Abstract:

Bitcoin mining has advanced from a interest for early adopters right into a extremely aggressive business dominated by large-scale Bitcoin farms. With the BTC value surpassing $110,000 in 2025, many buyers are asking: is bitcoin mining nonetheless worthwhile? At this time, profitability depends upon a number of components together with mining {hardware}, electrical energy prices, community issue, and transaction charges. For these contemplating getting into the market, understanding the economics is important earlier than committing capital.

How Bitcoin Mining Generates Income

Block Rewards & Transaction Charges

As of the newest halving, miners obtain 3.125 BTC per block.

Transaction charges now account for a bigger portion of earnings, particularly during times of excessive community congestion.

Mining Swimming pools

Mining swimming pools have develop into the norm resulting from growing community issue. Solo mining is impractical for many contributors, whereas swimming pools distribute rewards based mostly on contributed hashrate.

PPS (Pay Per Share): Miners obtain a set payout for every share of labor submitted, no matter whether or not the pool finds a block. This offers predictable income however might supply decrease long-term earnings.PPS+ (Pay Per Share Plus): Miners earn the PPS base plus a proportional share of transaction charges from efficiently mined blocks, growing potential earnings during times of excessive community exercise.Platforms like bitcoin farm tarkov illustrate how each dwelling miners and professionals can leverage pooled mining to safe constant payouts.

ASIC Bitcoin Miners vs GPU Mining

For BTC mining, ASIC miners outperform GPUs in effectivity and hashpower. Fashionable ASIC bitcoin miners ship greater TH/s whereas consuming much less electrical energy.

Evaluating ASIC Bitcoin miner ROI contemplating:Price per terahash (TH), Vitality effectivity (watts per TH), {Hardware} longevity

Older machines lose profitability rapidly, whereas new era ASIC miner fashions preserve aggressive margins even throughout community issue will increase. For critical miners, investing in environment friendly ASIC Bitcoin miner {hardware} is vital.

Electrical energy Prices and Location

Electrical energy is the biggest operational expense in BTC mining. The associated fee distinction between industrial and residential electrical energy could make or break profitability.

Industrial Electrical energy: Giant-scale Bitcoin farms typically safe industrial electrical energy contracts at charges as little as $0.03–$0.05 per kWh. This low-cost energy is a key benefit for skilled miners, permitting them to function high-performance ASIC bitcoin miners whereas sustaining optimistic margins.

Residential Electrical energy: Residence miners sometimes pay $0.10–$0.15 per kWh in lots of international locations, such because the U.S. At these charges, mining profitability drops sharply, making solo or small-scale mining financially unfeasible with out entry to environment friendly {hardware} or pooled mining methods.

Different power options, resembling photo voltaic, hydro, or capturing flare gasoline, can scale back operational bills and enhance ROI. Entry to low-cost, sustainable electrical energy stays some of the decisive components for anybody nonetheless mining right now.

Calculating Profitability

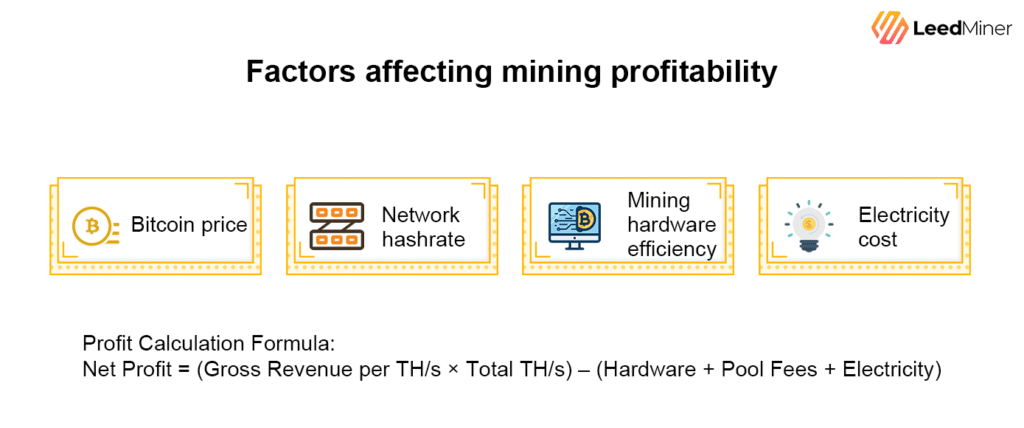

Mining profitability is decided by a mixture of:

- Bitcoin value

- Community hashrate

- Mining {hardware} effectivity

- Electrical energy price

Web revenue might be approximated as:

Web Revenue = (Gross Income per TH/s × Complete TH/s) – ({Hardware} + Pool Charges + Electrical energy)

For these utilizing hashpower marketplaces, the calculation simplifies: customers pay for contracts upfront and obtain rewards straight, making it simpler to mannequin potential ROI earlier than investing.

Timing and Technique for Maximizing ROI

Efficient BTC mining just isn’t passive. Strategic actions embrace:

Timing Acquisitions: Purchase hashpower throughout anticipated Bitcoin rallies or durations of excessive transaction charges.

Goal Environment friendly Hashpower: Desire contracts backed by the newest ASIC miner {hardware}.

Monitor Community Issue: Leverage short-term changes in issue to extend reward chance.

Adopting an lively strategy ensures miners can maximize ROI whereas mitigating publicity to community volatility.

Skilled vs Residence Miners

Giant Bitcoin farms dominate the mining panorama. Their benefits embrace bulk {hardware} acquisition, low-cost electrical energy, and superior operational methods.

Residence miners face steep limitations: greater power prices, restricted entry to probably the most environment friendly ASIC miners, and decrease possibilities of block rewards. Nonetheless, hashpower marketplaces now enable smaller buyers to take part in BTC mining with out proudly owning bodily infrastructure, democratizing entry to industrial-scale profitability.

Conclusion: Is Mining Nonetheless Price It in 2025?

BTC mining stays worthwhile in 2025 for strategic and knowledgeable contributors. Key components driving profitability embrace environment friendly ASIC miner {hardware}, low-cost electrical energy, lively administration of hashpower, and participation in dependable mining swimming pools.

For particular person miners, leveraging hashpower marketplaces or pooling sources offers a sensible path to incomes Bitcoin whereas avoiding the excessive capital necessities of a full-scale farm. The period of passive, set-it-and-forget-it mining is over; success favors agile contributors who use data-driven methods to maximise ROI.

FAQ (Steadily Requested Questions)

1. Are dwelling miners at an obstacle in comparison with industrial Bitcoin farms?

Are dwelling mining rigs at an obstacle in comparison with industrial-grade Bitcoin mining farms?

Industrial-grade Bitcoin mining farms profit from bulk energy contracts, optimized cooling programs, and economies of scale, leading to decrease working prices and better long-term profitability.

Residence mining rigs sometimes incur greater residential electrical energy costs and face limitations in warmth dissipation and noise. Nevertheless, selecting the best dwelling mining rig reveals that that is truly fairly easy. There are high-hashrate, low-power dwelling mining rigs available on the market which might be small, quiet, and require no specialised cooling programs—much like family home equipment. For extra particulars, please refer to a different article:Goldshell XT-BOX The Ultimate Home Miner

2. Which ASIC miner is finest for Bitcoin mining proper now?

The “finest” ASIC miner depends upon effectivity (J/TH), hash charge, and energy price. Basically, newer-generation ASIC bitcoin miners with excessive power effectivity present the strongest ROI. Miners ought to evaluate price per terahash, energy utilization, and {hardware} reliability earlier than buying.

3. Can somebody begin mining Bitcoin with out shopping for {hardware}?

Sure. Hashpower marketplaces and cloud mining platforms enable customers to buy mining energy straight as a substitute of proudly owning gear. This eliminates {hardware} upkeep and electrical energy administration however requires cautious analysis to keep away from overpriced contracts or unreliable suppliers.

4. How a lot electrical energy does a typical ASIC miner use?

A contemporary ASIC bitcoin miner consumes between 2,000–3,500 watts, relying on the mannequin. The actual price affect depends upon native electrical energy charges:

- Industrial charge: $0.03–$0.06/kWh → sometimes worthwhile

- Residential charge: $0.10–$0.15/kWh → typically unprofitable with out optimization

5. Why do some miners transfer to colder areas or close to energy vegetation?

Cooling and electrical energy are the largest operational prices. Colder climates scale back cooling bills, whereas proximity to power sources (hydroelectric, geothermal, stranded pure gasoline) reduces electrical energy price, growing internet profitability.

6. What are some at the moment common high-performance Bitcoin mining machines?

Bitmain Antminer S21 Hyd 335Th, Bitmain Antminer S21e XP Hyd 430Th, Bitmain Antminer S19K Pro, These are all high-performance mining rigs, in addition to some smaller dwelling mining machines, such because the Goldshell XT-BOX, NerdMiner NerdQaxe++, and Luckyminer sequence.