In response to on-chain information and market experiences, XRP is underneath contemporary promoting strain as a result of a big share of holders at the moment are displaying losses.

Associated Studying

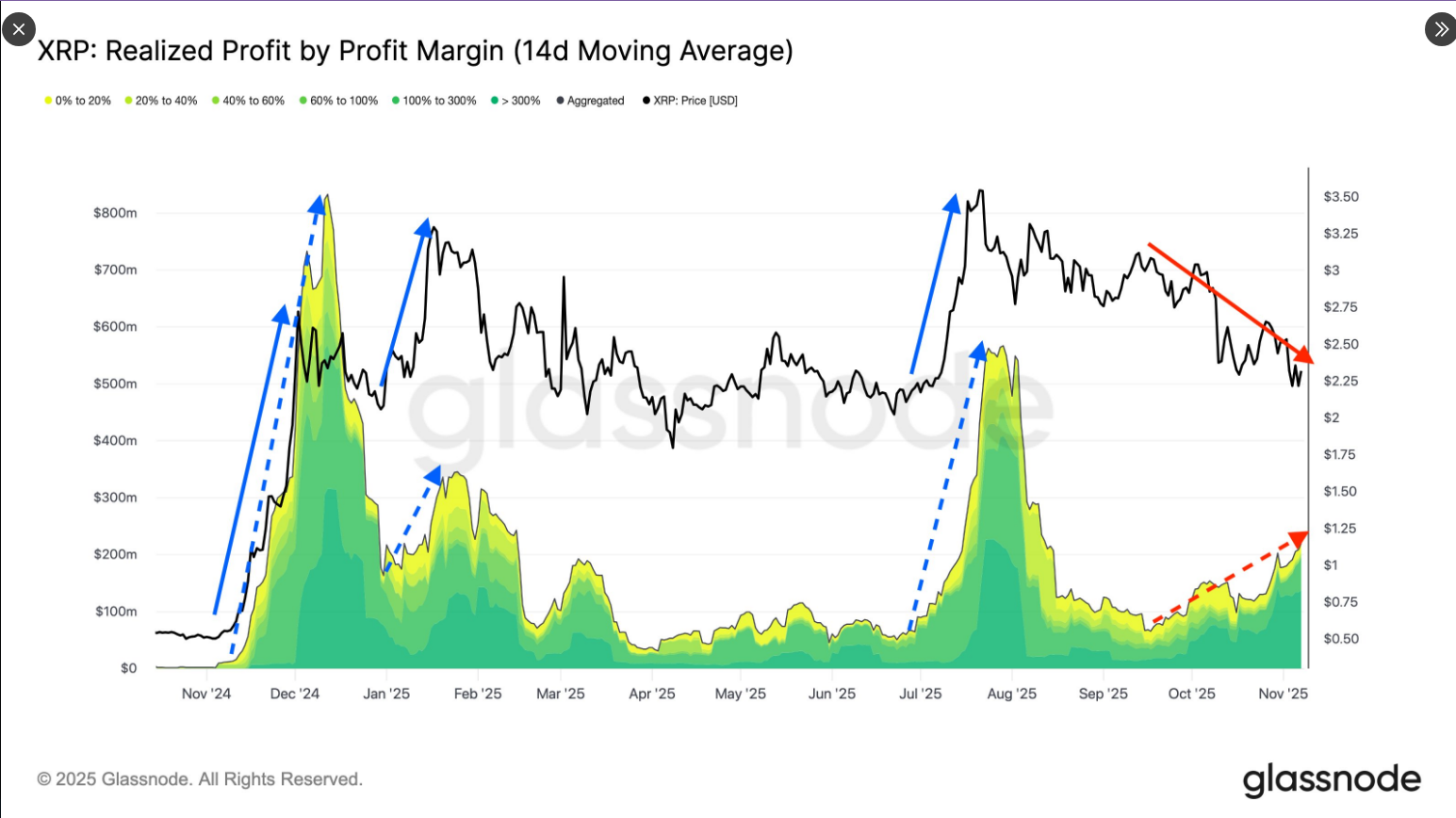

Glassnode experiences that 41.5% of XRP provide — or near 27 billion tokens — sits in loss, the bottom profitability stage since November 2024 when XRP traded close to $0.53.

At right this moment’s ranges, about 4 instances larger than that November determine, an enormous share of holders purchased above present costs and at the moment are uncovered.

Holder Focus Raises Promoting Threat

Market analysts say this positioning has modified dealer conduct. Tony Sycamore, a market analyst at IG Australia, disclosed that many wallets seemingly picked up XRP when it was above $3.00 throughout months together with January, July, August, September, and early October.

Meaning a large group is now holding paper losses after the 40%+ slide from the July $3.65 peak. The dimensions of unrealized losses can encourage some traders to exit if costs hold drifting decrease, which might add promoting strain.

The share of XRP provide in revenue has fallen to 58.5%, the bottom since Nov 2024, when value was $0.53.

Immediately, regardless of buying and selling ~4× larger ($2.15), 41.5% of provide (~26.5B XRP) sits in loss — a transparent signal of a top-heavy and structurally fragile market dominated by late consumers.

📉… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD— glassnode (@glassnode) November 17, 2025

ETFs Might Deliver Recent Demand Or Little Affect

Experiences have disclosed a wave of exchange-traded funds tied to XRP that will alter flows. Canary Capital launched the primary spot-XRP ETF on November 13 and posted the strongest first-day end result for US ETFs in 2025.

Franklin Templeton’s EZRP is scheduled to start buying and selling on November 18, with funds from Bitwise, 21Shares and CoinShares shut behind. Merchants hope these merchandise will appeal to new cash into XRP, however historical past exhibits preliminary demand can differ broadly and is dependent upon broader market liquidity and danger urge for food.

Key Foothold

On the time of reporting, XRP trades round $2.19, down greater than 10% within the final seven days. Analysts are watching the $2.16 space as a key foothold.

💥 JUST IN: FRANKLIN TEMPLETON’S SPOT $XRP ETF (EZRP) LAUNCHES TOMORROW.

BULLISH 🚀 pic.twitter.com/rmGN1rdVGI

— Amonyx (@amonbuy) November 17, 2025

If that stage is defended, a bounce towards the $2.35–$2.60 band might be attainable. If it fails, additional retracement in the direction of decrease ranges is a practical consequence, particularly with a big portion of holders underwater and cease orders probably clustered beneath present help.

On-Chain Alerts Paint A High-Heavy Image

In response to information from blockchain trackers, the market seems “top-heavy,” that means that a lot of those that entered lately paid excessive costs for his or her cash and are thus extra susceptible. That sample typically makes rallies much less steady till profit-taking strain eases or contemporary consumers step in.

Associated Studying

On the similar time, exercise on the XRP Ledger has been rising, and renewed readability round guidelines for digital property in some jurisdictions has helped sentiment a bit.

Within the close to time period, value motion will seemingly correlate with ETF inflows and whether or not consumers can defend the $2.15 stage. A transparent break above $2.60 might relieve promoting strain, whereas a break under help may set off additional promoting by holders attempting to restrict losses.

For now, XRP is caught in a battle between the strain of unrealized losses and new potential flows of capital from ETFs.

Featured picture from Unsplash, chart from TradingView