to create new monetary merchandise and a digitally native monetary institution.

On October 10, bitcoin and the broader crypto market crashed. Some imagine it was as a result of Trump threatened tariffs on China, however some contend that the broader crash was triggered when MSCI introduced it was reviewing whether or not firms that maintain crypto as a core enterprise, like MSTR, needs to be categorised as “funds” slightly than working firms. Some contend that ‘sensible cash’ anticipated this threat instantly after MSCI’s announcement, resulting in the sharp market drop, with the result now hinging on MSCI’s January 15, 2026 determination.

Trillions of {dollars} in Bitcoin

Earlier this yr in an interview with Bitcoin Journal, Saylor outlined an bold imaginative and prescient to construct a trillion-dollar Bitcoin stability sheet, utilizing it as a basis to reshape world finance.

He envisions accumulating $1 trillion in Bitcoin and rising it 20–30% yearly, leveraging long-term appreciation to create an enormous retailer of digital collateral.

From this base, Saylor plans to situation Bitcoin-backed credit score at yields considerably larger than conventional fiat methods, probably 2–4% above company or sovereign debt, providing safer, over-collateralized options.

He anticipates this might revitalize credit score markets, fairness indexes, and company stability sheets whereas creating new monetary merchandise, together with higher-yield financial savings accounts, cash market funds, and insurance coverage companies denominated in Bitcoin.

On the time of writing, Bitcoin is experiencing excessive ranges of promote strain and its worth is dipping near the $80,000 vary. Bitcoin’s all-time excessive got here solely six weeks in the past when it hit costs above $126,000.

Technique’s inventory, $MSTR, is buying and selling at $167.95 down over 5% on the day and over 15% during the last 5 buying and selling days.