Ethereum has been revealed to be outpacing Bitcoin in fund holdings development. This comes as extra establishments purchase into ETH’s narrative, with there being a rise within the Ethereum ETF inflows because the begin of the 12 months.

Ethereum Outpacing Bitcoin In Fund Holdings Progress

A CryptoQuant analysis revealed a shifting institutional allocation with Ethereum outpacing Bitcoin in fund holdings development. Latest fund holdings information have proven a notable distinction between ETH and BTC in relation to how establishments are allocating their capital. The evaluation famous that whereas each belongings have continued to draw long-term capital, the expansion tempo between them has shifted considerably over the previous 12 months.

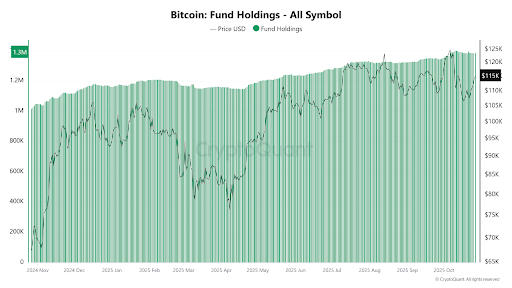

Bitcoin fund holdings at the moment stand at round 1.3 million BTC and have elevated by round 36% during the last 12 months. The CryptoQuant evaluation famous that this displays regular however measured institutional accumulation, which is in keeping with BTC’s position as a macro reserve and hedge in opposition to inflation. The evaluation added that the capital getting into BTC seems to be steady, paced, and fewer reactive to short-term market cycles.

In the meantime, Ethereum has skilled larger growth. The whole ETH fund holdings are 6.8 million ETH, up round 138% year-over-year (YoY). The CryptoQuant evaluation famous that this acceleration aligns with the scaling of spot ETH ETF inflows. It additional aligns with the rise in staking participation and Ethereum’s position as the inspiration settlement layer for DeFi, tokenization, and layer-2 networks.

The Ethereum/Bitcoin fund holdings ratio additional illustrates the structural shift in institutional allocation. A 12 months in the past, the ETH fund holdings had been about thrice the scale of the Bitcoin fund holdings. Now, the ratio is claimed to be shut to 5. The CryptoQuant evaluation discovered that this isn’t only a non permanent rotation however a sustained shift pushed by differentiated narratives: Bitcoin as a digital financial asset, and Ethereum as a yield-bearing network infrastructure.

The evaluation said that the important thing implication is that establishments now view Ethereum as a core holding slightly than a secondary allocation. Then again, Bitcoin retains its position because the dominant macro asset, however with a extra mature and slower-growing possession base. The continuation of this divergence in the ETH/BTC ratio is claimed to rely on ETF lows, on-chain exercise traits, and broader liquidity circumstances in international markets.

ETH Additionally Surpasses BTC In This Metric

Crypto analysis platform CryptoRank revealed that Ethereum has surpassed Bitcoin in digital asset treasuries (DATs) by whole provide. ETH is now main the way in which with 4.1% of its whole provide held by institutional treasuries, adopted by Bitcoin, with 3.6% held by DATs, and Solana, with 2.7% held by these establishments.

CryptoRank said that the surge in Ethereum holdings amongst these DATs coincided with Donald Trump’s signing of the GENIUS Act, which regulates the stablecoin business. Since then, institutional traders have elevated their ETH accumulation, positioning ETH because the core infrastructure asset of the DeFi economic system.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.